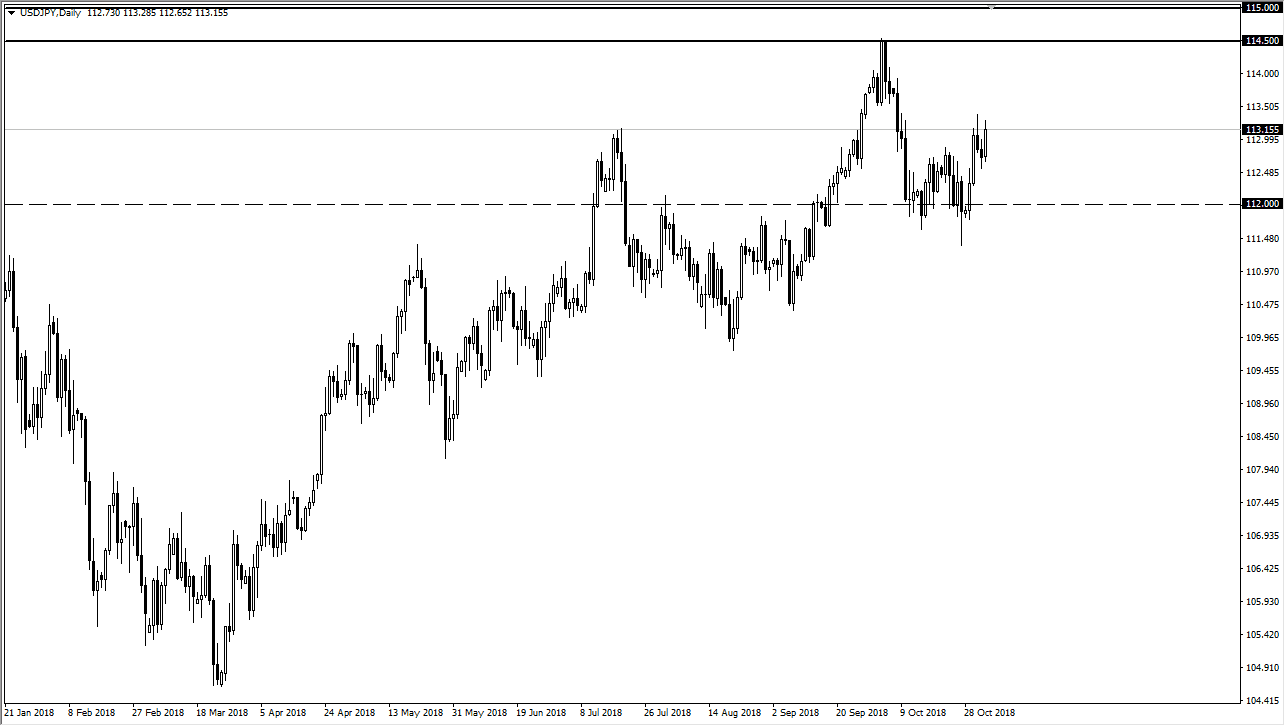

USD/JPY

The US dollar has broken higher during the trading session on Friday after the jobs report, reaching towards the ¥113.50 level before pulling back slightly towards the end of the day. The market has broken above a minor resistance barrier, and I think that the ¥113.50 level is minor resistance, but I think that we could eventually go higher, perhaps reaching towards the ¥114.50 level which has been massive resistance. I believe that resistance extends to the 115 young level after that, and overall I think that it is going to take several attempts to break above there, and therefore I think it takes several attempts before that finally happens. The ¥112 level underneath should be massive support, and therefore I think that a pullback should offer plenty of value.

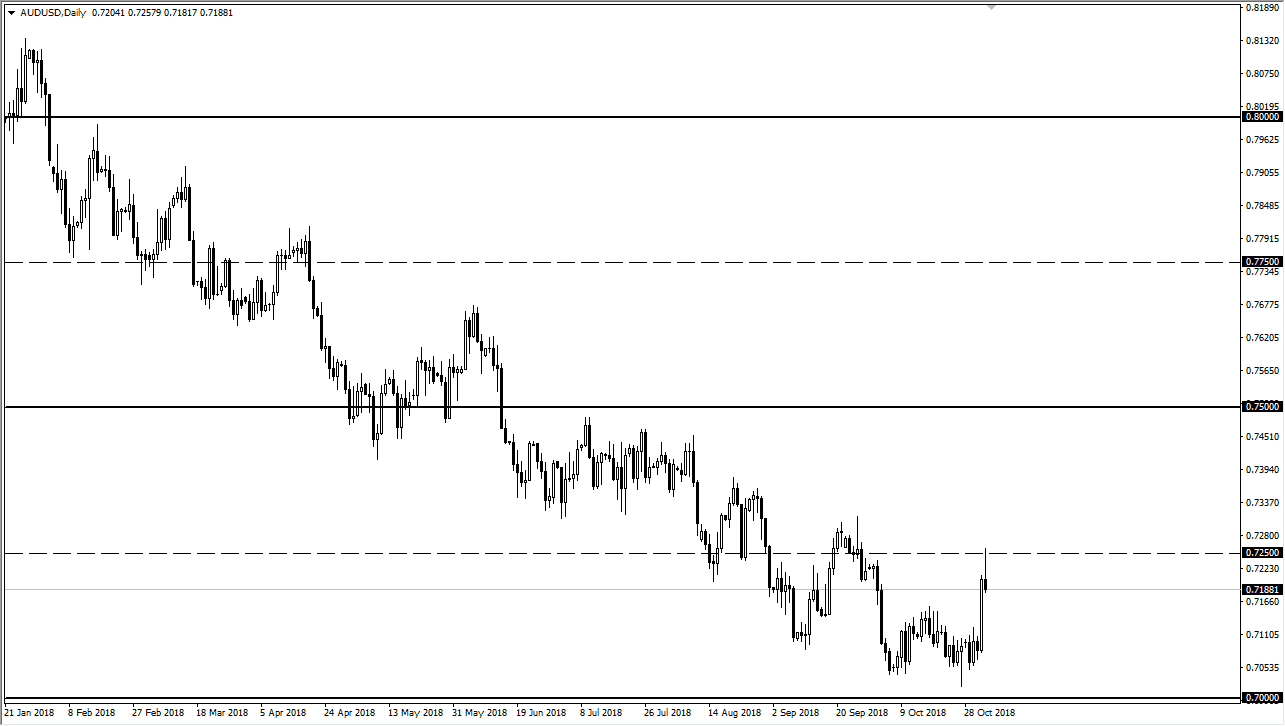

AUD/USD

The Australian dollar initially tried to rally during the trading session on Friday but found enough resistance at the 0.7250 level to turn things around and form a bit of a shooting star. That of course is a negative sign, and if we can break down below the bottom of the daily candle stick, then I think the market reaches the lower levels. Otherwise, if we break above the top of the shooting star, then I think that it’s not until we break above the 0.73 level that I could start buying. Beyond that, then I think there’s even more resistance at the 0.75 handle.

I believe that the 0.70 level underneath will continue to be massive support, but we could end up breaking down below there to continue the longer-term downtrend. I don’t think that’s going to happen in the short term though, at least not until the disappointment of a lack of a deal between the Americans and Chinese comes to fruition after the Argentine meeting.