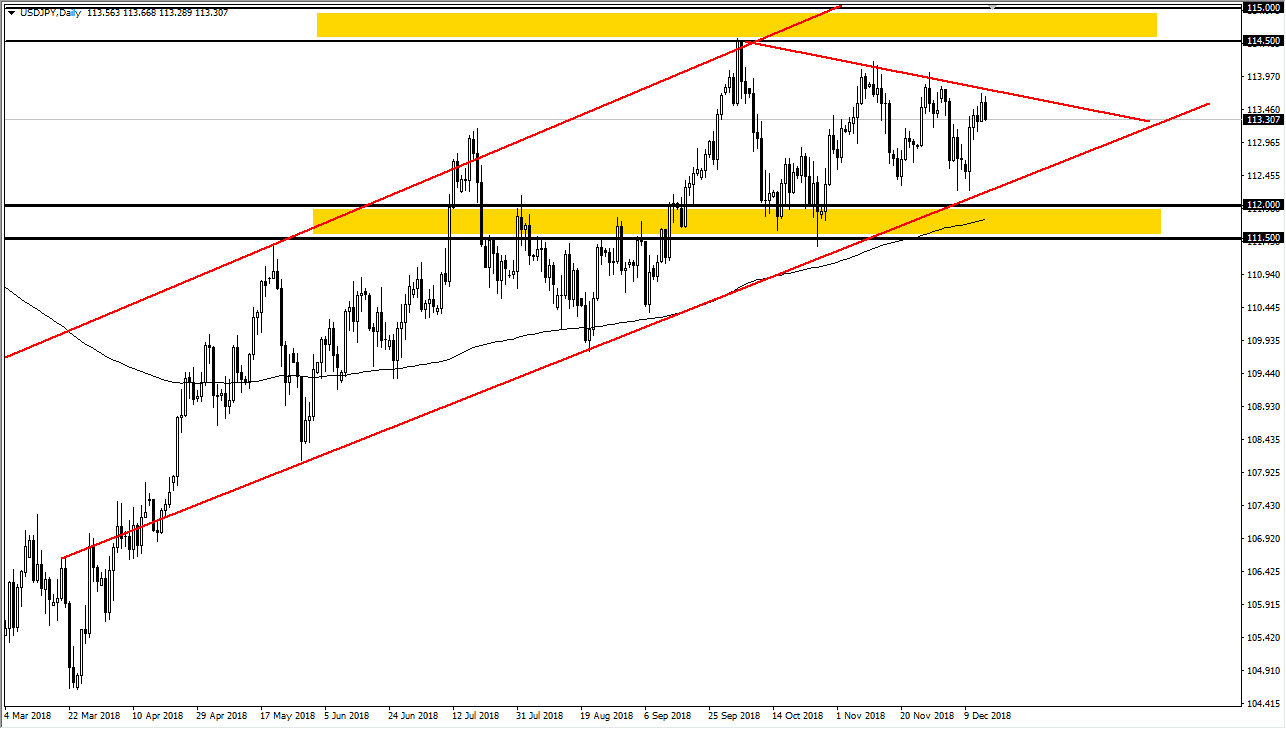

USD/JPY

The US dollar has fallen during trading on Friday at the downtrend line that I have marked on the chart. I think that this market is going to compress between now and the end of the year, because most money is going to avoid starting new positions between now and the holiday. At this point, I think we will continue to trade in this wedge, as the 115 region above is massive resistance on longer-term charts, just as the 200 day moving average just below the uptrend line should offer plenty of support. Because of this, I expect a pullback but I also expect buyers somewhere around ¥112.50. Short range bound trading system should be employed during the next couple of weeks, and I believe that there is essentially “fair value” somewhere near the ¥113 level.

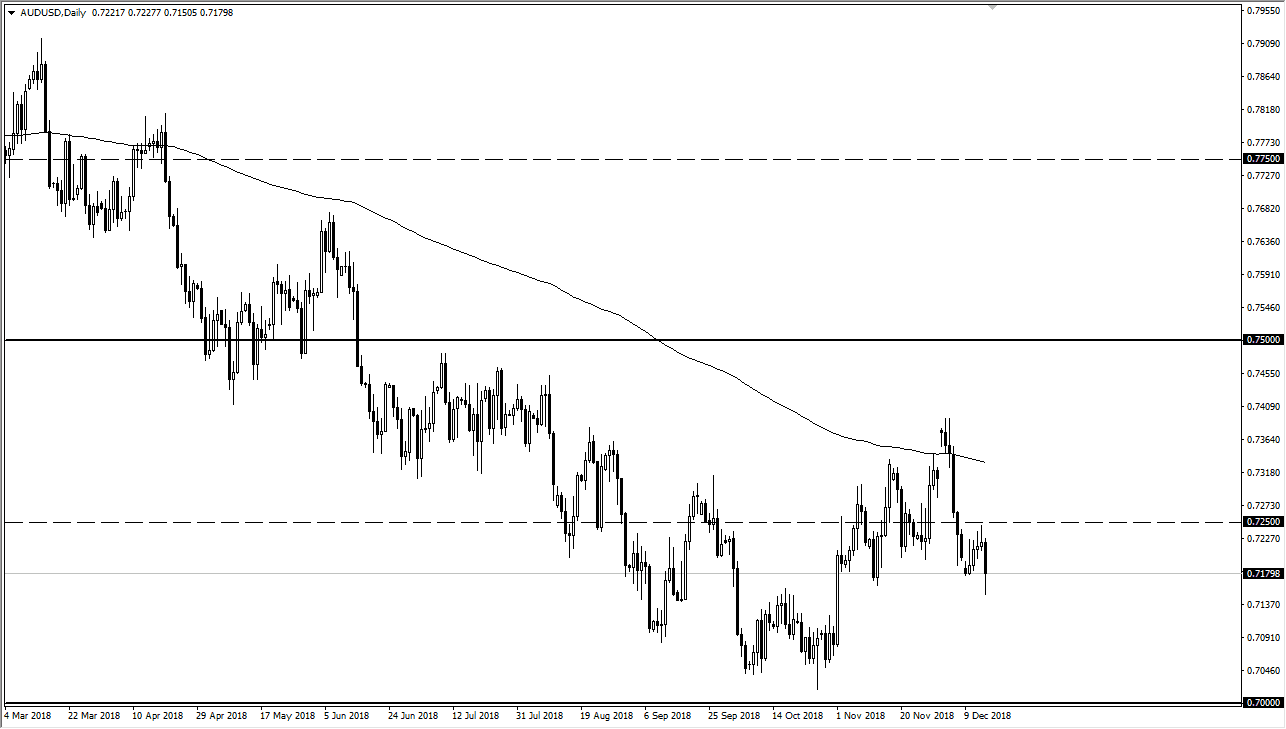

AUD/USD

The Australian dollar broke down during trading on Friday as poor economic figures came out of China. We had formed a couple of shooting stars earlier in the week, so this should not have been a huge surprise. We did recover a bit towards the end of the day but ultimately this is a market that will continue to be moving based upon the latest trade -related headlines and of course concerns about global slowdowns. I think at this point, we are much more likely to see this market grind its way down towards 0.70 then 0.7350. We got turned around at what I essentially think is “fair value” overall, so it makes sense that we favor the downside and continue to push lower. It’s not going to be easy, but I think the sellers are going to have the upper hand over the next several days.