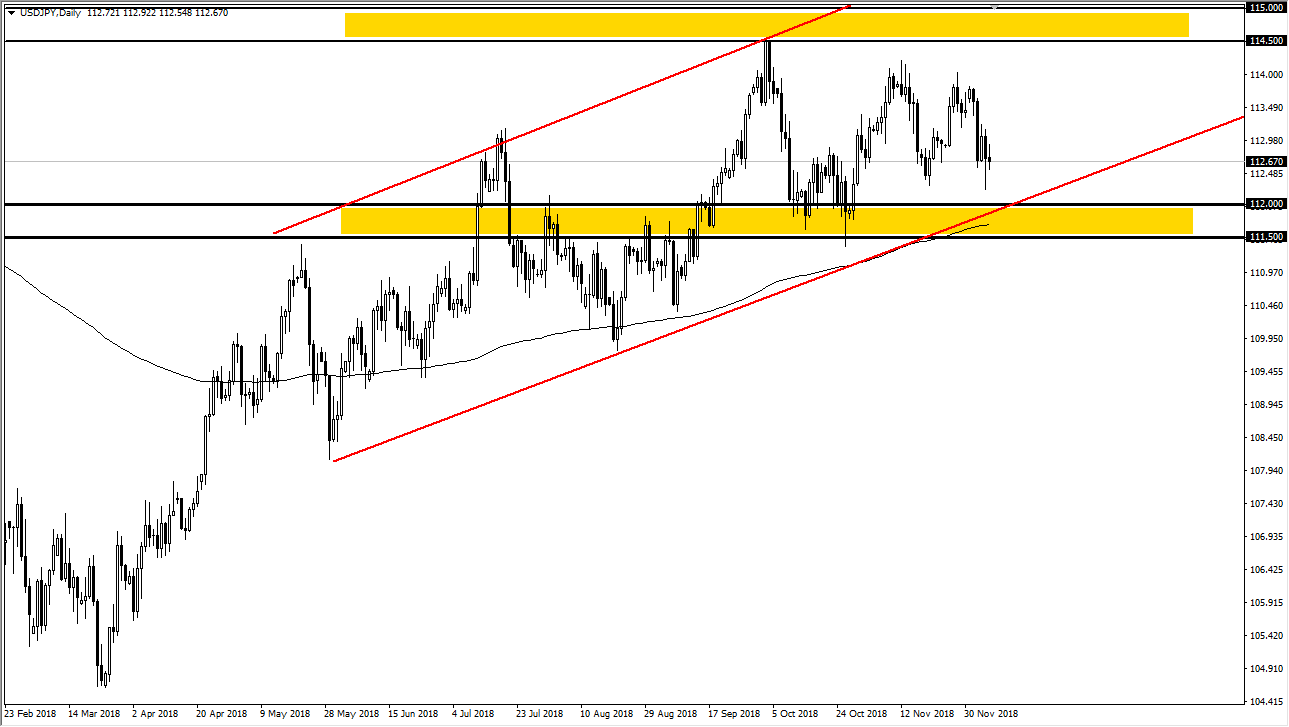

USD/JPY

The US dollar bounced around against the Japanese yen during Friday’s trading session, but after the jobs number came out it seems as if most traders simply went home. The markets continue to hover just above the ¥112.50 level, and I think are well supported underneath at the uptrend line that I have marked on the chart. Because of this, I don’t have any interest in shorting this market but I also recognize there is a lot of resistance above. I think we will continue to see rather choppy and short-term focused trading conditions between now and the end of the year. However, if we get some type of movement in the US/Chinese trade relations, that could move this market. I believe that the Federal Reserve softening the way it has over the last couple of days may be working against the greenback in this pair, and if that’s the case we could get the break down necessary to continue going lower. However, I’m not convinced until we get the daily close underneath the 200 day EMA.

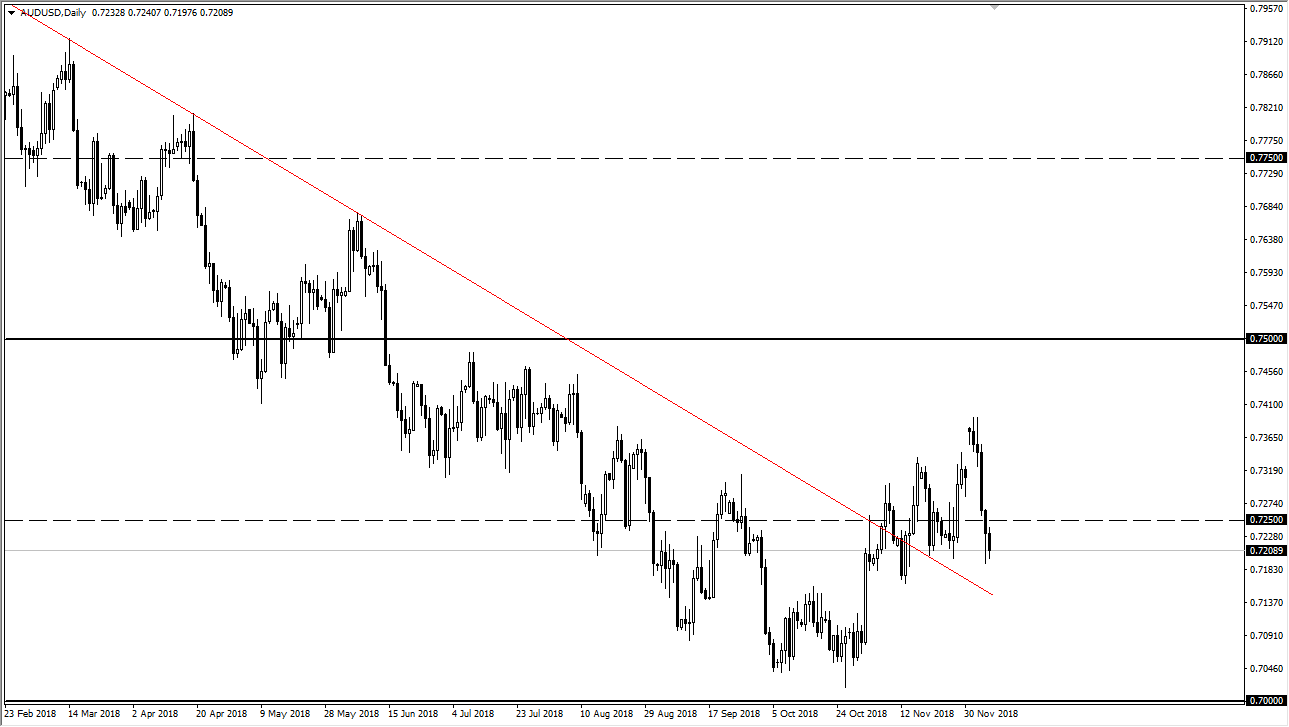

AUD/USD

The Australian dollar also fell during the day, but it seems as if it is well supported just below the 0.72 handle. Because of this, I think that it’s only a matter time before the buyers come in and try to pick up value, especially if we get some type of positive words coming from China about the US/China trade negotiations. That of course has a massive effect on the Australian dollar in general, and as a major contributor of raw materials to the Chinese economy, it makes sense that it will go up and down with the economic prospects of the mainland.