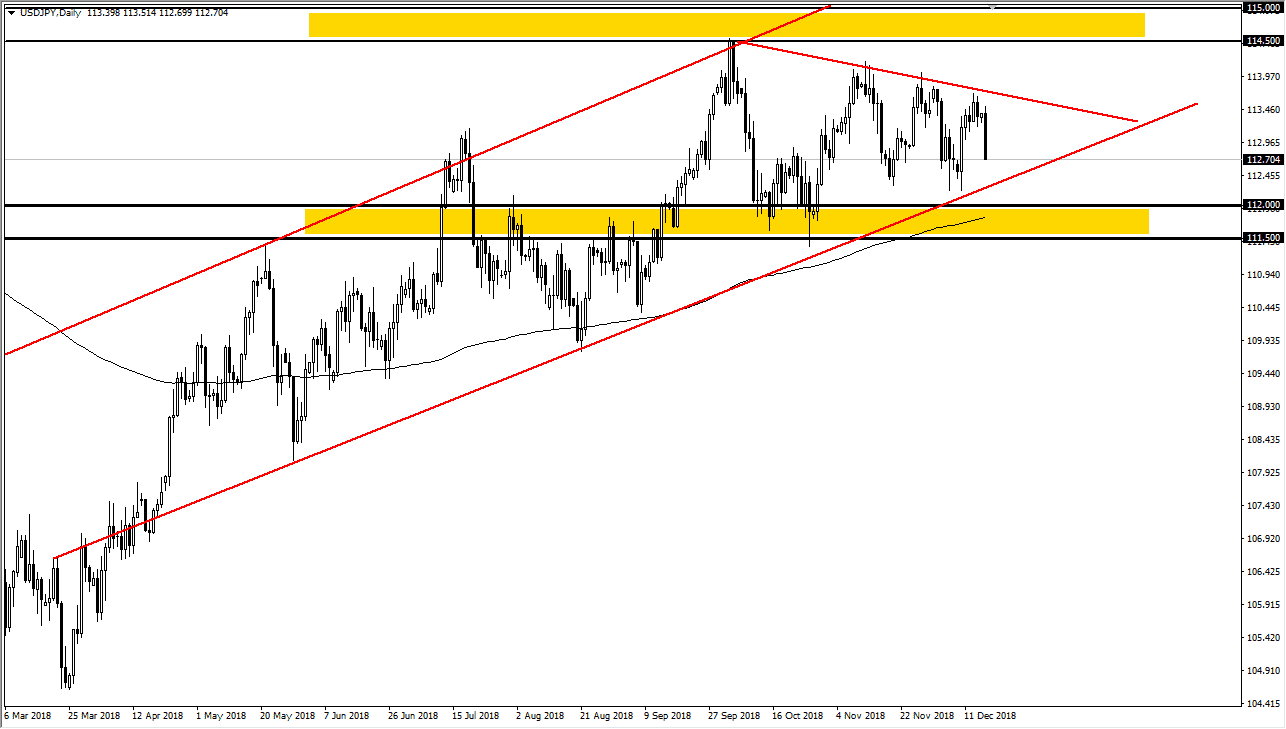

USD/JPY

The US dollar initially tried to rally to kick off the week, but then rolled over to break down significantly. The “risk off” attitude has come back into the marketplace in stock markets and commodity markets, and it of course will find its way into the Japanese yen as well. The Japanese yen of course is a safety currency, and therefore it makes sense that we see this market roll over. The Federal Reserve meeting on Wednesday of course will be crucial, as the interest rate hike is already counted on, but if the Federal Reserve sounds critically hawkish, that could send the market back to the upside. Lately, it appears that expectations for interest rate hikes next year are starting to dwindle a bit, and that of course should put downward pressure on the greenback. Between now and then, I would anticipate that we will probably see some sideways action, well within the wedge that I have drawn on the chart. After the press conference and/or announcement, if we find our way below the 200 day EMA on the chart, that could send this market much lower over the next several weeks.

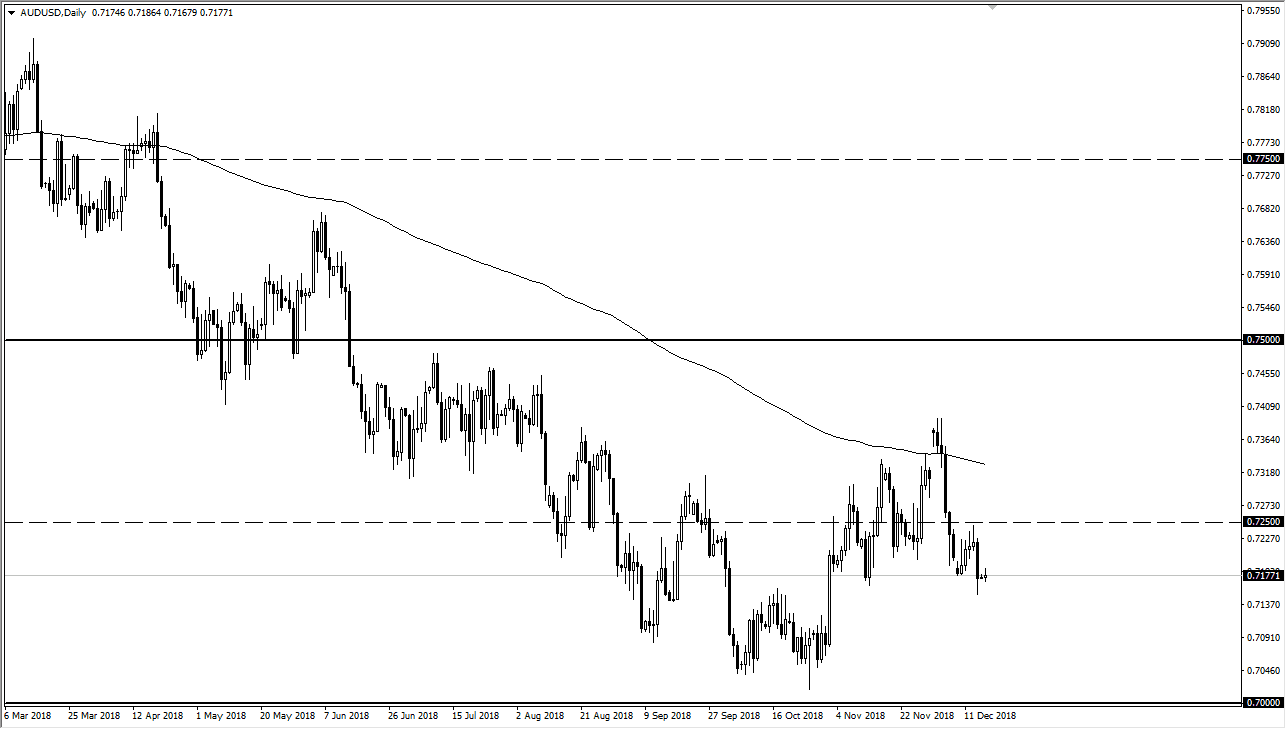

AUD/USD

The Australian dollar did very little during trading on Monday, as we continue to go back and forth in this general region. At this point, the 0.7250 level above is significant resistance, but it is also essentially “fair value.” If we were to break above there, it’s likely that the market could go to the 0.7350 level. Alternately, if we break down below the lows of the Friday session, the market could go down to the 0.70 level. I think at this point we are waiting to see what the Federal Reserve says after they rate hike on Wednesday, ultimately it will come down as to whether or not they are hawkish or dovish. I believe waiting for the Wednesday close is probably the best way to deal with this market. Beyond that, let us not forget about the tariff war that’s going on right now as well.