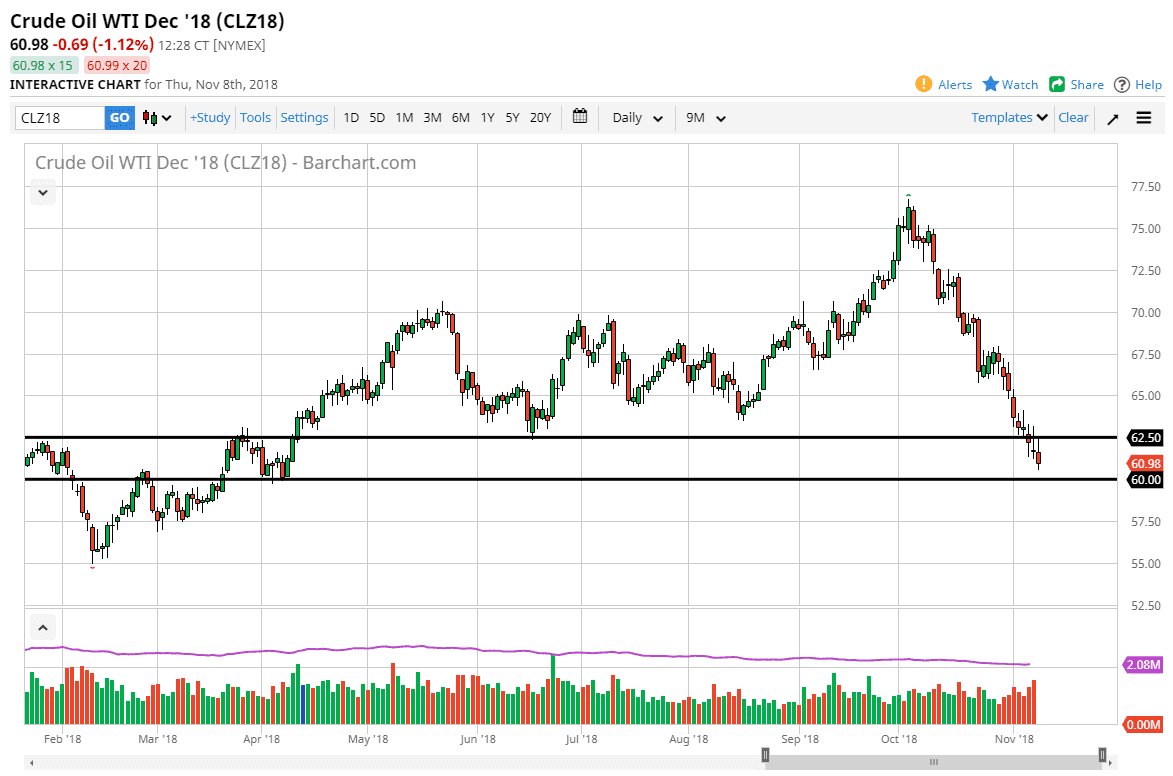

WTI Crude Oil

The WTI Crude Oil market initially tried to rally during the trading session on Thursday but found resistance again at the $62.50 level. With the surprise build yet again in the oil markets, and the United States producing over 12 million barrels a day, I think oil is going to continue to have major issues structurally. However, that doesn’t mean that we can’t see a pop, and quite frankly we need to at this point. After all, crude oil is oversold by just about any metric you measure it, so I think it’s likely that we need a relief rally but it’s not really until we break above the $65 level that there is more momentum coming into the market. If the US dollar strengthens, we could also drop down towards the $57.50 level.

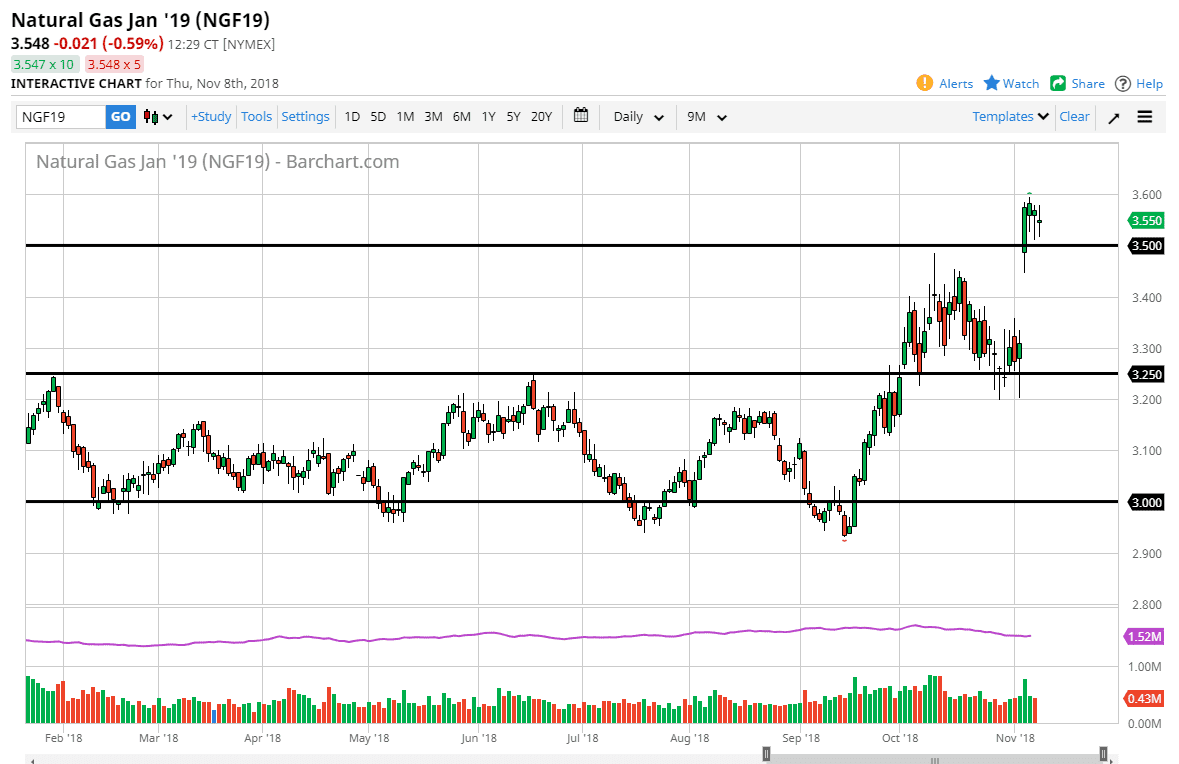

Natural Gas

Natural gas markets fell initially during the trading session on Thursday but then bounced again just above the $3.50 level. Ultimately, there is a bullish tone to this market as we recently gapped higher, and I think that although it’s a very strong market, I think that a pullback is very likely. I would love to buy a pullback in this market, especially closer to the $3.30 level. The $3.50 level so far is offering support, but paying this price is simply too expensive at this point, and quite frankly a bit dangerous. Ultimately, this is a “buy the dips” scenario, and therefore I think that the best thing you can do is simply wait for a drop in price to offer value. Recently we have seen revised weather reports for the winter in the United States, calling for colder temps. This of course has driven up demand.