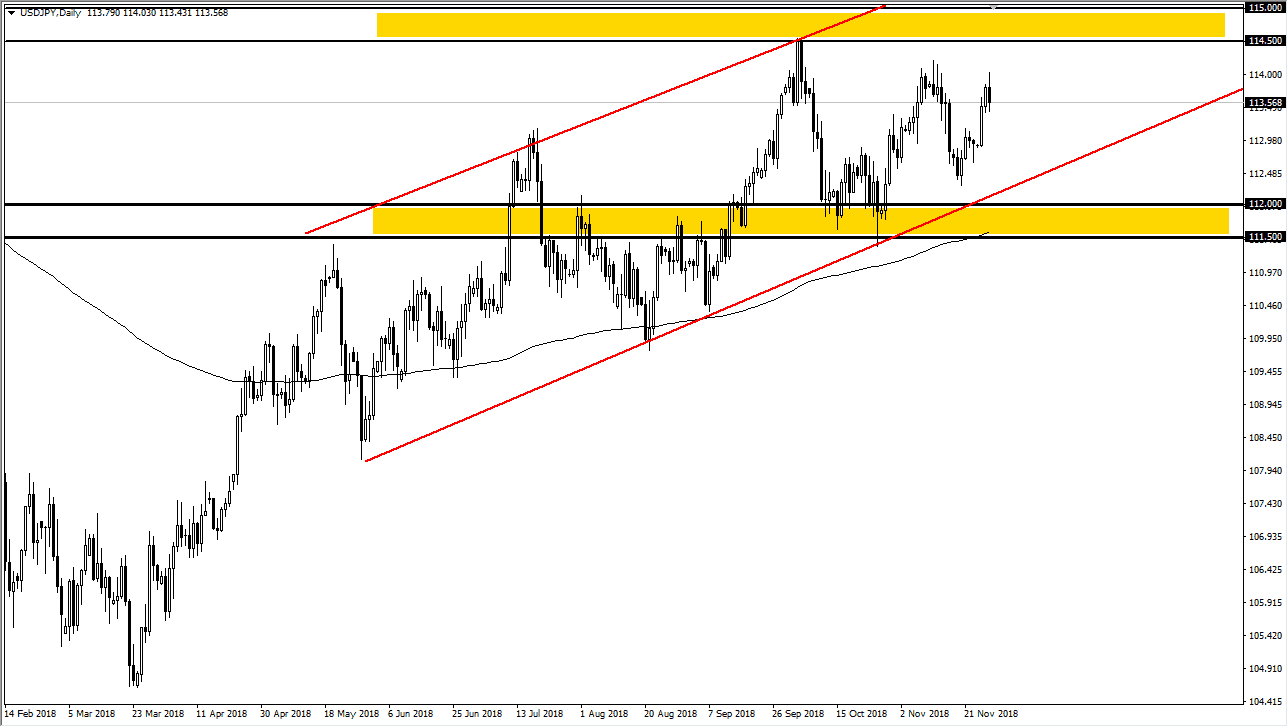

USD/JPY

The US dollar has initially tried to rally during the day on Wednesday, but Jerome Powell suggested that perhaps the Federal Reserve was not ready to raise interest rates as quickly as some people had feared. That had the market rolling over, as the US dollar got hammered. The next hurdle of course is the G 20 meeting, which has the Chinese and the Americans meeting. If they can come to some type of consensus, that could help the overall global growth picture, but at this point I think that the reality is that the market is getting a bit heavy here, so I think we could pull back towards the uptrend line as we have gotten a bit ahead of ourselves. The 200 day EMA sits below that uptrend line as well, so I think a short-term pullback is likely as we have seen so much in the way of resistance above the ¥114 level.

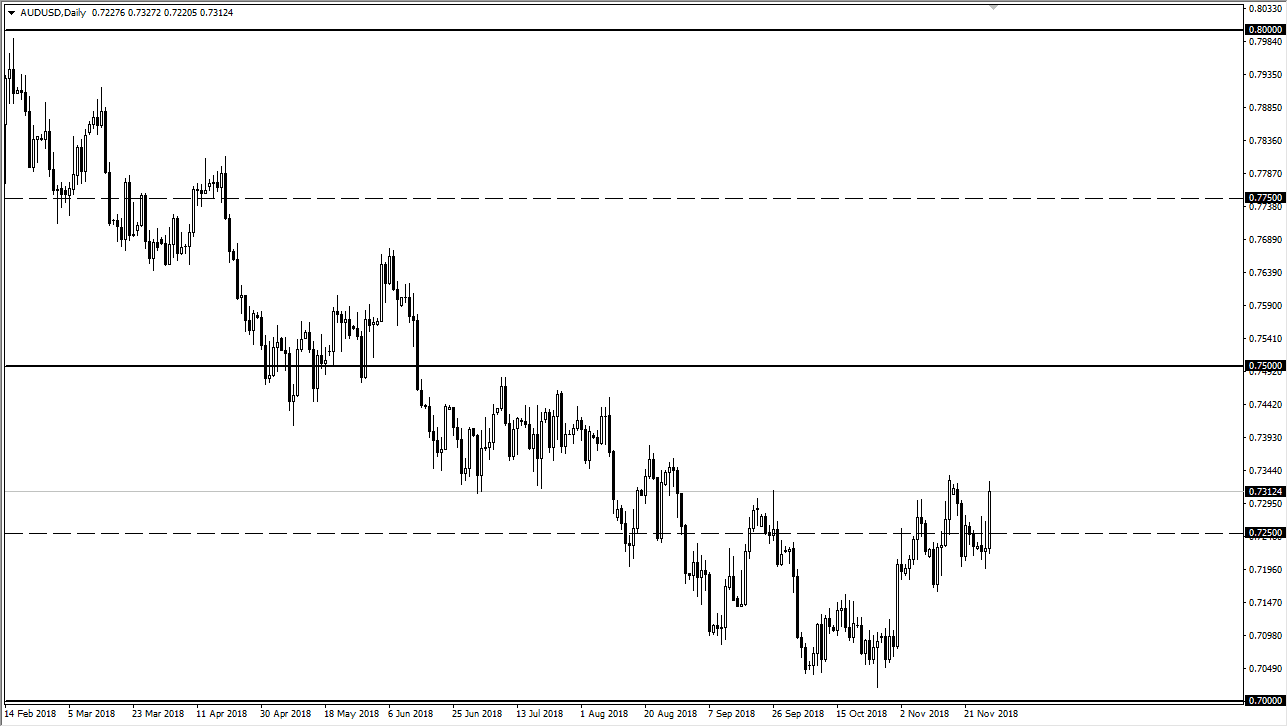

AUD/USD

The Australian dollar rallied significantly during the trading session on Wednesday, slamming into the recent highs after Jerome Powell had his speech. However, I find it interesting that we could not break above there and it tells me that we are still worried about the G 20 meeting between the Americans and the Chinese. The Australian dollar is rather unique in the fact that it is so sensitive to the Chinese economy. As long as there are fears of tariffs picking up against the Chinese, it’s hard to imagine that the Australian dollar will do well. Beyond that, the Australian economy has shown less than stellar numbers as of late, and of course there is the housing issue in Australia that seems to be rolling over.