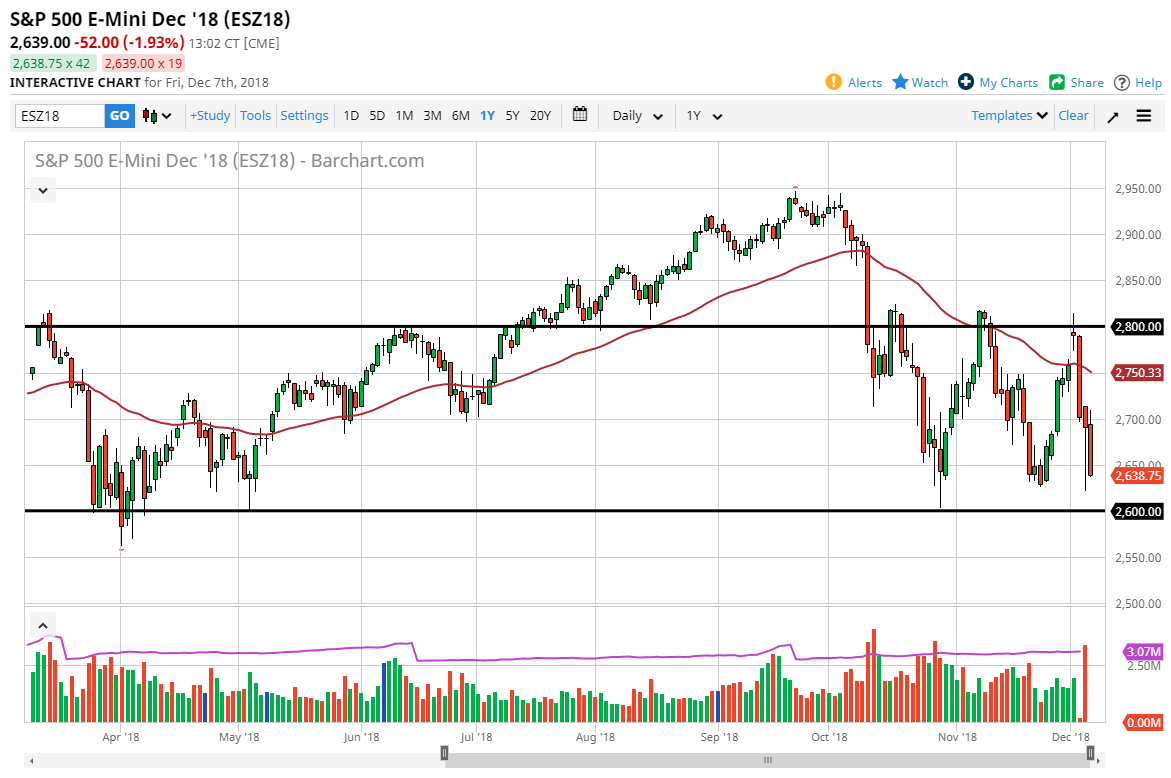

S&P 500

The S&P 500 broke down a bit during the day on Friday, reaching towards the 2650 handle and even slicing below it just a bit. Ultimately, the 2600 level underneath should be rather supportive, as we continue to bounce around in this range. I think the 2820 level is resistance, so we should continue to bang around in this overall region. We are closer to the bottom of it, so I would suspect that there are probably value hunters willing to step in here. If we do break down below the 2600 level, that could send this market much lower. We are obviously still concerned about the US/China situation, so those headlines of course will continue to be a major influence in this market as well. If and when we break out of the range, in either direction, it should measure for roughly 200 points.

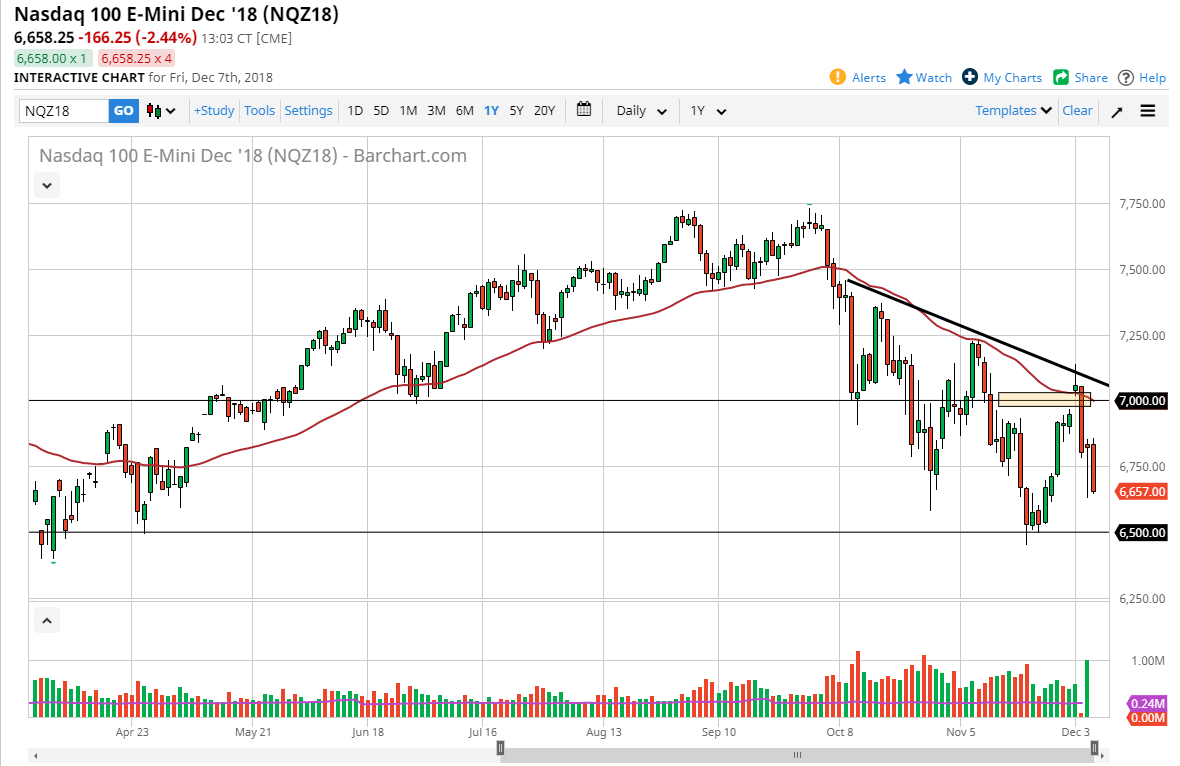

NASDAQ 100

The NASDAQ 100 got hammered during the trading session as well, reaching down to the 6650 region which was of course the lows from the previous session. There is support at 6500, so I anticipate that value hunters will probably be found in that general area. However, I would be much more comfortable fading rallies as they occur, especially if they reached the 50 day EMA. Short-term buying opportunities may present themselves, but overall I think this market continues to try to ground down a bit lower as the NASDAQ 100 is highly sensitive to all things US/China related. Until we get some type of traction in that part of the world, it’s very difficult to imagine that the NASDAQ 100 will have a good and easy go of it. If we break down below the 6500 level, we should probably start thinking about 6000 at that point.