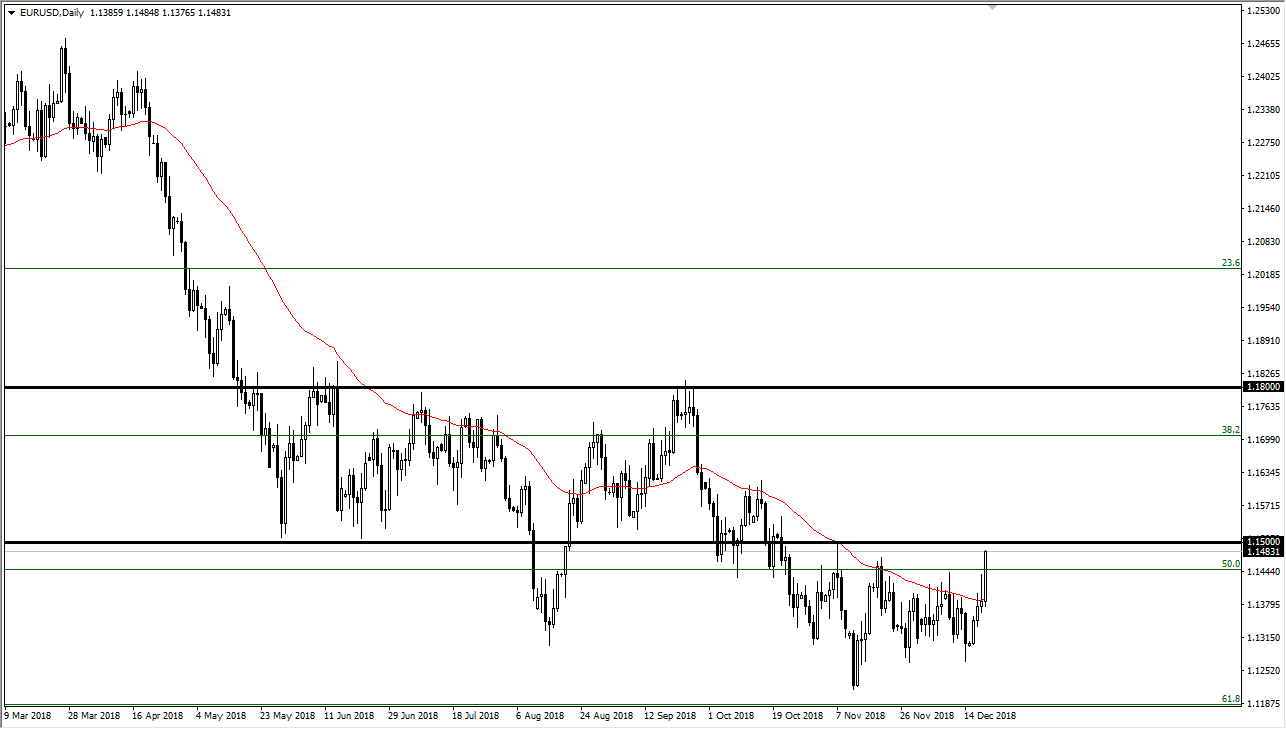

EUR/USD

The Euro broke higher during the trading session on Thursday, slicing through the shooting star that formed during the trading session on Wednesday. The 1.15 level above is resistance as it is not only psychologically important, but it has been structural resistance in the past as well as support. Overall, I think that we very well could pull back from here just a bit, but this was a bit of a reaction to the Federal Reserve yesterday, and then eventually the fact that Donald Trump is not willing to sign a continuing resolution to keep the government open due to a lack of funding for the border. Overall, we have bounced from the 61.8% Fibonacci retracement level, and we have broken above the 50 day EMA. Ultimately, I think we are at risk of a pullback from here though due to the time of year. If we break above the 1.16 level, then I think the market could go to the 1.18 handle.

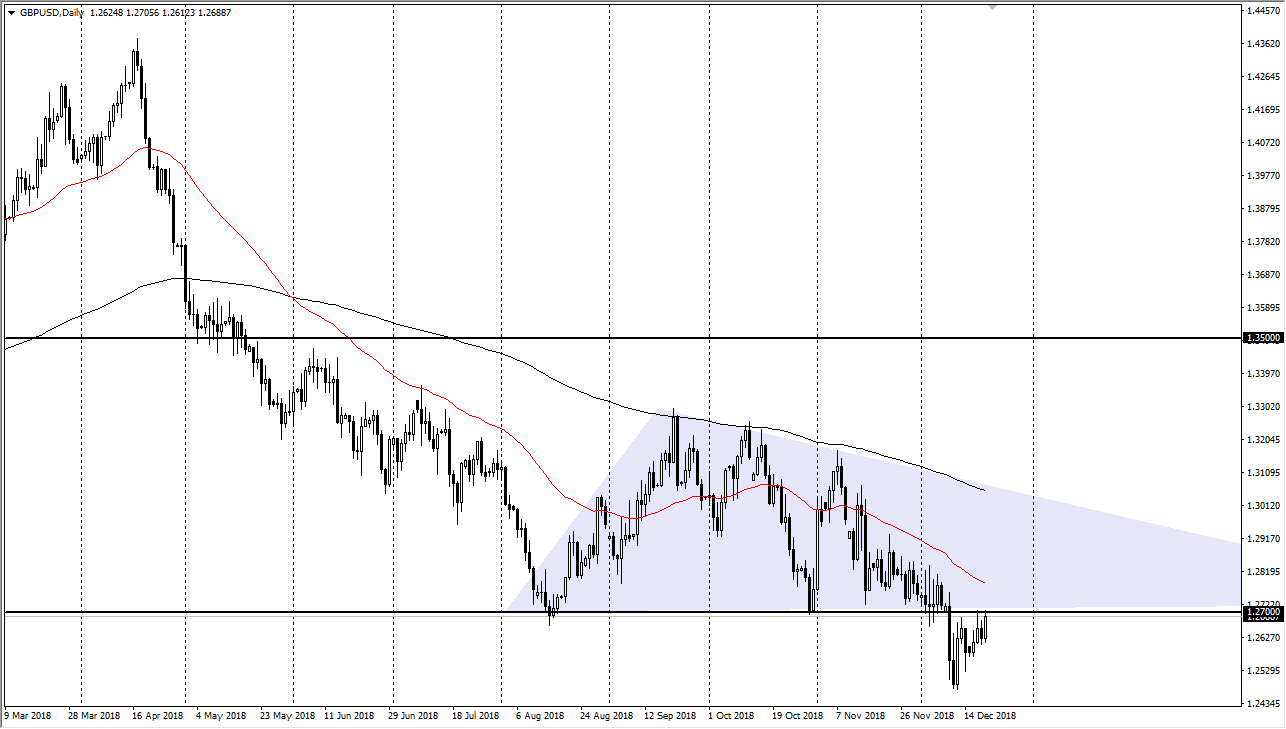

GBP/USD

The British pound has rallied during the session on Thursday as well, reaching towards the 1.27 level, an area that previously used to be supported, but is now resistance. I think at this point it’s likely that the area should hold though, as it is so vital. The 50 day EMA, marked in red on the chart, is turning down and heading lower. At this point, I think that the descending triangle still suggests that we are going to go down to the 1.22 handle, based upon the height. Ultimately, I think it makes sense as there is a lot of trouble with the Brexit, and I believe that the market will eventually fade this move, overall, I believe that the British pound is struggling but if we broke above the 50 day EMA, we could make a run towards the 200 day EMA.