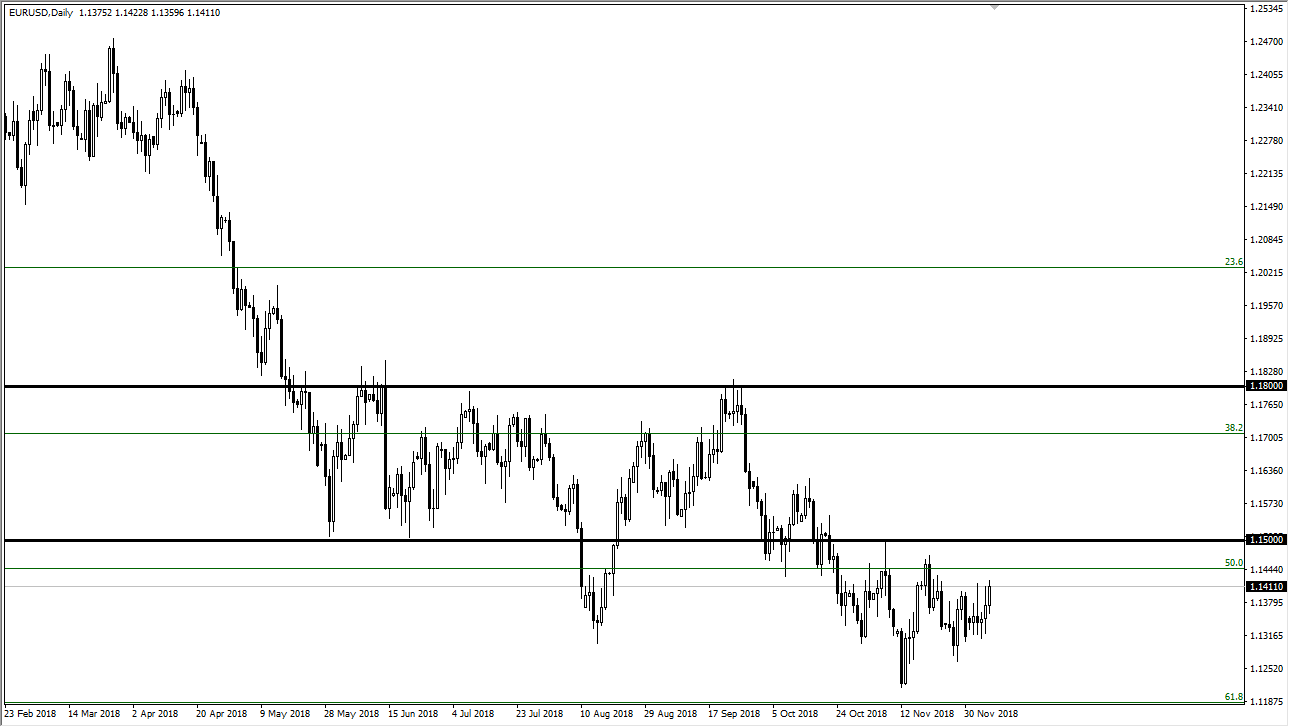

EUR/USD

The Euro pulled back slightly during the trading session on Friday but then shot higher after the jobs number was just slightly disappointing. However, there is a ton of resistance between this area and 1.15 above, so I think buying would be a bit premature here. Longer-term though, I think that the US dollar is trying to fall off a bit after the Federal Reserve has started to look a little bit soft. If we do break above the 1.15 handle, that could send the market towards 1.16 level next. However, I think that we will probably get some type of exhaustive candle that we can start shorting for the short term. This is a market that will of course start to lose a bit of liquidity as we closer to the holidays, so keep that in mind.

GBP/USD

The British pound fell during trading on Friday, reaching towards 1.27 level again. However we did get a little bit of a bounce in that area, so I think it’s likely that the buyers will continue to look at that area as potential value. However, if we were to break down to a fresh, new low then I think that the market will probably go down to the 1.22 level based upon the measured move from the descending triangle. I think that what will cause this could be a “no deal Brexit”, which of course would be very negative for the British pound. Every time we rally, I’m looking for an opportunity to start shorting this market, it will use short-term exhaustive candles as an opportunity to go short of this pair yet again. If we do break out to the upside, we could go as high as the 1.30 level, but I think that’s the least likely of the two scenarios.