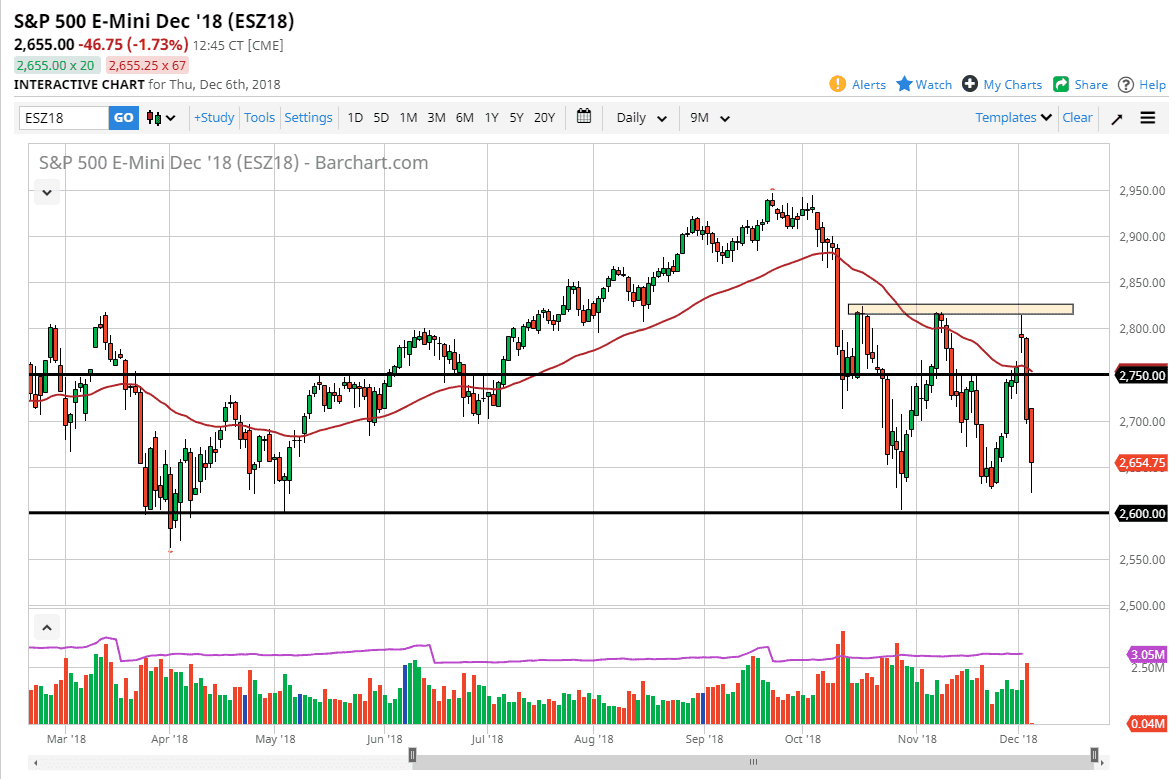

S&P 500

The S&P 500 fell rather hard to kick off the trading session on Thursday, reaching down to the lows again but I think there is plenty of support at the 2600 level and of course it makes sense that buyers step back in later in the day as we await the jobs figures coming out Friday morning. Because of that, I think you’re probably better off to leave this market alone but we have a couple of major areas to pay attention to that could give us trades going forward. For example, the 2600 level being broken to the downside for any significant amount of time will be a very negative turn of events. Alternately, if we can break above the 50 day exponential moving average, then we could see some bullish pressure. In the meantime, we are simply continuing to bounce around between 2600 on the bottom, and 2825 on the top.

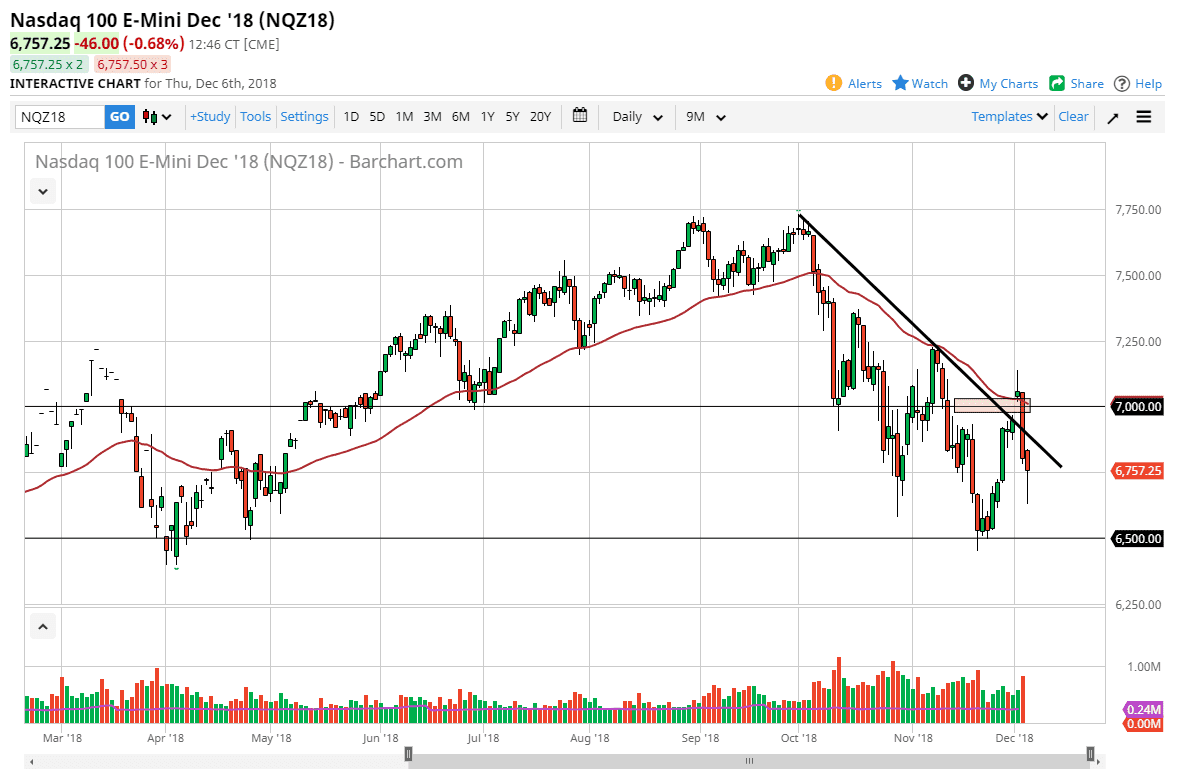

NASDAQ 100

The NASDAQ 100 fell rather significantly during the trading session on Thursday but turned around to bounce and form a bit of a hammer. This of course makes quite a bit of sense as the jobs number of course will have a massive influence on the markets, but which you can see, we have recently been making lower highs going forward. Ultimately, signs of exhaustion should be a nice selling opportunity above, but if we broke above the 50 day EMA on a daily close, then I think the buyers could come into really start to push things higher. The market is extraordinarily sensitive to the US/China trade negotiations as well, so pay attention to how those things are going. Right now, it looks as if we are trying to square things up ahead of the employment figures.