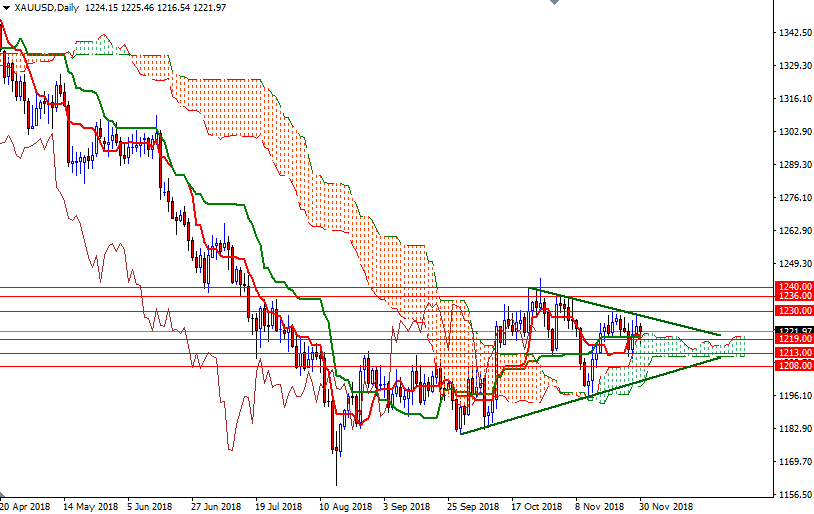

Gold prices settled at $1221.97 an ounce on Friday, suffering a loss of 0.12% on the week but making a gain of 0.57% over the month. XAU/USD tested a key technical resistance in the $1240-$1236 area at the beginning of November but failed to pass through. As a result, prices dropped below the $1213 level and returned to the daily Ichimoku cloud. Worries about rising interest rates have been a major factor working against the precious metal over the past few months, though the recent volatility in global markets prompted some buying interest in gold. The minutes from the Fed’s November 7-8 meeting showed that officials are on a course to raise interest rates this month, but they appeared more tentative about the pace of increases after that. Gold is still a dollar story so traders will be paying close attention to what the Fed will say at its final meeting of the year.

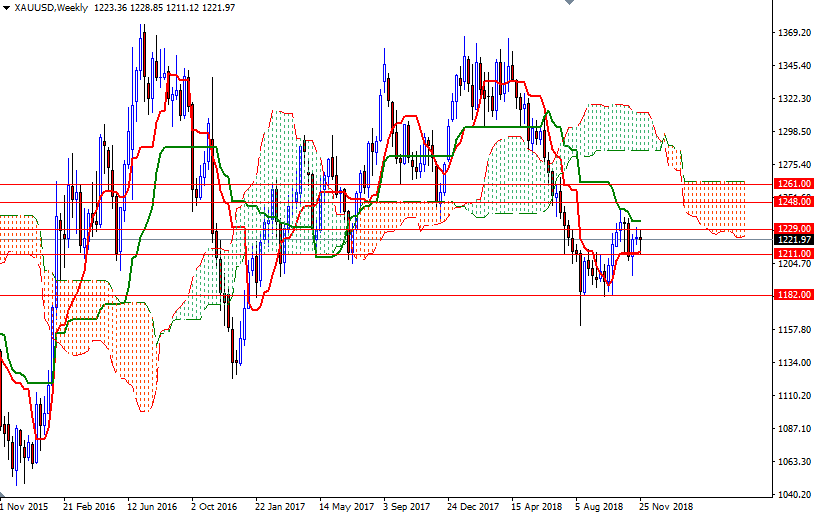

XAU/USD is trading above the Ichimoku clouds on the daily chart, and we have a positive Tenkan-Sen (nine-period moving average, red line) - Kijun-Sen (twenty six-period moving average, green line) cross. On the other hand, prices are still below the weekly cloud, and Tenkan-Sen and Kijun-Sen are negatively aligned. The Chikou-span (closing price plotted 26 periods behind, brown line) is also moving below prices.

With that in mind, I think the bulls have to capture the aforementioned key resistance in the 1240/36 zone to march towards the weekly Ichimoku cloud. If that is the case, the look for further upside with 1252/48 and 1261/0 as targets. A break above 1261 could foreshadow a move to 1273/0. However, if the market is unable to sustain a break above 1232/0, we will probably head back to the bottom of the 4-hourly cloud. The bears have too drag prices below 1213/1 to gain momentum for 1208/7 and 1205. Below there, the 1200-1198 area stands out as a strategic support. Closing be 1198 implies that the market is getting ready to test 1193. Further weakness below 1193 could lead to a drop to 1188.