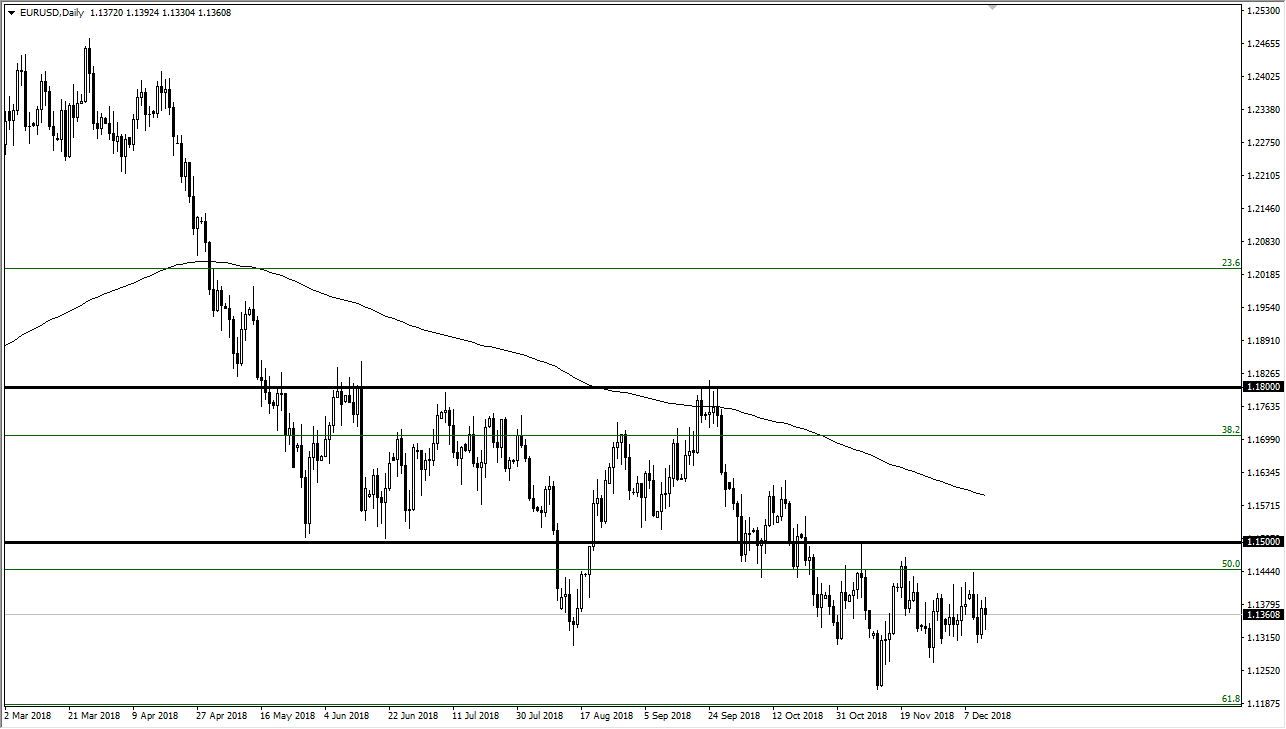

EUR/USD

The Euro went back and forth during trading on Thursday, as the ECB held firm, but had a less than compelling statement afterwards. Incoming economic numbers have been less than stellar, and therefore it puts a little bit of negativity on the Euro itself. The ECB did of course step away from the bond buying program, but it suddenly sounds a bit more dovish than it did just a couple of weeks ago. Beyond that, on the other side of the equation we have a Federal Reserve that seems to be a bit softer as well. These two things may cancel each other out, leaving the market looking for some type of clarity, something that we just simply do not have. The 1.15 level above continues to be massive resistance, with the 1.11 level underneath offers massive support. I think we go sideways for the next two weeks.

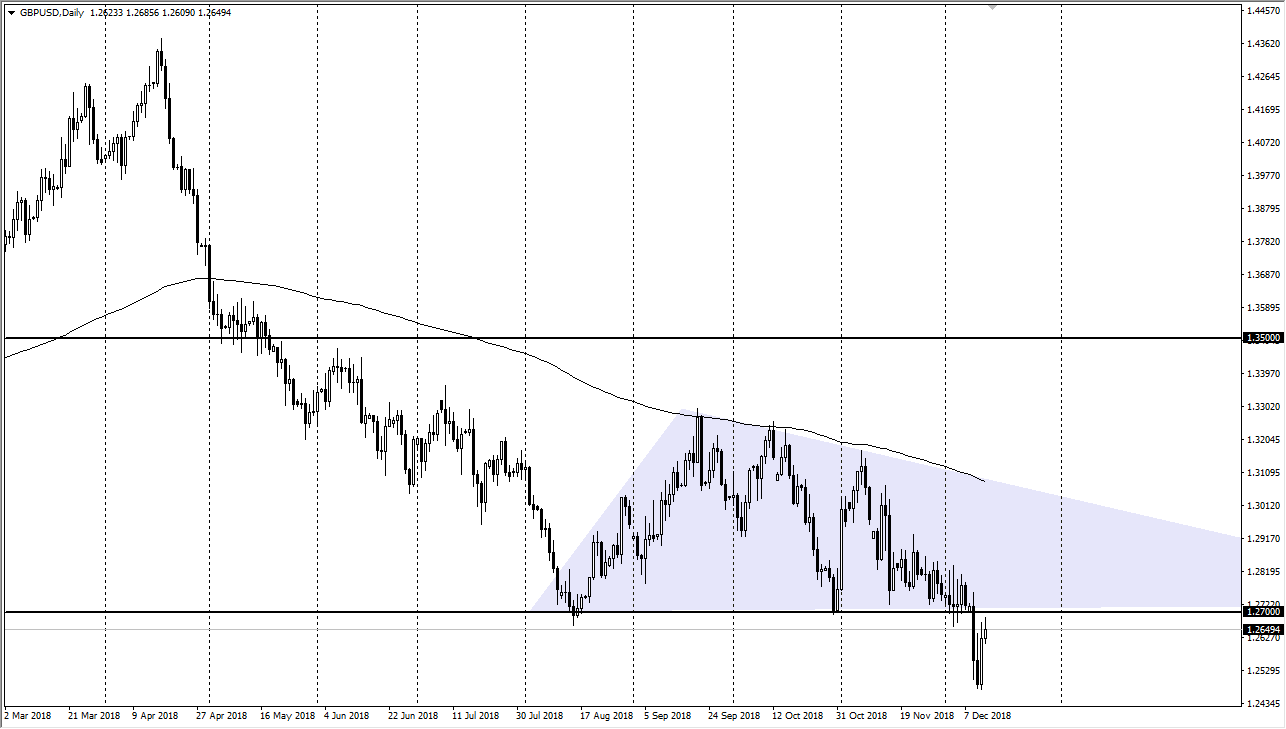

GBP/USD

The British pound rallied a bit during the trading session, but as you can see struggled at the 1.27 level. That’s an area that of course was supportive in the past, and now it looks to offer resistance. I think that the British pound is very vulnerable to negative headlines, and of course now that we have gotten the confidence vote out of the way, we will start to focus on the fact that the Brexit is going to be a very difficult and painful thing. Ultimately, I believe that if we get a daily close above the candle stick from Monday, then we have to reset. Otherwise, these rallies look very likely to be selling opportunities. Breaking the bottom of the descending triangle suggests that we are going to the 1.22 level, and we have just retested the bottom of the triangle, only to fail.