AUD/CHF

The Australian dollar measured against the Swiss franc is a major way to express your risk appetite of global assets. For example, the Australian dollar is considered to be “risky” as it is highly leveraged to commodities and of course the Chinese economy. I think at this point; the market probably is going to react violently to the US/China trade relations. This is a currency pair that will be moved drastically due to the global expectations, and I think there is far too much in the way of uncertainty right now to think that this market will rally and be able to sustain that move. That being said, the US and the Chinese come together in some type of trade agreement, it’s possible that we could see an explosive rally.

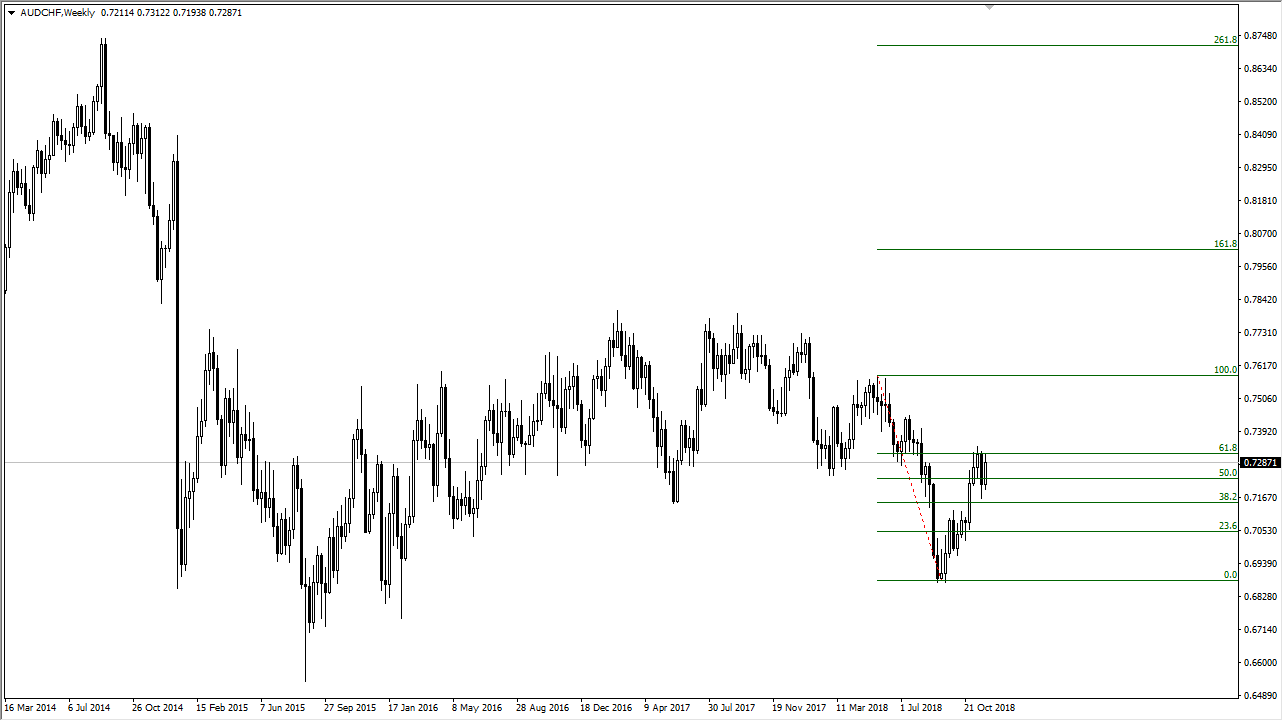

Looking at the weekly chart, you can see that the 61.8% Fibonacci retracement level is offering resistance as it was previous support and of course we look very volatile in the short term and as I write this we are awaiting to see what the Argentine G 20 conversations bring out. I think at this point, December is going to be pivotal as to where we go next, and I think the uncertainty will continue to make this a very interesting place to be. The 0.67 level above would be a major barrier to overcome, but if we wipe out the entire move that’s obviously very bullish. Alternately, if we break down below the 0.7150 level, the market then probably unwinds drastically. I also believe that it would be assigned that trade relations have gotten worse, not better. Beyond that, if we break down below the lows that we had recently made, that would show a massive negativity around the world, and you would probably see the Australian dollar hurting against most currencies. Simply put, if we can close well above the 61.8% Fibonacci retracement level, then I think the market continues to grind higher on good news. Otherwise, look out below.