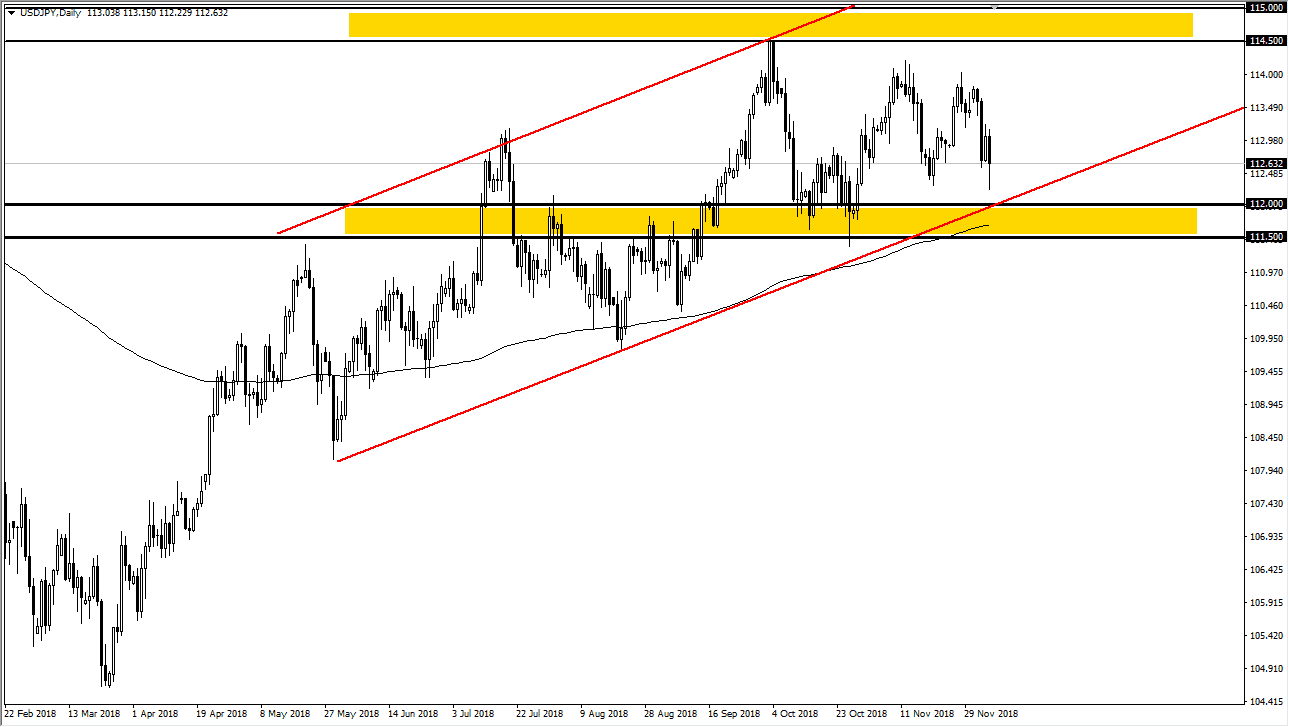

USD/JPY

The US dollar has spent most the day falling against the Japanese yen but found a bit of a bid underneath, as the uptrend line continues to hold the market up, just as the 200 day EMA does. The market has been grinding its way higher for some time, and I think that should continue to be the situation. The fact that we rally towards the end of the day makes sense considering that we have had such a massive selloff, plenty of reasons to think that support would come into play, and of course traders will have tried to cover shorts ahead of the jobs number which will of course move this market rather drastically. I believe that short-term pullbacks will be buying opportunities closer to the ¥112 level yet again, and I don’t think that the ¥114.50 level above will be broken. Expect a lot of noise, but ultimately I think value hunters will return if they get a chance.

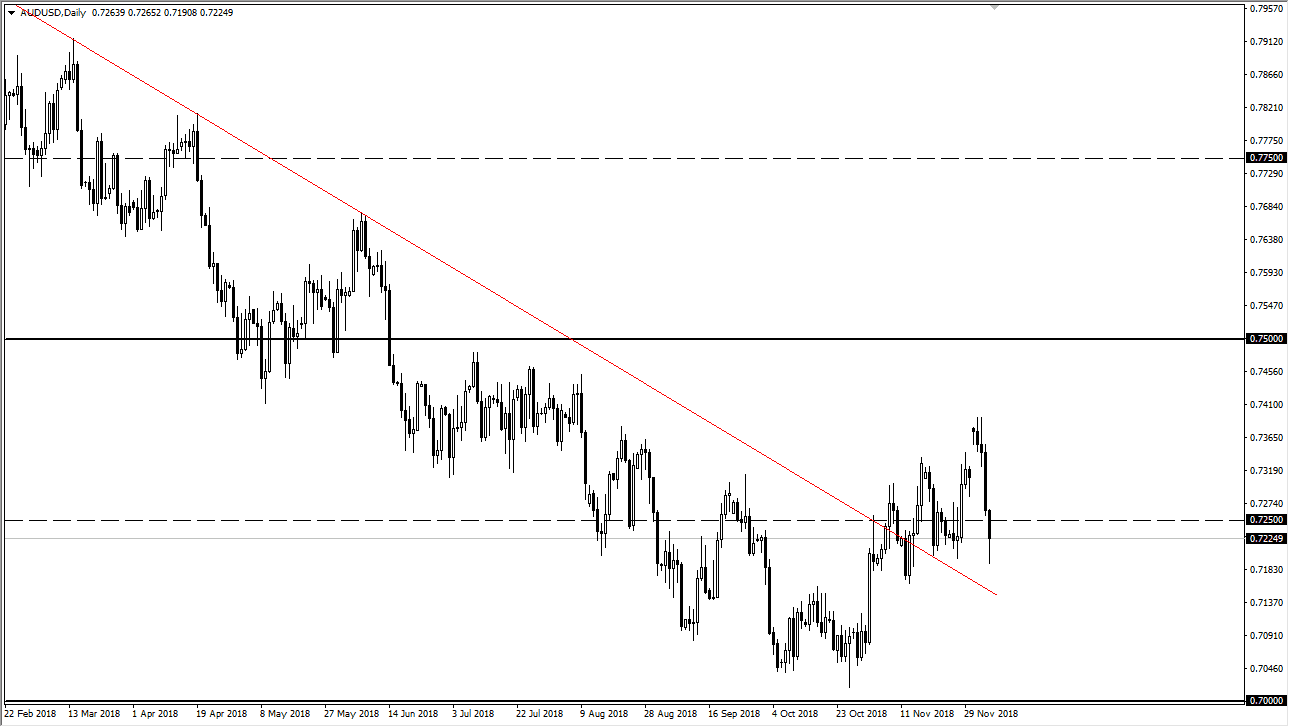

AUD/USD

The Australian dollar has broken down during the session on Thursday but found buyers underneath to show signs of resiliency as we stay above the previous downtrend line. That is a bullish sign and it should continue to lift the market a bit higher, and now that we have the jobs number coming I think that the trading public is going to start to pay attention to that. Granted, there are plenty of reasons to think that there is continued friction between the Americans and the Chinese, but in the short term this is all about the Nonfarm Payroll Numbers. I suspect that we could bounce, but I wouldn’t expect too much out of the market in the short term.