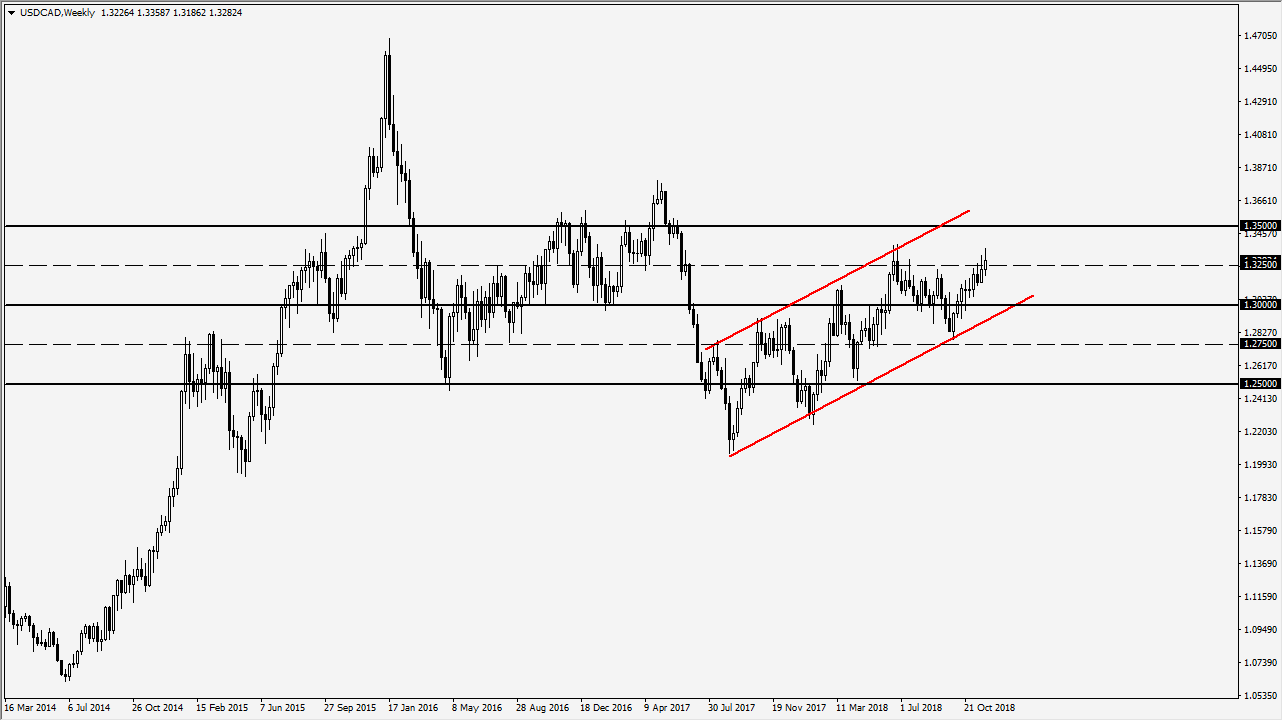

USD/CAD

The US dollar has been rallying against the Canadian dollar as of late, reaching as high as 1.3250 late in November. However, we have seen resistance here before so I think a pullback may be coming. This will probably coincide with oil trying to bounce from the $50 handle, which is where we are as high write this article. You can see that I have a nice uptrend in channel that still is very much intact, so I suspect that December will be more about generating momentum than anything else.

I anticipate that the 1.30 level will be targeted, as oil rallies a bit. After all, crude oil has been oversold in the Canadian dollar of course is a bit of a proxy for that commodity. There are mumblings now about Russia and a few other countries talking about possibly cutting back production, so that should help support oil, even if it’s just temporarily. If that happens, then the Canadian dollar should attract some trade flow.

It’s not until we break down below the uptrend line that I would be concerned though. I think this is simply a nice pullback that traders will be paying attention to in order to pick up a bit of value near the 1.30 region. Remember that the liquidity will get a bit thin later in the month, so it’s going to be difficult to put a lot of money into this pair, mainly because it trades very much lopsided in favor of the North American trading session. In other words, as we get towards the end of the month, spreads and liquidity will widen during Asian and even European trading to a certain extent. I believe that later in the month there may be a nice buying opportunity. If we do break out to the upside without pulling back, I believe that the 1.35 level will be the next major barrier.