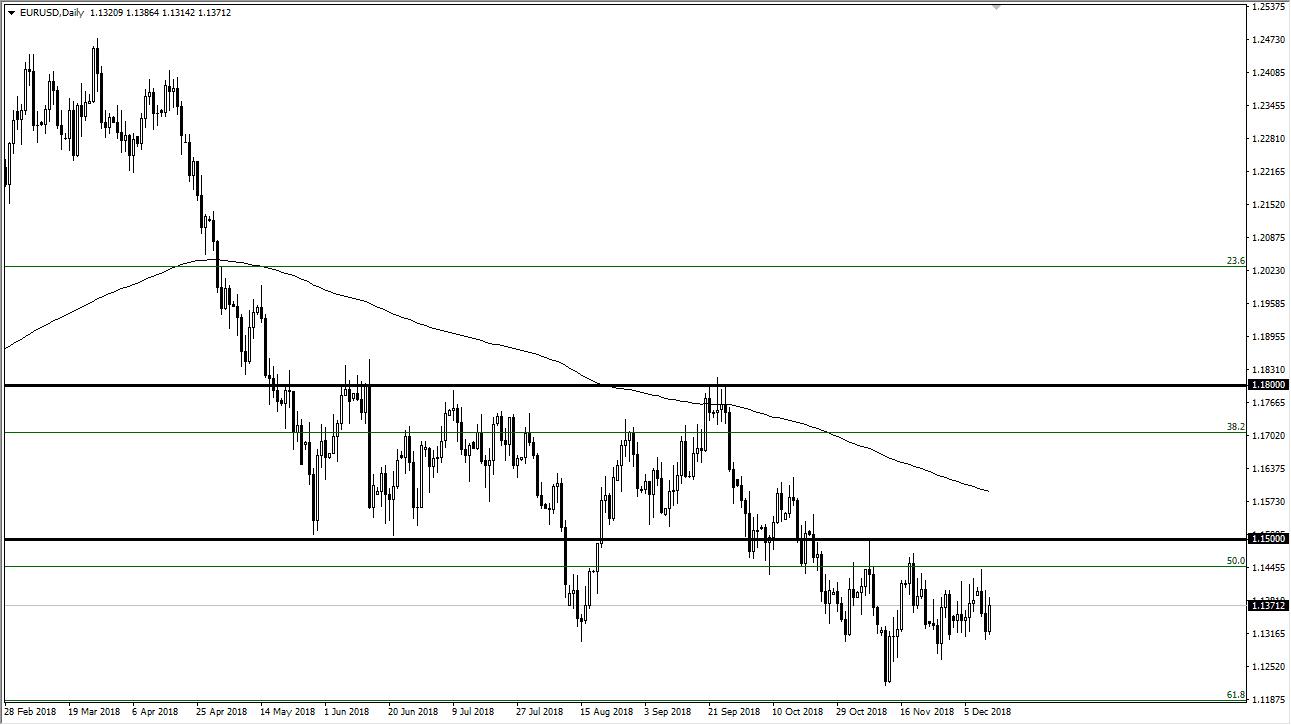

EUR/USD

The Euro rallied rather significantly on Wednesday, as we reached towards the 1.14 level. However, this is an area that continues to find a lot of resistance, and we are in the process of forming a bit of a symmetric triangle. Because of this, I anticipate that it’s only a matter of time before we see sellers jump back into this market, pushing it back down towards the 1.13 level. This is a choppy marketplace, and that makes sense as we are trying to figure out what the Federal Reserve is going to be doing, which obviously is a huge influence on the greenback itself. The Italians have given into ECB demands of putting out a 2% budget, but overall we are still in a downtrend. I think we simply chop back and forth between the 1.1450 and the 1.1250 range for the rest of the year.

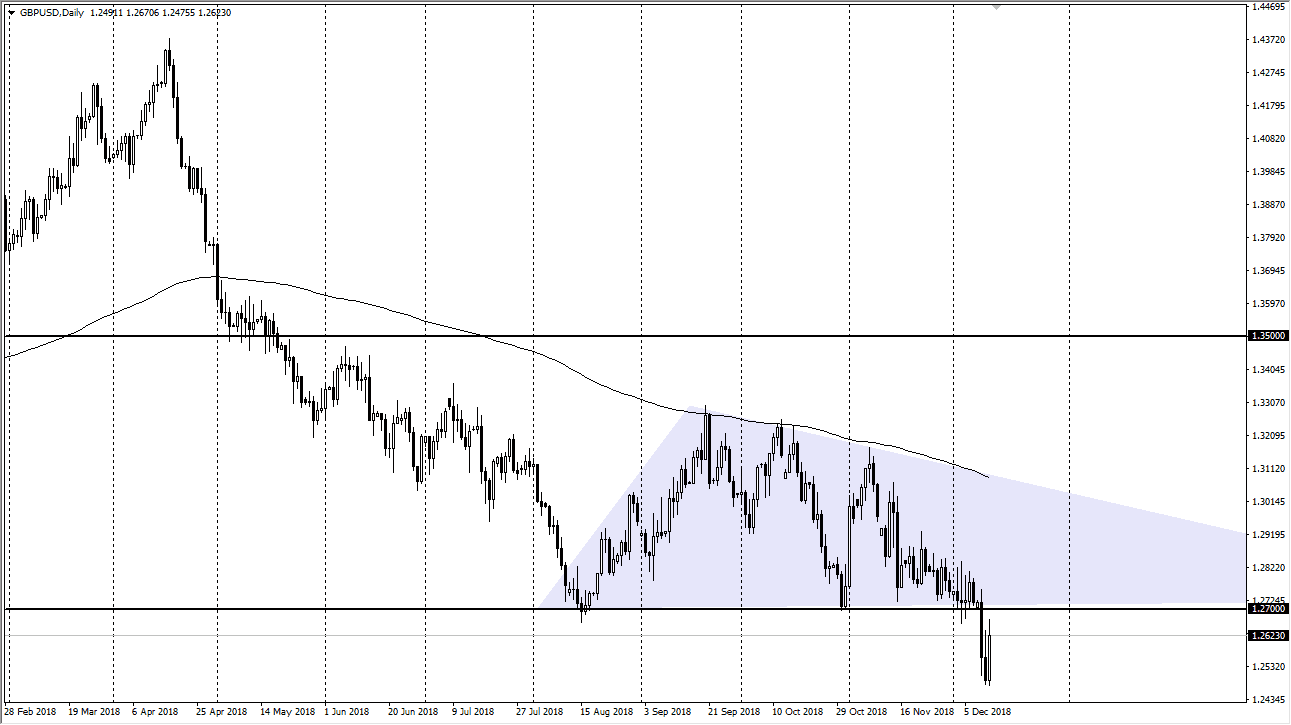

GBP/USD

The British pound has skyrocketed during the trading session on Wednesday, as Teresa May got a favorable vote out of Parliament. However, there are still all of the same issues facing the Brexit as there were before, so I think the 1.27 level will in fact offer major resistance, as it has previously been support. I fully anticipate that rallies are to be sold, and that it will be very difficult for this market to continue to go higher. I think quite frankly, we still look very likely to go lower, perhaps down to the 1.22 handle over the longer-term based upon the descending triangle that I have marked on the chart. I have no interest in buying the British pound until we have some type of deal or at least a good chance that a deal involving the Brexit.