EUR/USD

The Euro broke down rather significantly during the trading session on Friday, reaching down to the 1.13 level. That’s an area that has been support and resistance in the past, and it looks as if traders are continuing to struggle to hang onto gains here, so I think selling short-term rallies continues to work. The Italian debt situation continues to cause issues for the European Union, so I think that traders are probably going into the weekend worrying about that and of course the G 20 meeting between President Donald Trump and President Xi. With that in mind, it makes sense that perhaps the US dollar would get a bit of a bid. I think it’s not until we break above the 1.15 level on a daily close that the Euro will change its fortunes. I don’t necessarily think we are heading into a major break down though.

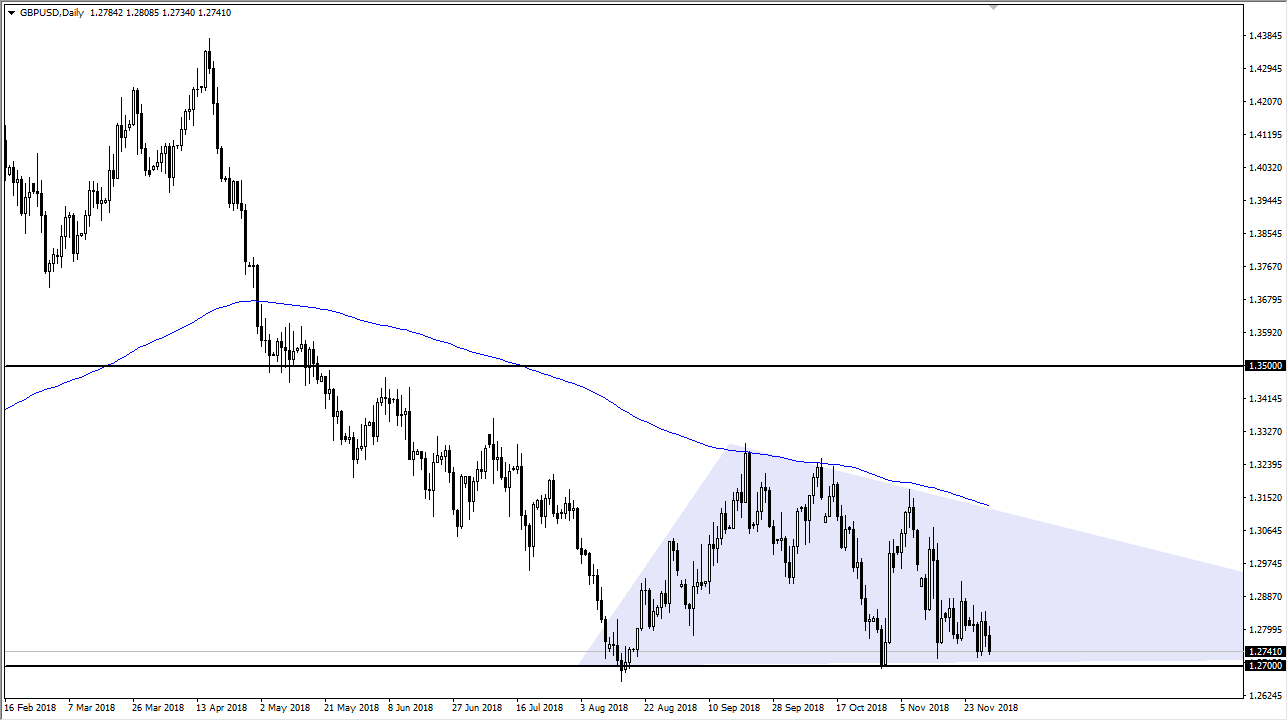

GBP/USD

The British pound continues to look very vulnerable to selling pressure in every time it rallies, you should be selling. The 1.27 level underneath continues offer significant support, but if we break down below there it’s likely that we could go as low as 1.22 level based upon the measurement of a descending triangle that we are currently in. I don’t think that we are going to be able to sustain a rally for any length of time, and it’s not until we break above the 200 day EMA on the chart that I would be a buyer. There is also a downtrend line in the descending triangle, so I think it makes sense that rallies will be faded as we worry about the Brexit and of course it looks like the British Parliament isn’t ready to sign away on the agreement.