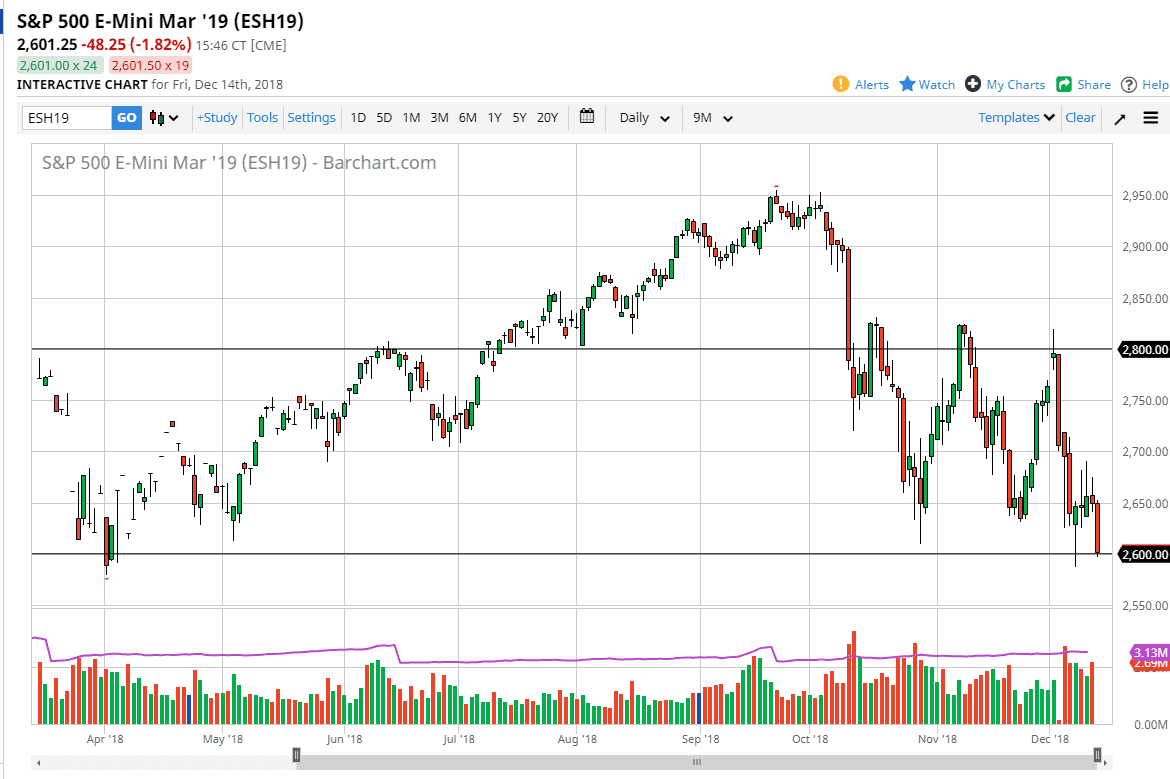

S&P 500

The S&P 500 broke down significantly during the trading session on Friday, falling down to the 2600 level. That’s an area that has been massive support, and the fact that we are sitting there tells me that we are more than likely going to break below this level. Ultimately, if we break down below the hammer from the Monday session, then the market is very likely to continue to go much lower, perhaps reaching towards the 2500 level. Beyond that, breaking down below there would confirm a breaking of the recent consolidation area, possibly sending this market down to the 2400 level. I do not trust rallies at this point, at least not until we clear the 2700 level, something that would take an extraordinary amount of bullish pressure, and perhaps even some type of good news, something that we just simply don’t have.

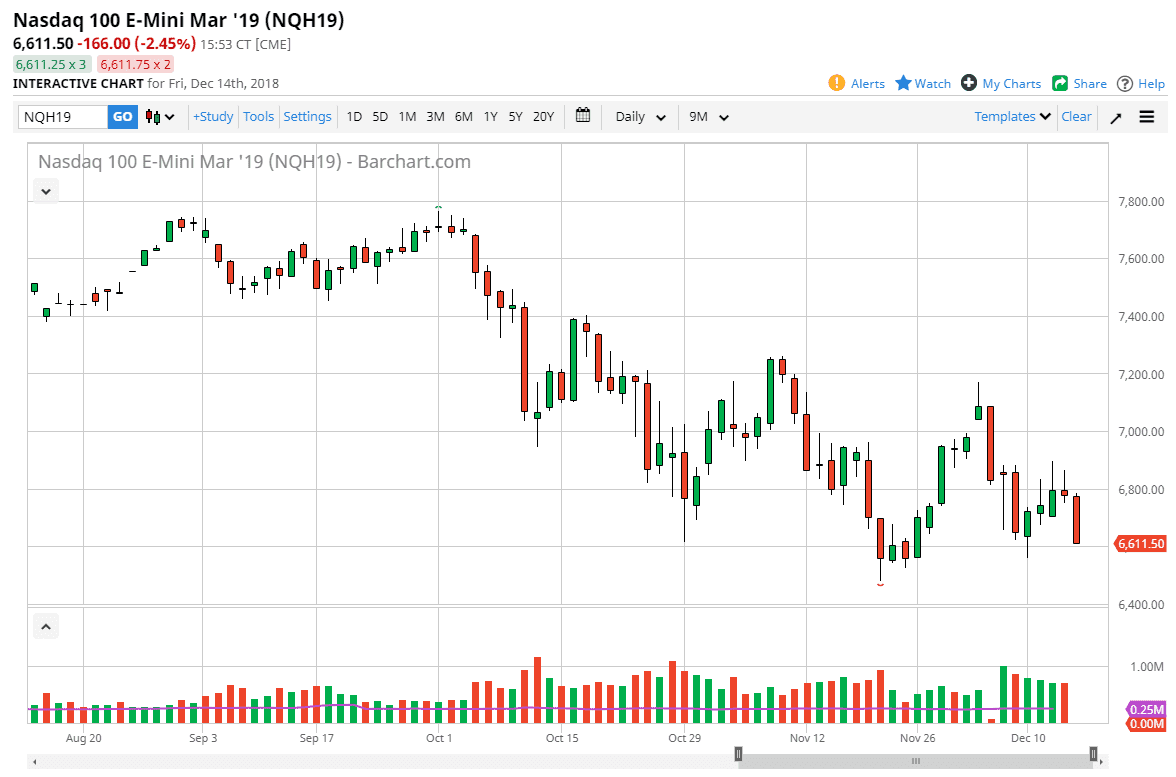

NASDAQ 100

The NASDAQ 100 also broke down during the day, reaching towards the 6600 level. Ultimately, I think that we do continue to go lower, because as long as the US/China trade war is an issue, tech companies will suffer overall. I think at this point, the market is likely to continue to see a lot of bearish pressure on short-term rallies, and therefore I think that the rallies will be selling opportunities. In fact, it’s not until we clear the 7000 handle that I feel comfortable buying the NASDAQ 100, which would more than likely will need some type of headline to push things higher, perhaps either from Beijing or the United States. If we get some type of resolution between the Americans and the Chinese, that could send this market much higher.