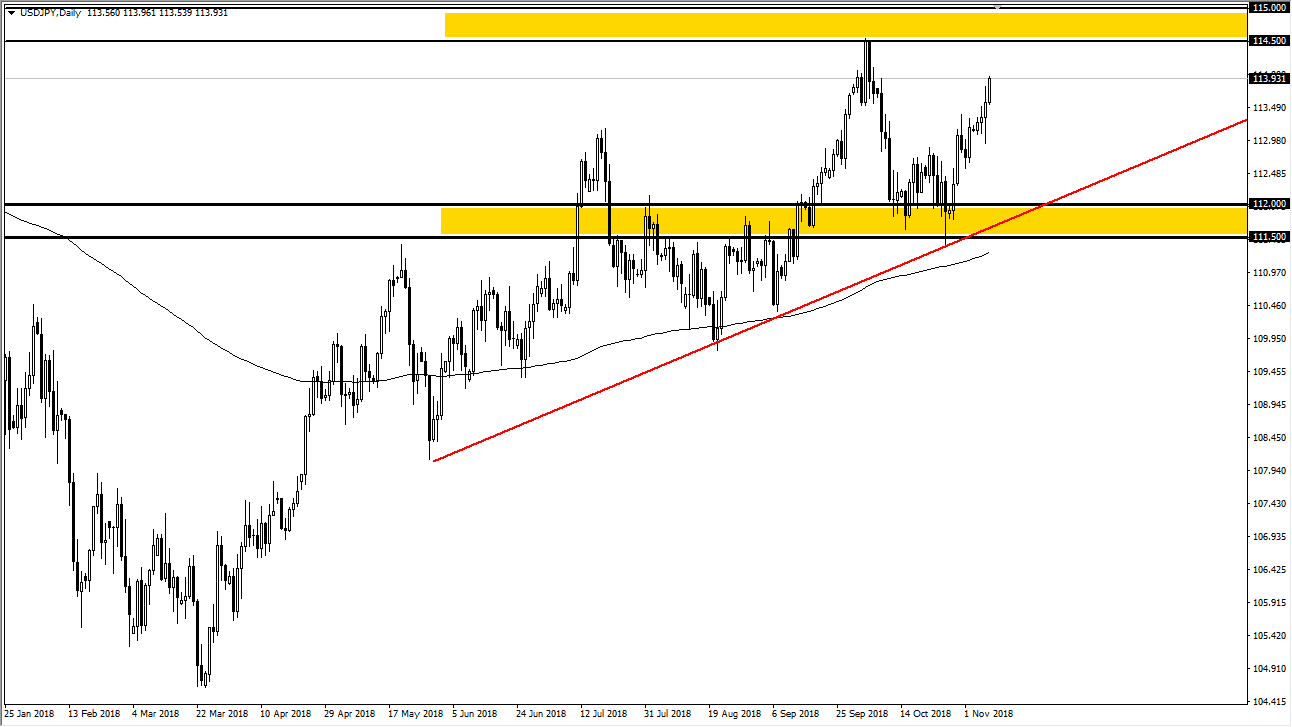

USD/JPY

The US dollar rallied significantly during trading on Thursday as the Federal Reserve has left rates on hold. It looks as if we are going to trying to go into the ¥114.50 level, which is significant resistance extending to the ¥115 level. If we can break above there, then the market goes much higher. However, I think at this point the resistance will probably hold. I think that short-term pullbacks continue to be buying opportunities, and at this point that’s how I approach this market. I don’t have any interest in shorting this market, because I do think that eventually we will break out and above this area. The uptrend line and the 200 day EMA are both well below, but within striking distance of a couple of days negativity. With that in mind, I believe that we will get a better opportunity to go long.

AUD/USD

In what could be one of the more confusing pairs to trade right now, the Australian dollar has initially tried to rally but then broke down again. There is a downtrend line that has been broken which in and of itself should be rather bullish, but at the same time we have the 200 day EMA just above. I think at this point it’s likely that the Australian dollar will be very choppy and volatile, because not only are we paying attention to the US dollar and its strength or weakness, but we are also paid attention to the trade war which I believe that the market has mistakenly thought the Democrats winning the house would put on ice. I think they will be very surprised by the fact that Trump and the Democrats both agree. Once that comes to fruition I would anticipate the sea more downward pressure. It’s not until we break above the 200 day EMA that I would be a bit more comfortable buying.

.png)