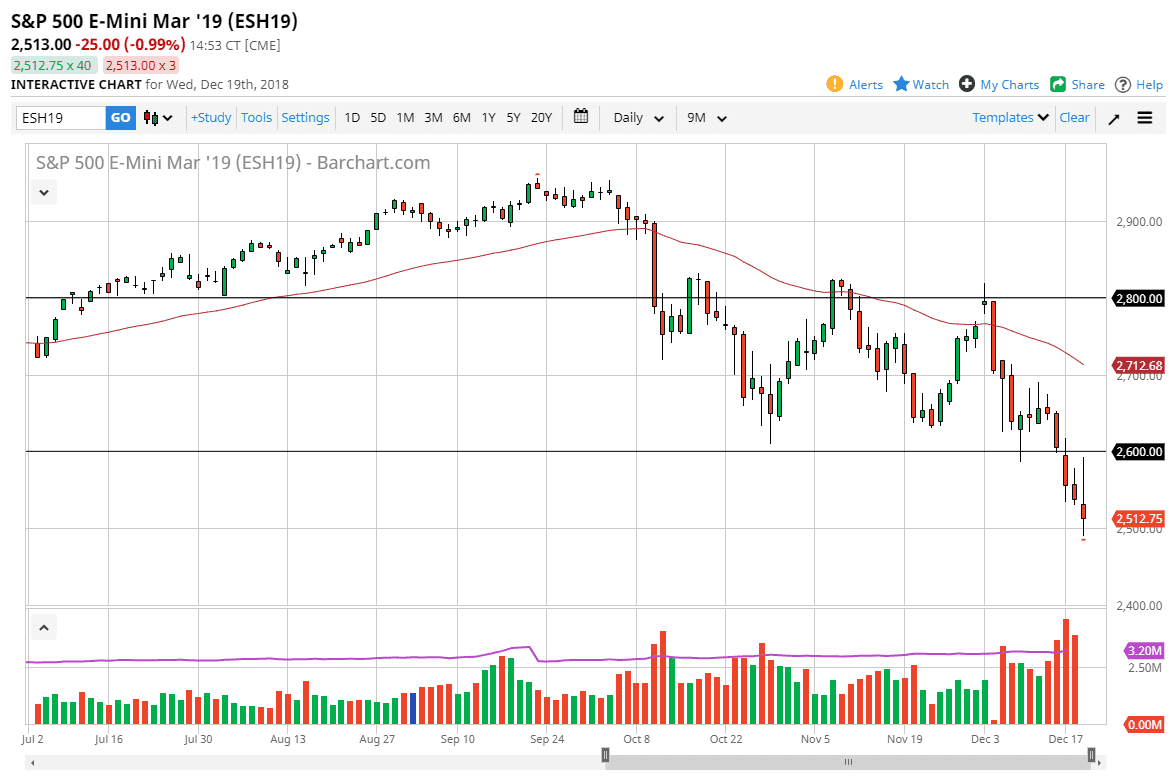

S&P 500

The S&P 500 went back and forth during the trading session as we awaited the Federal Reserve statement, and the much-anticipated interest rate hike. While the Federal Reserve suggested that perhaps there were only two interest rate hikes coming next year, it didn’t seem to be dovish enough for equities traders and we ended up selling off anyway. At one point, we broke down below the 2500 level, and now I think we’re going to make a move towards the 2400 level based upon the breakdown of the previous consolidation area, and of course the confirmation of the previous support being resistance now. That area measures for 200 points, which brings us to 2400. Beyond that, 2400 had previously been an area of importance, so it all wrapped up quite neatly. I continue to sell rallies.

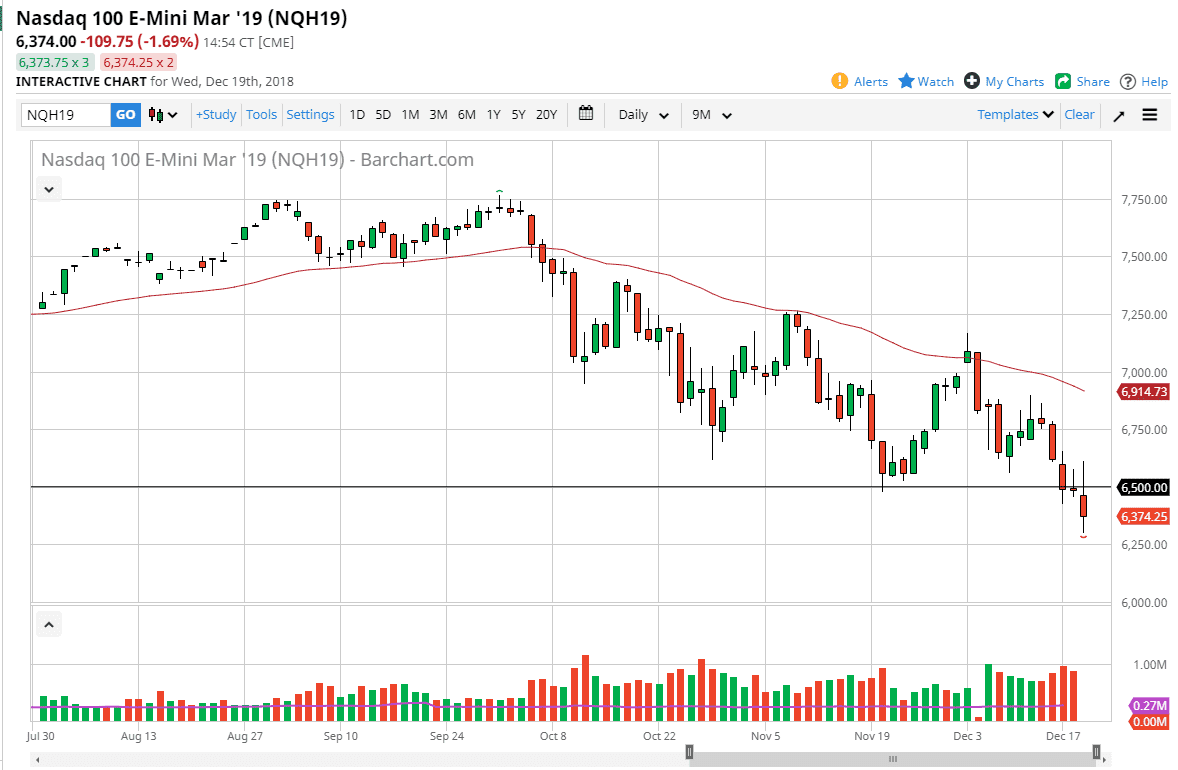

NASDAQ 100

The NASDAQ 100 also broke above the 6500 level initially during the day but turned around of form a negative looking candle. It looks now that we are going to continue the downtrend, and it’s not until we break above the 50 day EMA that I would consider buying this market. It will continue to be beat up upon by the trade war between the United States and China, as so many of the technologically-based companies will be hurt by that. Beyond that, Facebook now finds itself in yet another scandal, which has people shutting some tech overall. Quite frankly, there’s nothing good about this chart from the upside and I think that rallies will continue to be thought of as opportunities to short this market. I believe that we will go looking towards 6000 rather soon and do not trust rallies at this point.