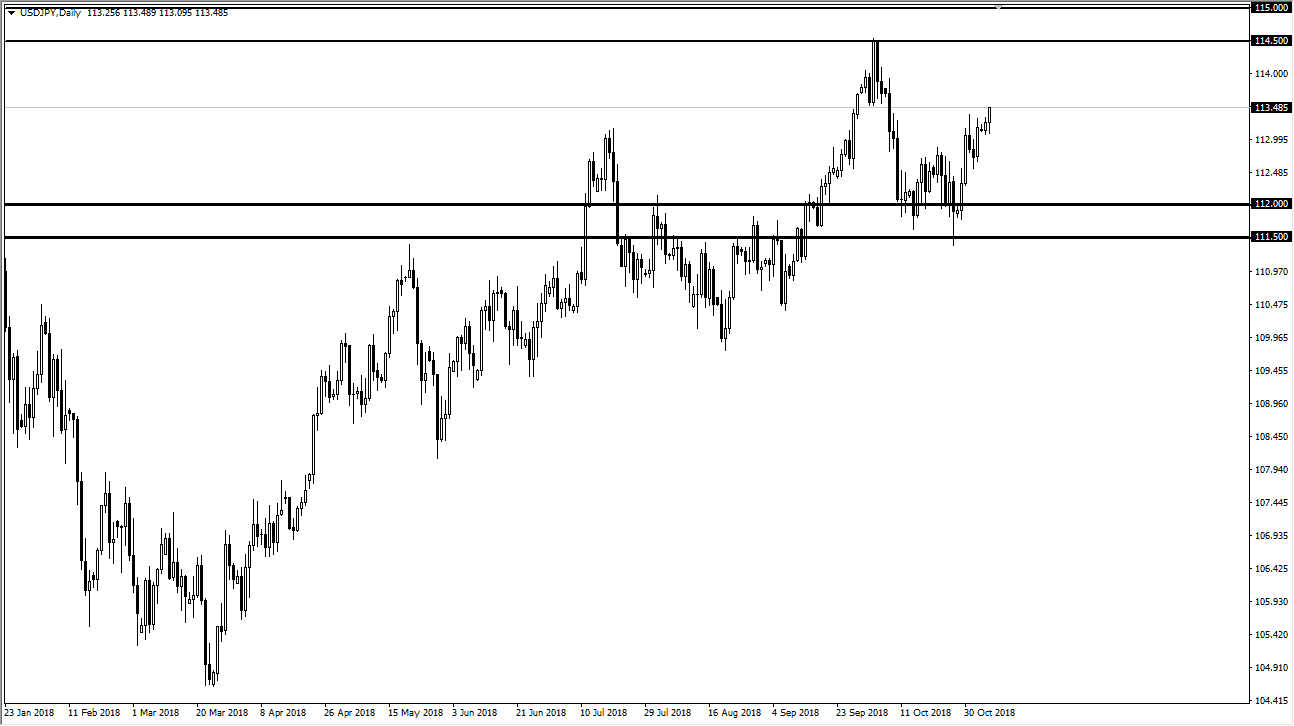

USD/JPY

The US dollar has rallied against the Japanese yen during the Tuesday session, leading up to the midterm elections in America. I think at this point it’s likely that we are going to continue to grind towards the upside, reaching towards the ¥114.50 level. Pullbacks at this point should be buying opportunities that a lot of traders will take advantage of, and the ¥112 level underneath should be an area where buyers will probably be interested in jumping back into this market. I think that the support level extends down to the ¥111.50 level, as the area had been so important more than once in the past. I think at this point, the market will probably continue to look for buying opportunities, and if we can break above the ¥115 level, then I think the market probably goes looking towards the longer-term “buy-and-hold” scenario.

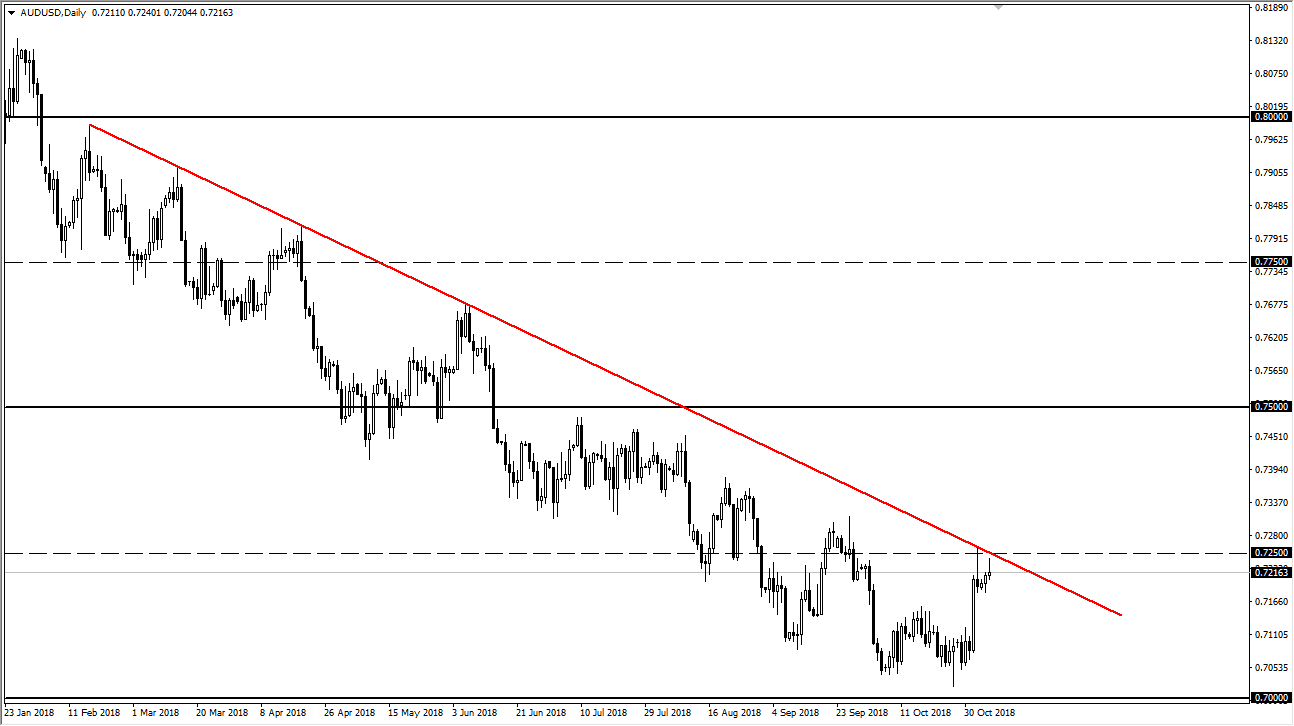

AUD/USD

The Australian dollar continues to struggle to keep gains, as the down trending line continues to put bearish pressure on this market. The Australian dollar is highly leveraged to the Chinese economy, and therefore it makes sense that as long as there is a problem between the United States and China, there’s going to be a problem with the Australian dollar and its value. There are significant concerns with the Australian economy because of these external forces and I think that continues to be the case. The 0.7250 level offers a significant amount of resistance, so if we break above there it could be construed as an attempt to change the trend, but right now I think it’s more likely that we continue to reach towards the 0.70 level underneath which is of course a major, round, psychologically significant figure.