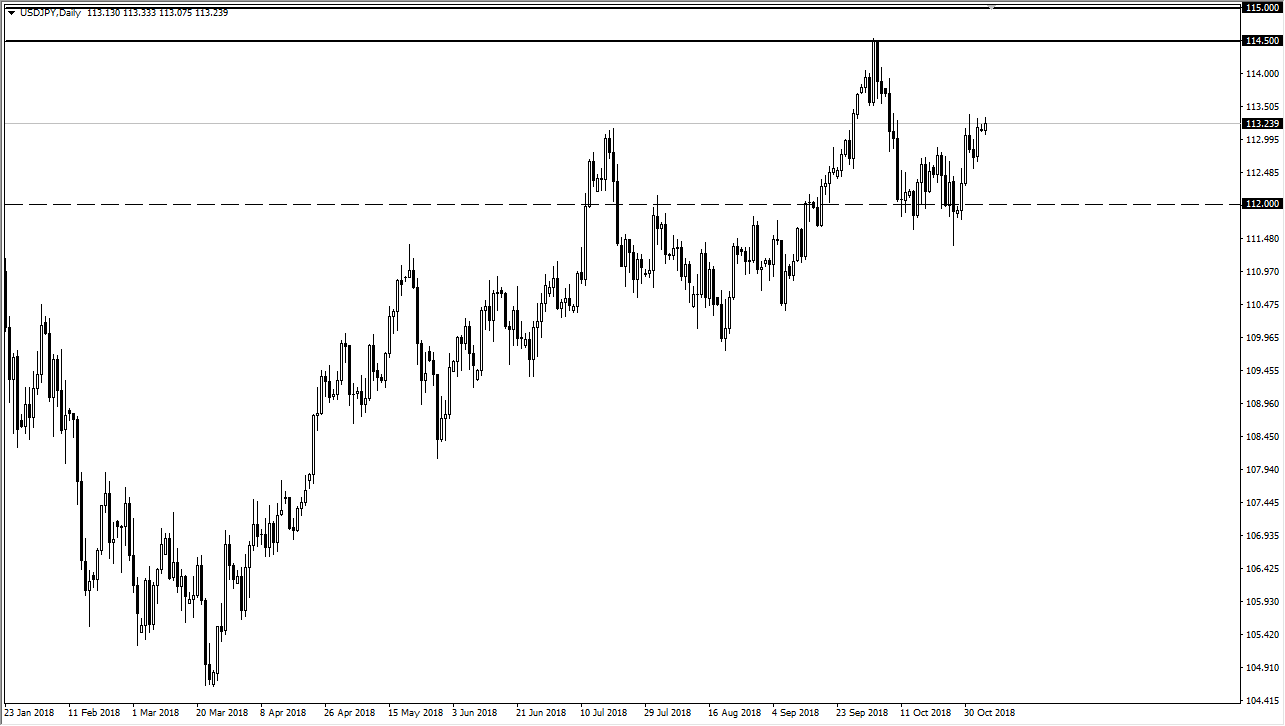

USD/JPY

I’d be very careful about trading this pair today, because this is going to come down to the election in my estimation. With the House of Representatives expected to go to the Democrats, if that does not happen it will throw this market into a tizzy. We are obviously in and uptrend, but we are obviously in an area that has offered a little bit of resistance recently, so a pullback would make sense. The pullback should be a buying opportunity though, as I think the ¥112 level is going to be a bit of a floor, while the ¥114.50 level above is a ceiling, extending all the way to the ¥115 level. Breaking above there allows the market to go much higher for a longer-term trade. Ultimately, I think a pullback is coming, and then the buyers will get involved at lower levels.

AUD/USD

The Australian dollar turned around during the day on Monday but has not broken above the major downtrend line that I have drawn on the chart. Because of this, I would anticipate that somewhere just above we should see sellers reentered the market and push the Aussie lower. I don’t have any interest in trying to go long until we clear the 0.7250 level on a daily close. I think that we probably have a lot of volatility ahead of us, mainly because this pair is highly attached to the Chinese economy, and quite frankly the trade situation between the Americans and the Chinese, which of course is a completely fluid situation. I do not hesitate to sell signs of exhaustion just above, and therefore I think if you watch the short term charts, you can start selling on signs of exhaustion. If we do break down from here, I anticipate a move to the 0.71 handle.