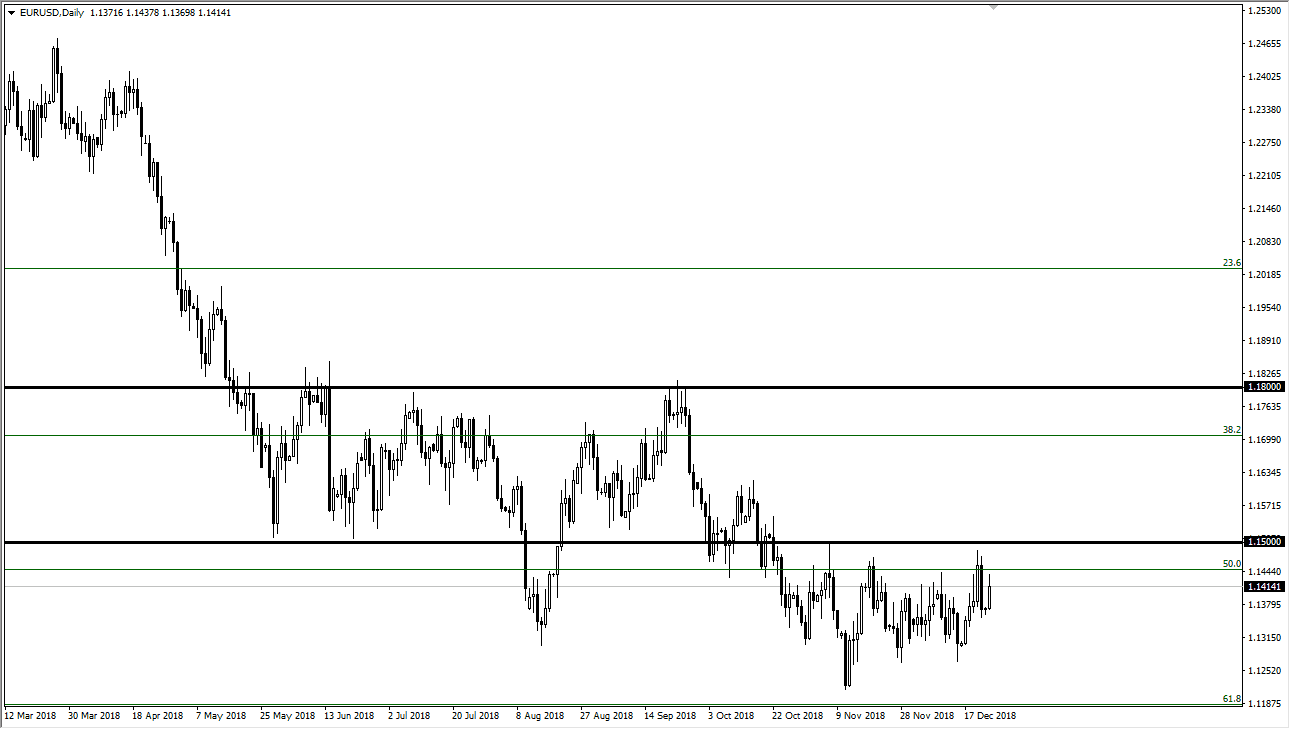

EUR/USD

The Euro rallied a bit during the trading session on Monday but ran into resistance again above the 1.14 handle. This is a market that is very range bound but does look like it’s trying to tilt to the upside a bit. That being said, one of the biggest problems that we ran into is the time of year, which of course means that liquidity can’t be trusted. I believe that the 1.15 level above continues to be very important, so a break above that level could send this market higher. Signs of exhaustion between here and there could be a short-term selling opportunities, but it looks as if we are trying to turn the corner. For what it’s worth, the lows were just above the 61.8% Fibonacci retracement level. Much of the reaction was probably due to what was going on in the US stock markets.

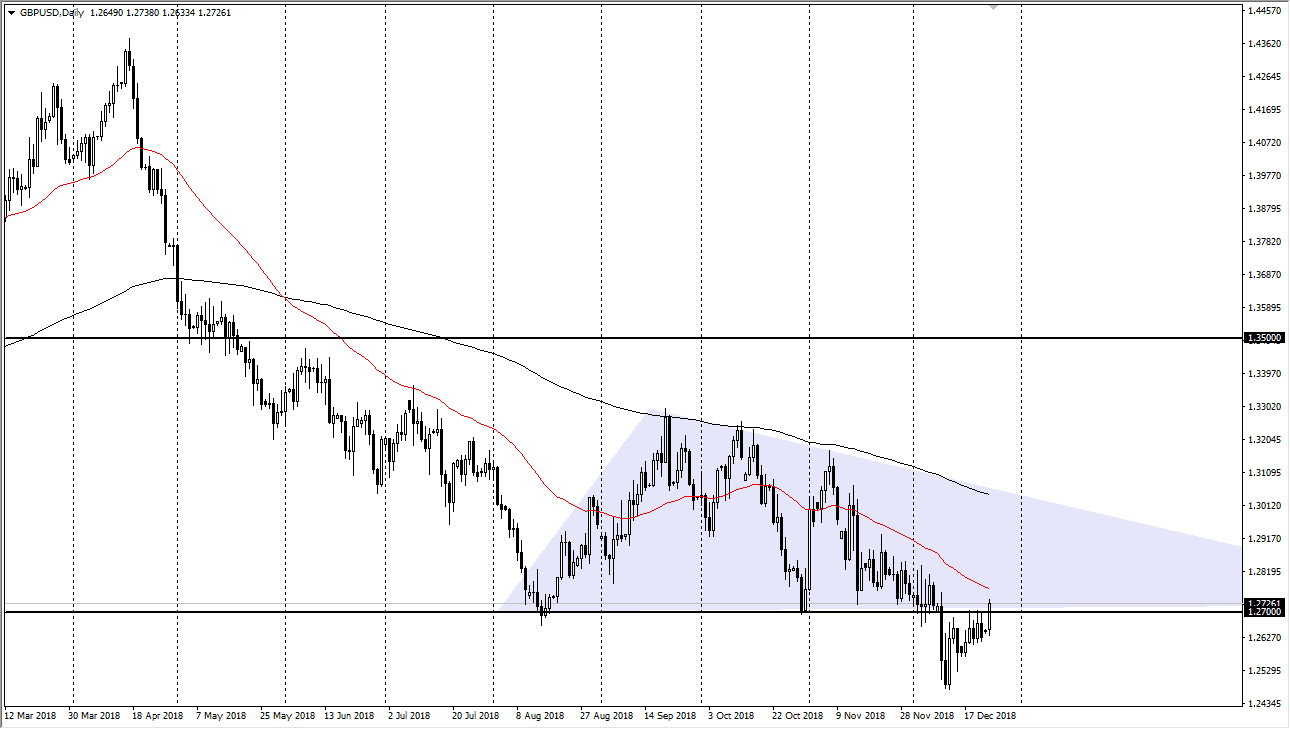

GBP/USD

In a bit of surprise, the British pound broke above the 1.27 level during trading on Monday. The 50 day EMA is just above though, and it most certainly is tilting to the downside. At this point, I think that signs of exhaustion are selling opportunities, and at this point I think there is a lot of noise above that will continue to push this market to the downside. Even though we have rallied a bit on Monday, I think that a lot of this comes down to the US stock market falling apart on Monday again, but at this point it’s only a matter time before headlines about the Brexit continues. If that continues to be a major driver, then this market will continue to go much lower. I think the 1.22 level underneath will be the target based upon the height of the consolidation area.