Gold prices fell $4.21 an ounce on Friday as a stronger U.S. dollar index put some downside pressure on the precious metals markets. Despite Friday’s losses, XAU/USD ended the week with a gain of $0.66. Federal Reserve officials indicated last week that they plan to proceed with a December rate hike, but their cautious comments about the U.S. economy also suggested the central could slow the pace of raising interest rates in 2019. Global stock markets were mostly weaker last week. Worries about slowing global growth and trade tensions produced some safe-haven demand for gold.

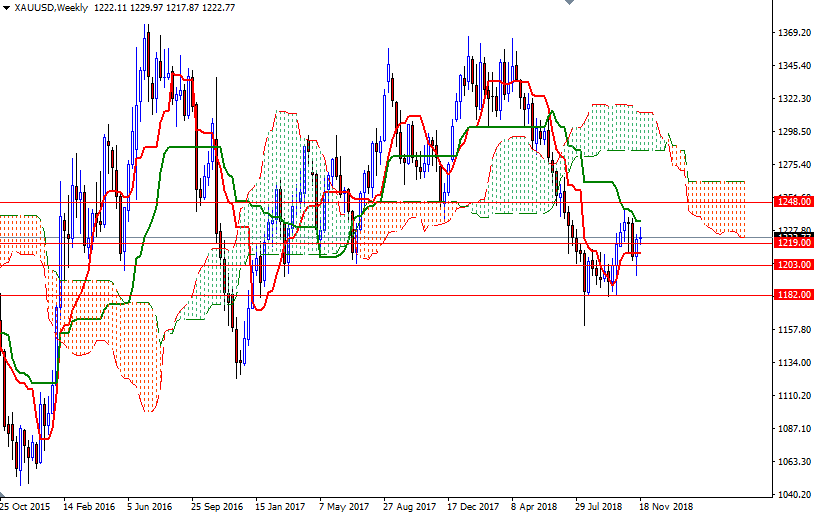

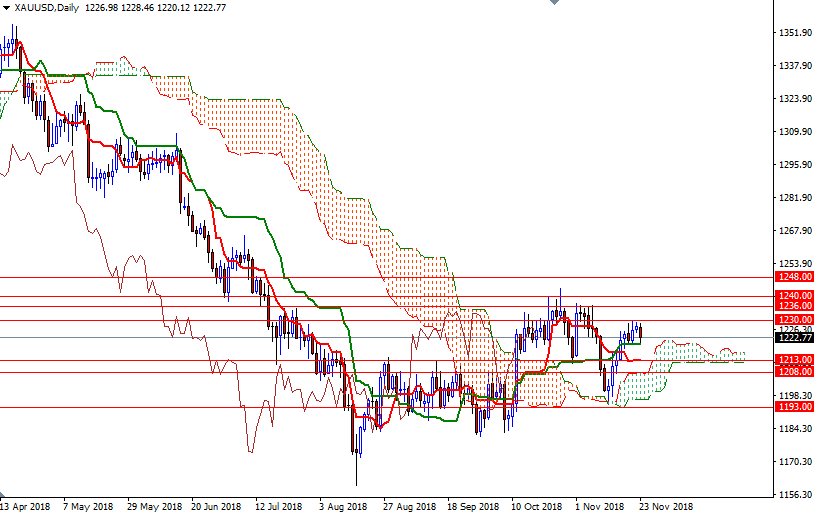

XAU/USD is trading above the Ichimoku clouds on the daily and the 4-hourly charts, suggesting that the bulls have the near-term technical advantage. However, beware that the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are negatively aligned, and prices are below the weekly cloud. With that in mind, I think the bulls have to convincingly lift prices above the 1240/36 zone, the confluence of the 200-week moving average and the 38.2% retracement of the bearish run from 1365.10 to 1160.05, to gain momentum and challenge 1245.50 and 1252/48. A break through there could trigger a push up to 1261/0.

On the other hand, if the resistance in the 1232/0 area remains intact and XAU/USD dives below the 1219.50-1219 zone, we may revisit 1216 or even 1213, the daily Tenkan-Sen. The top of the daily Ichimoku cloud sits at 1208 so the bears have to produce a daily close below there to make an assault on 1203. Below there, the 1200-1198 are stands out as a strategic support. If this support gives way, the market will be targeting 1193.