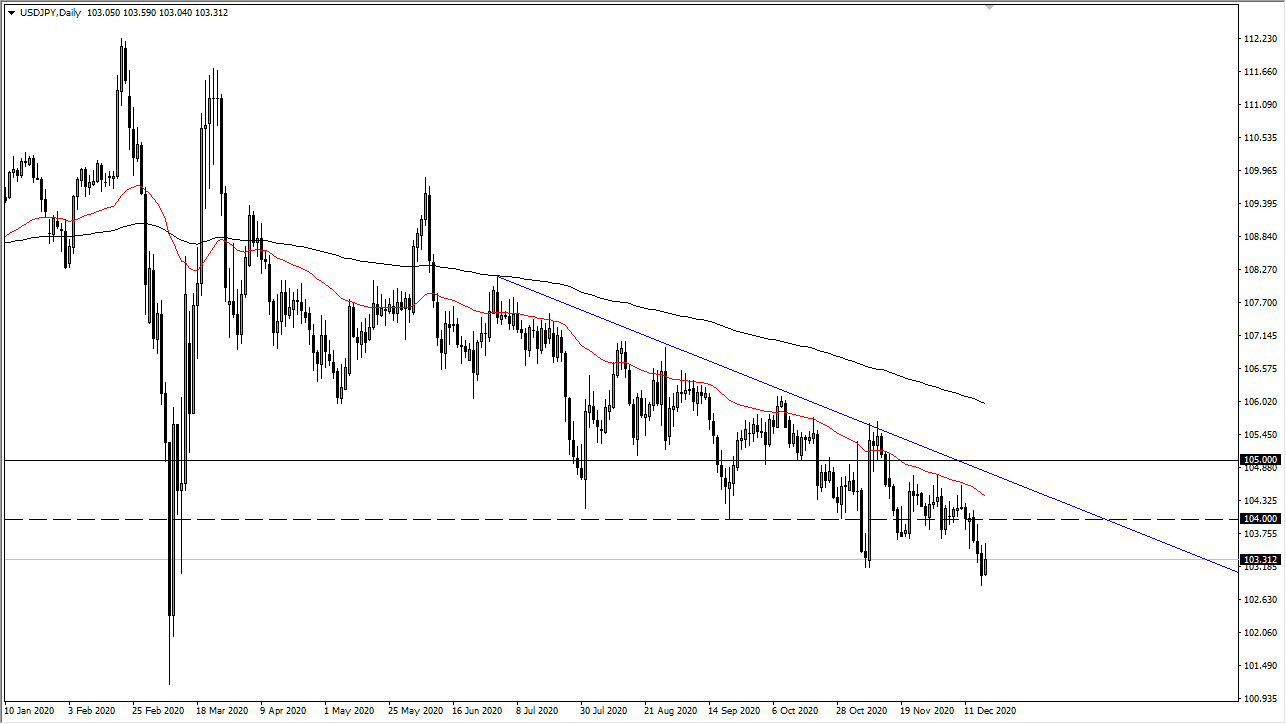

USD/JPY

The US dollar bounced the nicely during the Wednesday session, as we had reached below the ¥113 level. This is a market that continues to find buyers underneath and balance every time we do drop, but there’s also a massive resistance above. Because of this, I think that you need to be a bit cautious in your expectations, but short-term pullbacks should honor short-term rallies. I believe that the ¥114.50 level above is the beginning of significant resistance to the psychologically important ¥115 handle. I also believe that the uptrend line underneath, and the 200 day EMA below that offers massive support. If we were to break down below there, then it could change things rather rapidly. However, at this point I think the simple “buy on the dips” short-term traders type of environment.

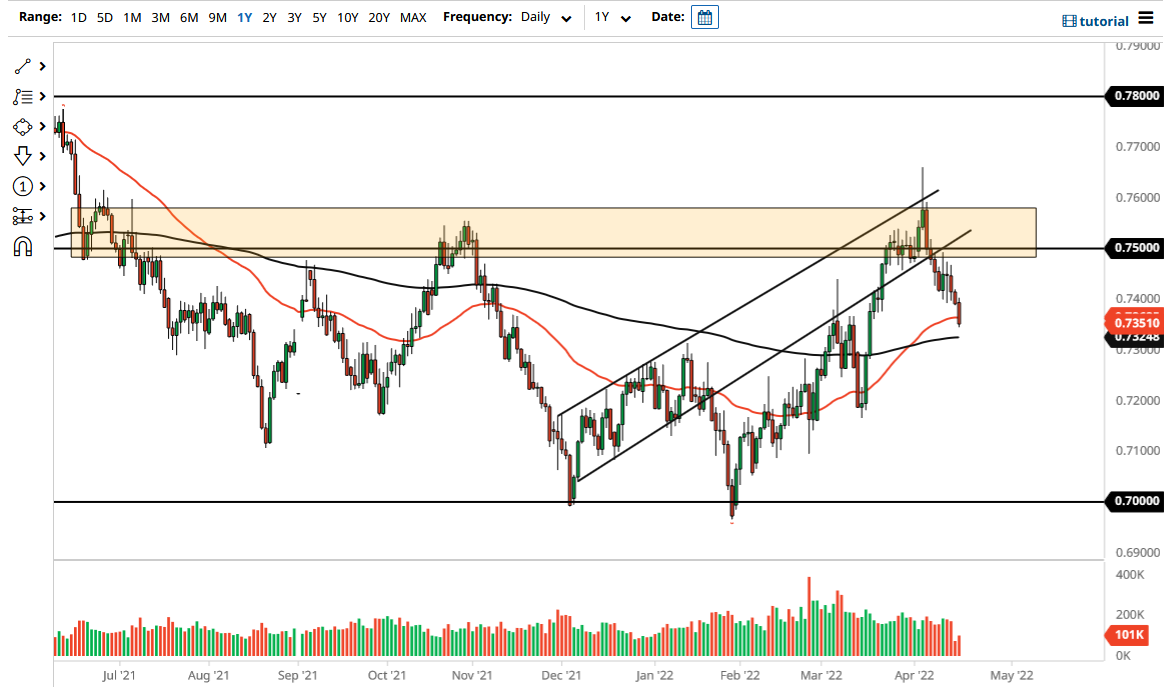

AUD/USD

The Australian dollar has fallen to fill the gap and more during the session on Wednesday as traders are starting to question whether the United States and China actually accomplished anything during the meeting. With a deal that wasn’t a deal, and light on details, it’s not a surprise that we have seen this market turned around. I believe that the carnage in the stock market precedes what could happen in the currency market, but I also recognize that there is support below. I would be a seller now, at least not until we break down below the 0.72 handle. If we bounce from the 0.7250 level, we could go looking towards the 0.73 level but we also need stock markets to help as well, giving us a bit of a “heads up” on what risk appetite will be. The better it is, the better off the Aussie will do and of course vice versa.