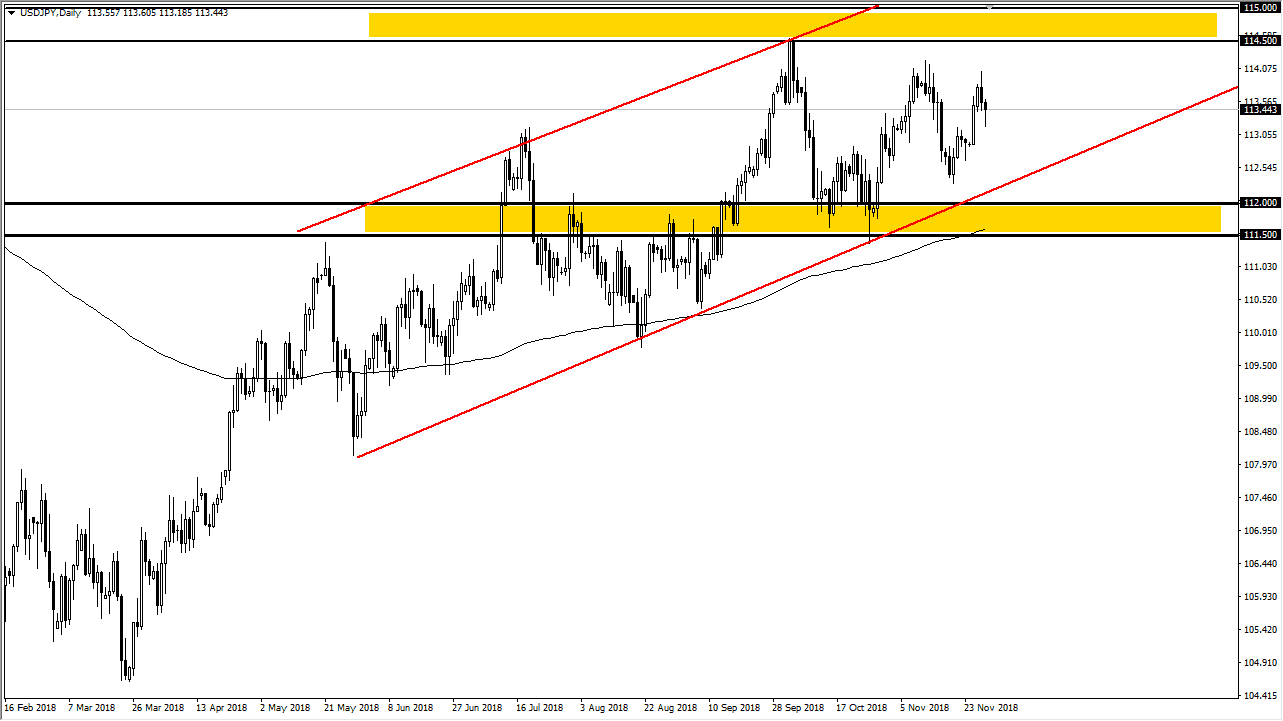

USD/JPY

The US dollar has fallen during most of the session on Thursday but saw a resurgence later in the day against the Japanese yen. It looks as if the buyers are willing to come in and pick up this currency pair every time it drops, and I do see significant amounts of support underneath. Because of this, I pay attention to the uptrend line, the ¥112 level and of course the 200 day moving average. It would take all of those levels being broken for me to start shorting this market. If we did break through those levels though, that would be horrifically negative. I think we are simply trying to build up the momentum to finally break above the ¥114.50 level, which extends to the ¥115 level. A break above there is a longer-term “buy-and-hold scenario.

AUD/USD

The Australian dollar is a currency that you should not be trading at the moment, because we are going into the weekend with the G 20 meeting and the Saturday dinner between President Trump and Xi that could or could not move the markets as far as expectations are concerned. What I mean by this is that if there are signs that the United States and China were going to move forward in some type of cooperation or at least give the market some hope, the Australian dollar will explode to the upside. However, if it is contentious and nothing good comes of it, I suspect that the Australian dollar will get hammered. This is because Australia is so highly levered to the Chinese economy, so think that you should probably wait until the weekend to put any money in this market. The risks far outweigh the rewards.