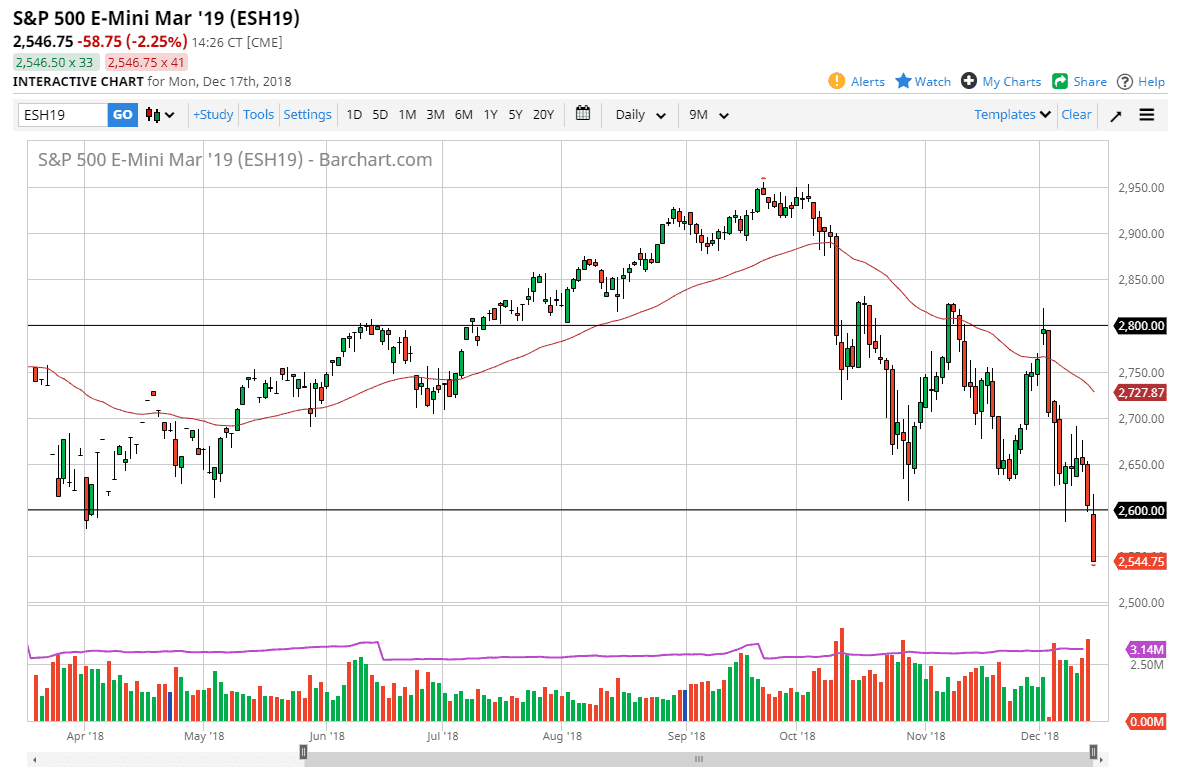

S&P 500

The S&P 500 initially tried to rally during the trading session on Monday but was rejected and pushed below the 2600 level. The market then broke down below the 2550 handle, and it now looks as if the S&P 500 is essentially broke. At this point, I think that the market is probably going to go looking towards the 2500 level, and you can make an argument for the 200 point area that we just got done bouncing around in signaling another 200 point drop, down to the 2400 level. It’s obvious that the “Santa Claus rally” isn’t coming, at least not unless something happens with the Federal Reserve and the statement. If they suddenly sound like they are going to be much more data dependent, that could give the stock market a short-term pop, but quite frankly I think once that wears off it’s likely that we could see people start to worry about the global economy.

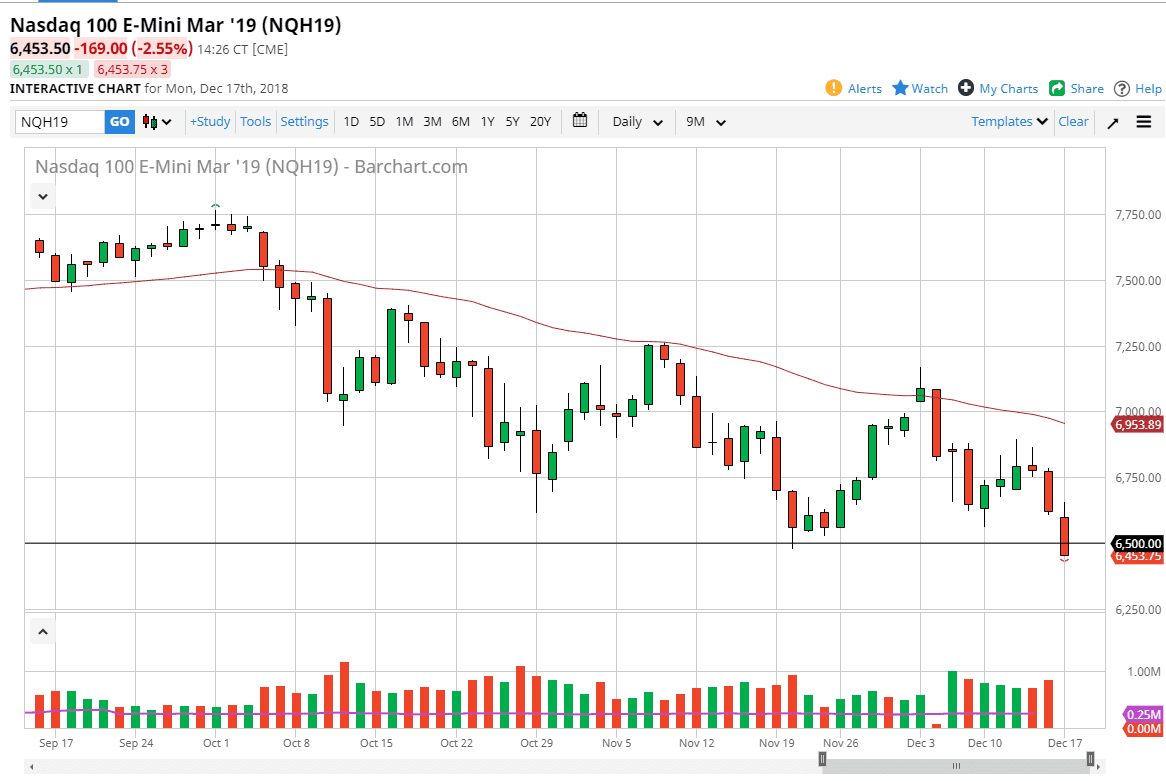

NASDAQ 100

The NASDAQ 100 also tried to rally initially but then broke down below the 6500 level, so it looks as if we are ready to go much lower. At this point, I think that if we break down below the lows of the trading session on Monday, we probably will unwind this market to go looking towards the 6250 handle. This market will be especially sensitive to the US/China trade relations issue, and therefore I think that rallies cannot be trusted. If we did break above the couple of long wicks from last week, then we can make an argument for buying, but that probably isn’t going to happen in the short term, at least not unless the Federal Reserve somehow helps the situation.