WTI Crude Oil

The WTI Crude Oil market broke down rather significantly, slicing through the $55 level. We broke down below the hammer from the previous session, which is always a very negative sign. At this point, we are closing towards the very bottom of the range, so that’s obviously a very negative sign as well. I think that if we break down below the bottom of the range for the day, and it’s very likely that we will, the $52.50 level underneath would be targeted, beyond that, I think that the market goes down to the $50 level. If we rally, I believe that there is a lot of resistance above at the $58 level as well. I think at this point oil simply cannot get out of its own way. Are we are oversold? Of course we are. Can we go lower? Yes.

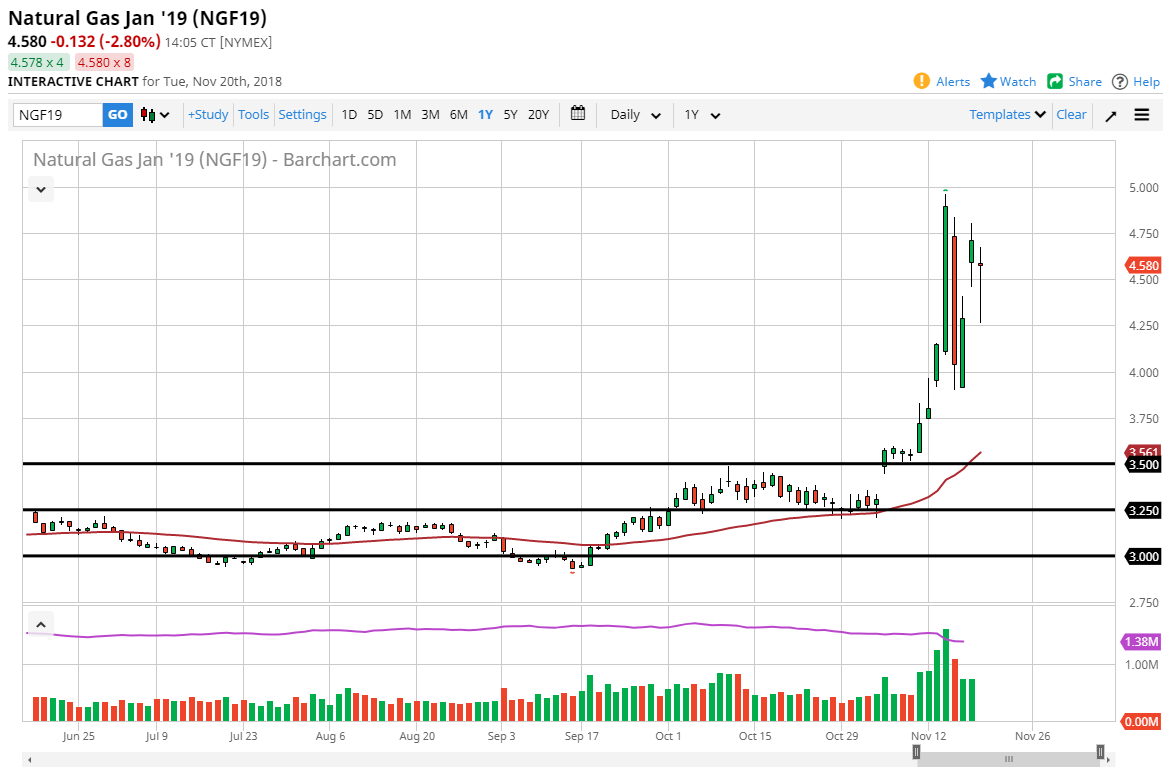

Natural Gas

Natural gas markets went back and forth during the trading session on Tuesday, as we have formed so much in the way of a very volatile situation. I think at this point, we have filled the gap from a couple of days ago, but we will still probably find exhaustion above. The $5.00 level is also psychologically important, so it’s only a matter of time before sellers get involved. If we break down below the $4.25 level, that probably opens the door to the $4.00 level next.

Even though we have shown so much in the way of bullish pressure, at this point you would have to assume that we are overbought. Overall, volumes are declining and I think part of the volume situation is that we are heading into the Thanksgiving holiday in the United States, so that of course will have a lot to do with the volatility as well. I fully believe that sometime relatively soon we will fall right back down.