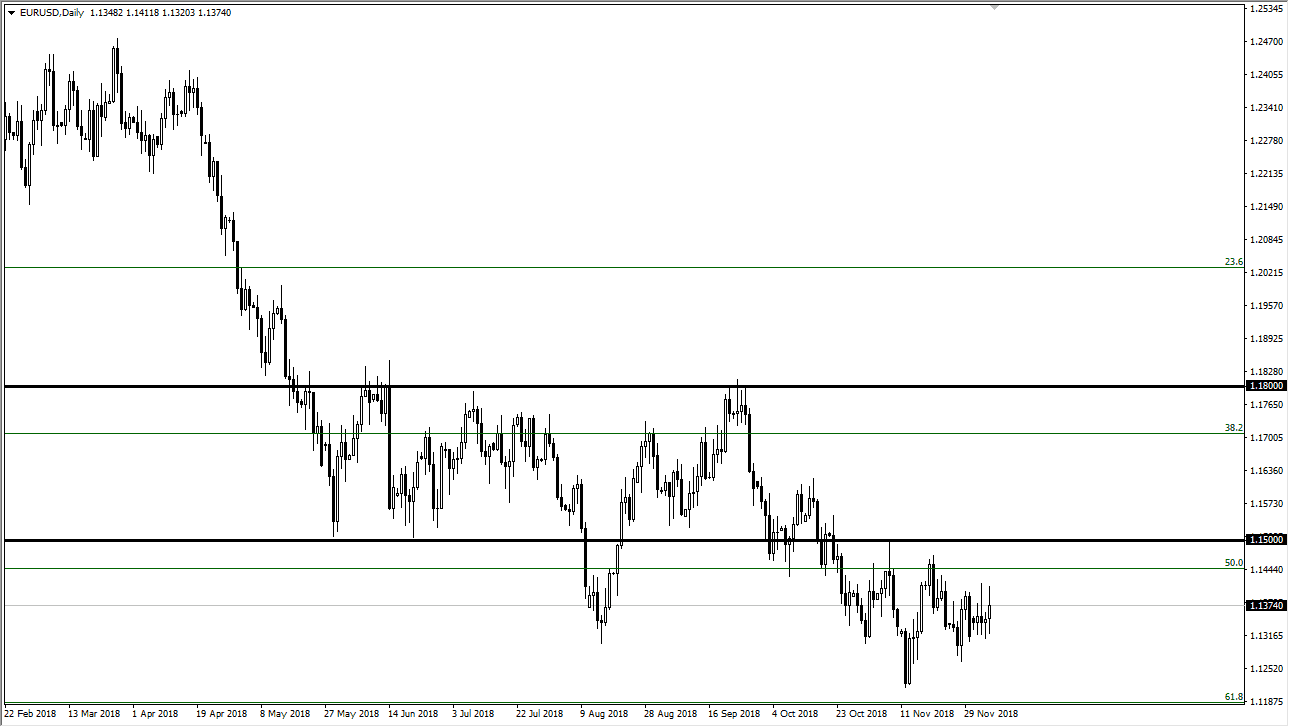

EUR/USD

The Euro rallied significantly during the trading session on Thursday, but then rolled over to show signs of weakness again. The Euro continues to fail once we get close to the 1.14 handle, but overall I think what the market is trying to figure out where to go next, and with the jobs number coming out Friday, it’s likely that we will continue to go back and forth. Typically, the jobs number will produce a day that goes back and forth, and essentially go nowhere by the time it all closes. I suspect that will probably be the case again during the day on Friday. I think that the 1.15 level above will keep the market down, just as the 1.11 level underneath will be supportive. Ultimately, we are simply chopping back and forth.

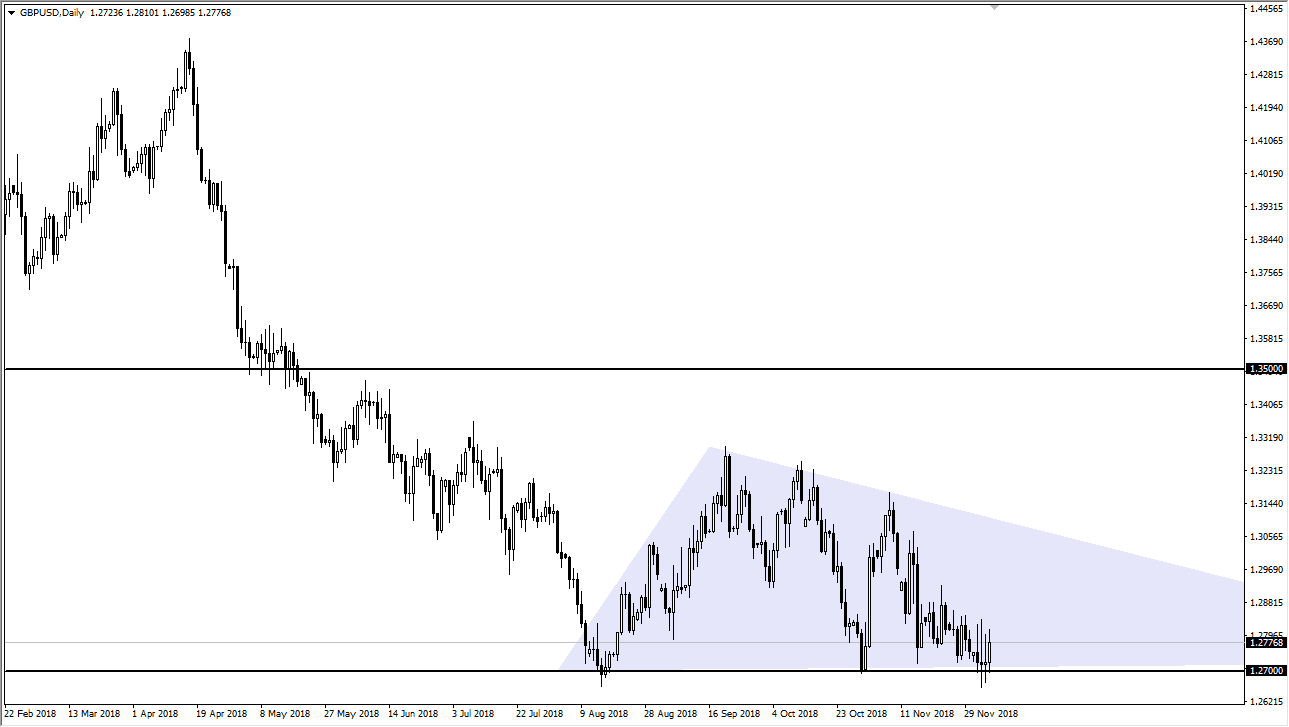

GBP/USD

The British pound has rallied significantly during the trading session on Friday, but continues to struggle near the 1.28 level above, which is massive resistance. I think at this point it’s likely that the market will continue to do more of the same, perhaps reaching down towards the 1.27 handle. That’s an area that is significant support, and if we can break down below there it’s likely that the market could go down to the 1.22 handle based upon the descending triangle. Every time we rally, I look at it as an opportunity to short the market, and I think with the jobs number coming out on Friday it’s likely that we will see a lot of volatility. However, at the end of the day it’s more about the Brexit than anything else, which of course continues to cause headlines that throw this market around. Overall though, I am negative.