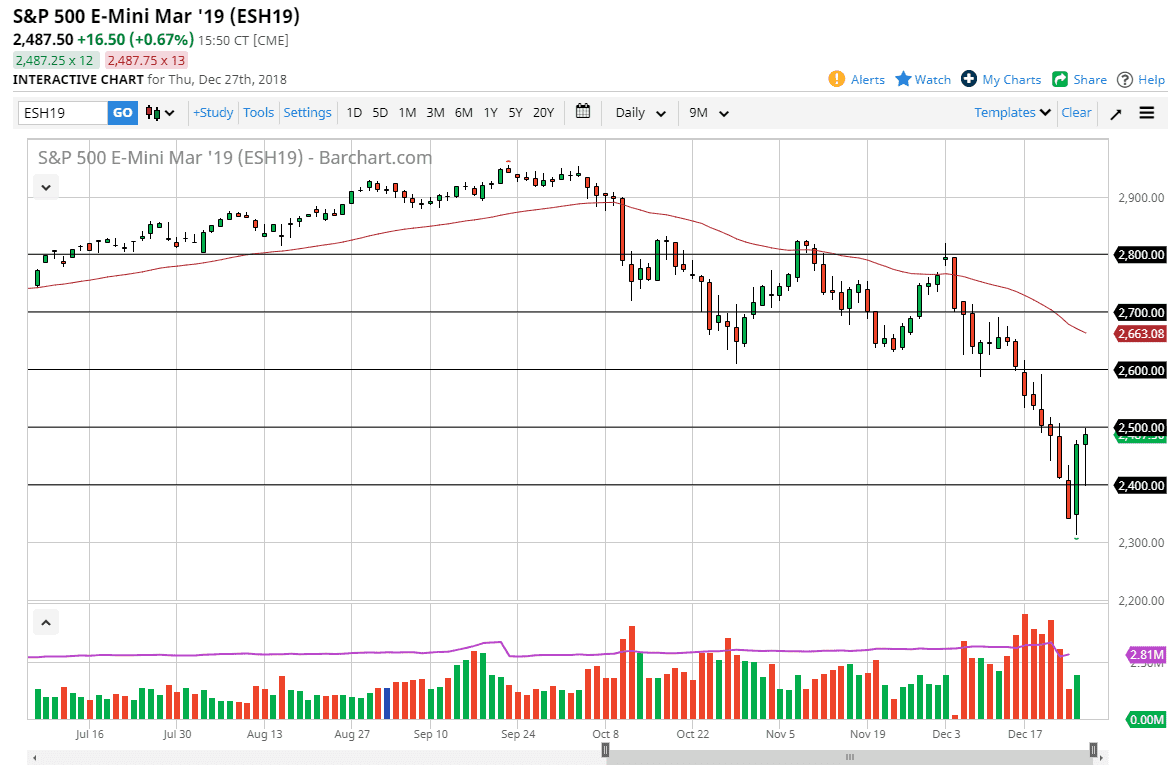

S&P 500

The S&P 500 cratered initially during the trading session on Thursday, but then in the last hour of trading in your, it exploded to the upside. We ended up forming a hammer that sits just below the 2500 level, and with the pension rebalancing that happens at this time of year, it could send this market even higher. However, I think the 2600 level is still significant resistance as it was support. The 50 day EMA above there is also a major resistance barrier. Ultimately, I think that the market is very thin, and of course there is going to be a lot of frayed nerves out there. I think the next couple of days could be positive, but once we get out of the year and into next year, we could have selling reenter this market. You would not be wrong to stay on the sidelines at this point.

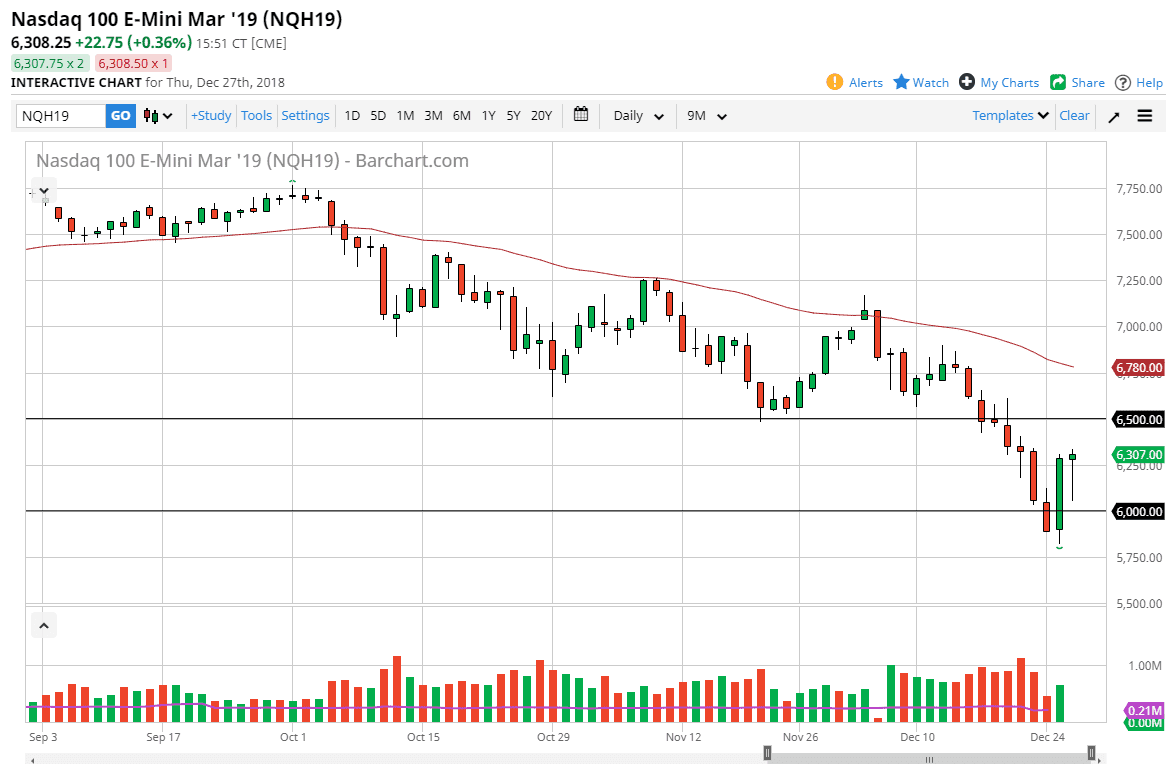

NASDAQ 100

The NASDAQ 100 broke down significantly as well but found the 6000 level to find support. We turned around of form a bit of a hammer and I think at this point it’s likely that the hammer suggests that we could go to the 6500 level. This is an extraordinarily dangerous market right now, so I think that the market is going to be difficult to handle with any type of leverage. Ultimately, I think that the market shows a lot of support at the 6000 handle, and the bullish and coping candle now looks rather strong from the previous session. The 50 day EMA above will cause a bit of resistance, but if we can clear that then I think algorithms will come in and start buying things again.