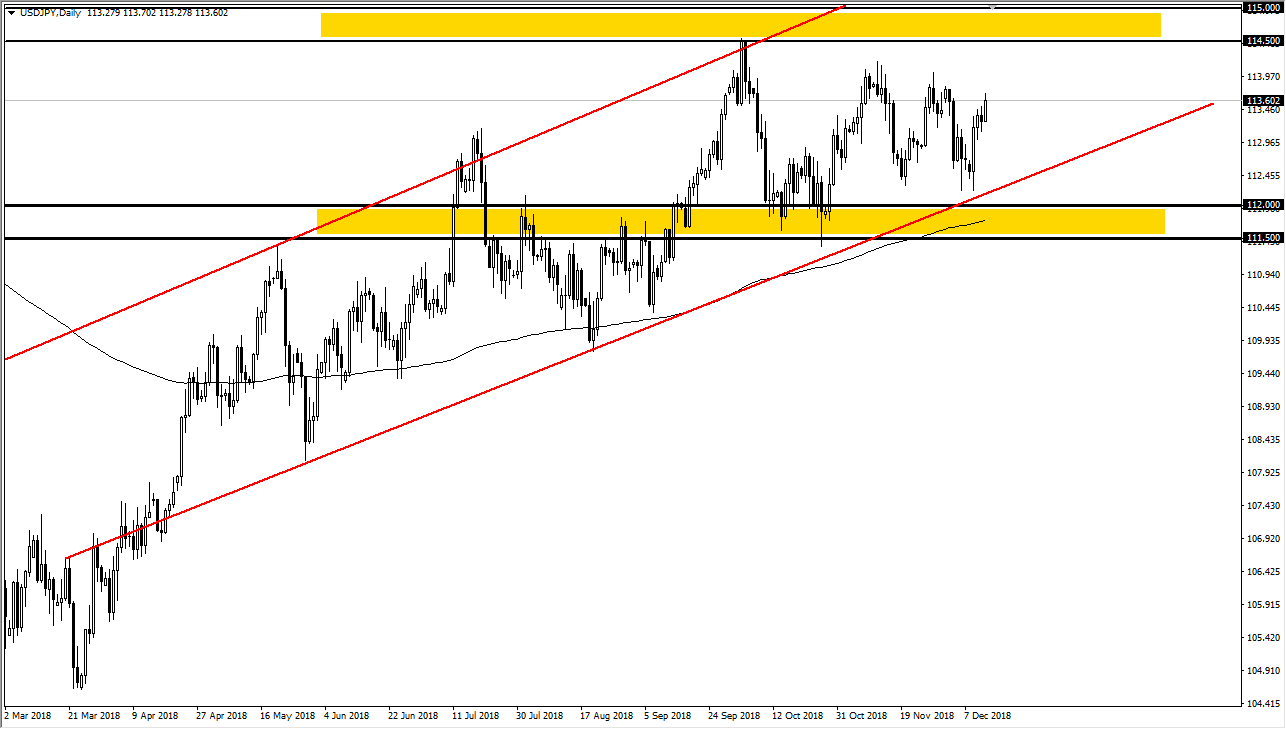

USD/JPY

The US dollar rallied a bit during the trading session on Thursday, reaching towards the ¥113.75 level. The ¥114 level above has been resistance, extending all the way to the ¥115 level. On the other side of the equation, we have a massive uptrend line that has held more than once, as well as the 200 day EMA. We have been in a nice uptrend in channel, and I think that will hold between now and the end of the year, but obviously the end of the year brings in a lack of liquidity. With that in mind, I believe that short-term pullbacks offer short-term buying opportunities, but overall this is a market that is essentially “stuck” in a very short range. In general, I think a break down or a breakout is probably a January story, and the next couple of weeks will be a simple back and forth and tight market.

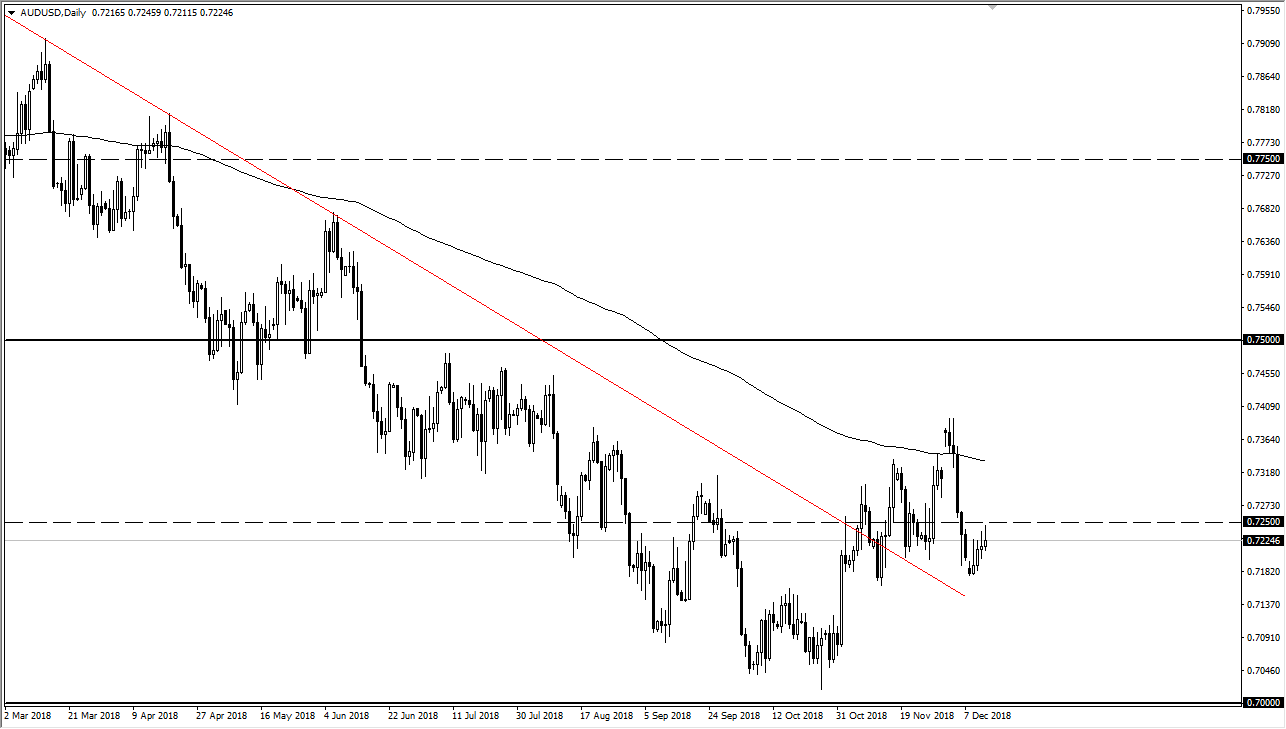

AUD/USD

The Australian dollar has initially rallied during the trading session on Thursday, reaching towards the 0.7250 level. However, we turned around of form a shooting star. That shows just how difficult it’s going to be to continue going higher, and we have had a couple of shooting stars in a row now. Ultimately, I do think this shows that the market is very likely to break down, and perhaps reach towards the 0.7150 level. Hello there, we could go to the 0.70 level after that. The alternate scenario of course is that we break above the 0.7250 level, which opens the door to the 0.7350 level. That would take some type of good news coming out of China or the United States involving trade relations at this point though.