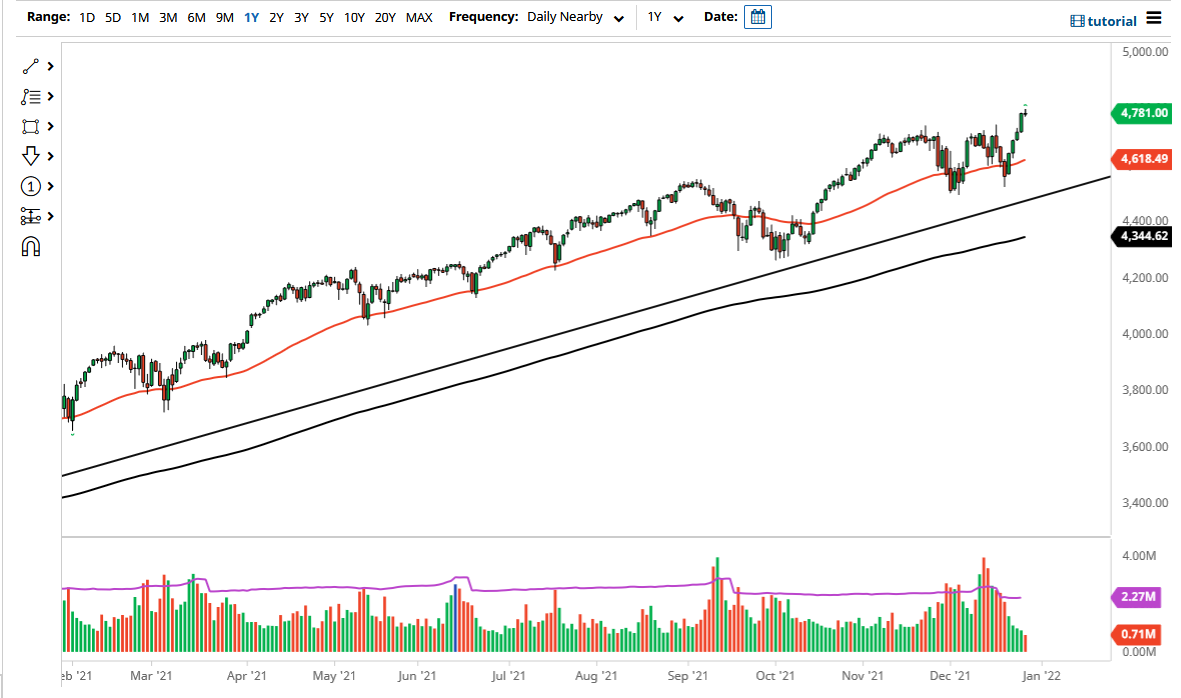

S&P 500

The stock market was of course closed during the Wednesday session in observance of the state funeral for George HW Bush. However, the futures market was open early in the day, and stopped right at a major level. As you can see, we had previously had a downtrend line that the market had broken above, but then sliced through during the Tuesday session. In thin trading on Wednesday, we bounced back to that trend line, showing it as resistance. The 50 day EMA is just above the 2750 level, so I do believe that there is a significant amount of resistance overall. I think it’s very likely that we will see sellers jump back into this market on any signs of strength. However, if we do close above the 2750 level on the daily chart, then we could make another push higher. However, I think the biggest thing that’s helping this market is the fact that the underlying is closed.

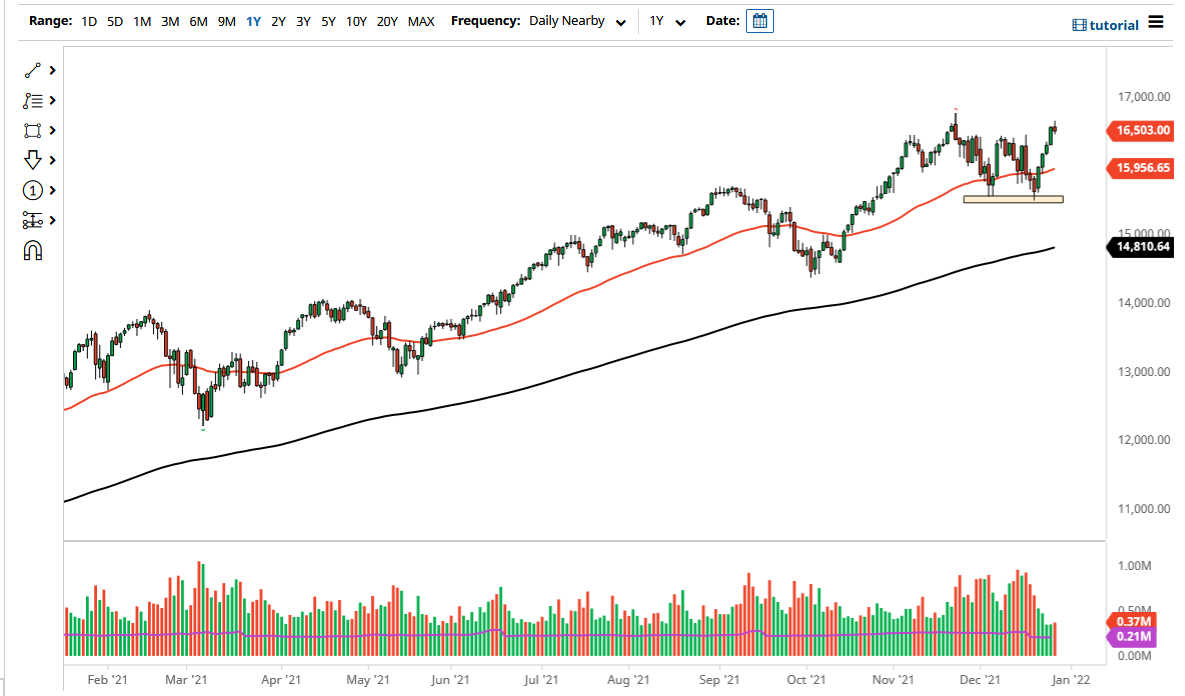

NASDAQ 100

The NASDAQ 100 also rallied in the early electronic trading, testing the previous downtrend line, and stopping right there. I think at this point, the 7000 level above is massive resistance, and the fact that we sliced right through the gap from the beginning of the week tells me that there is serious negativity in this market. I think it’s not until we close above the 50 day EMA on the daily chart that I would consider this market as a potential buying opportunity. Between now and then, I think that rallies are to be treated with suspicion and that exhaustive candles could kick off more selling going forward. The biggest problem with the market right now is that it is simply reacting due to algorithmic traders based upon random headlines.