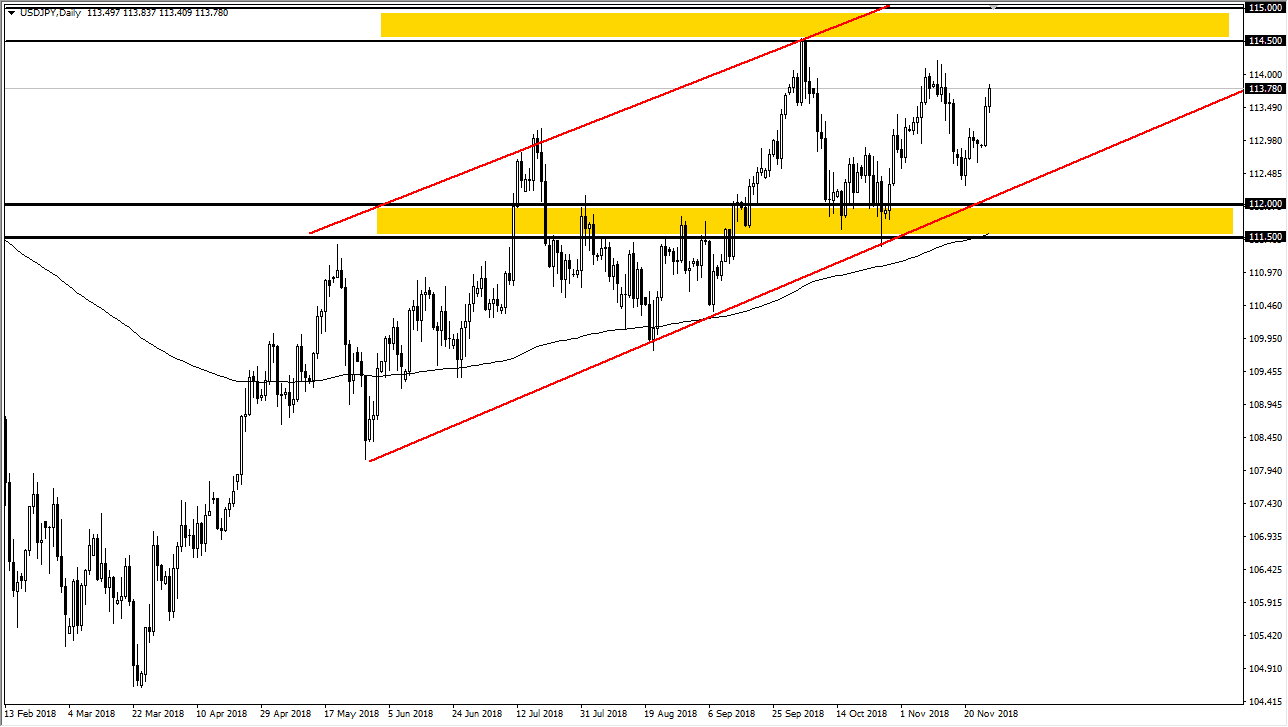

USD/JPY

The US dollar rallied against the Japanese yen during trading on Tuesday, as we are reaching towards the ¥114 level. However, there is so much in the way of resistance between here and the ¥114.50 level that I think the sellers are coming back rather quick. I believe that this market will roll over rather soon, and that we will probably pull back in order to build up a bit of momentum. If the uptrend line underneath were to get broken and of course the 200 day EMA gets broken, that would obviously be a very negative sign. If that doesn’t happen, then this should end up being a buying opportunity at lower levels. I anticipate that ¥113 will probably offer some support as well. Keep in mind that the interest rate differential between the two currencies still favors a stronger US dollar, but there is a massive barrier above focused around the ¥115 region.

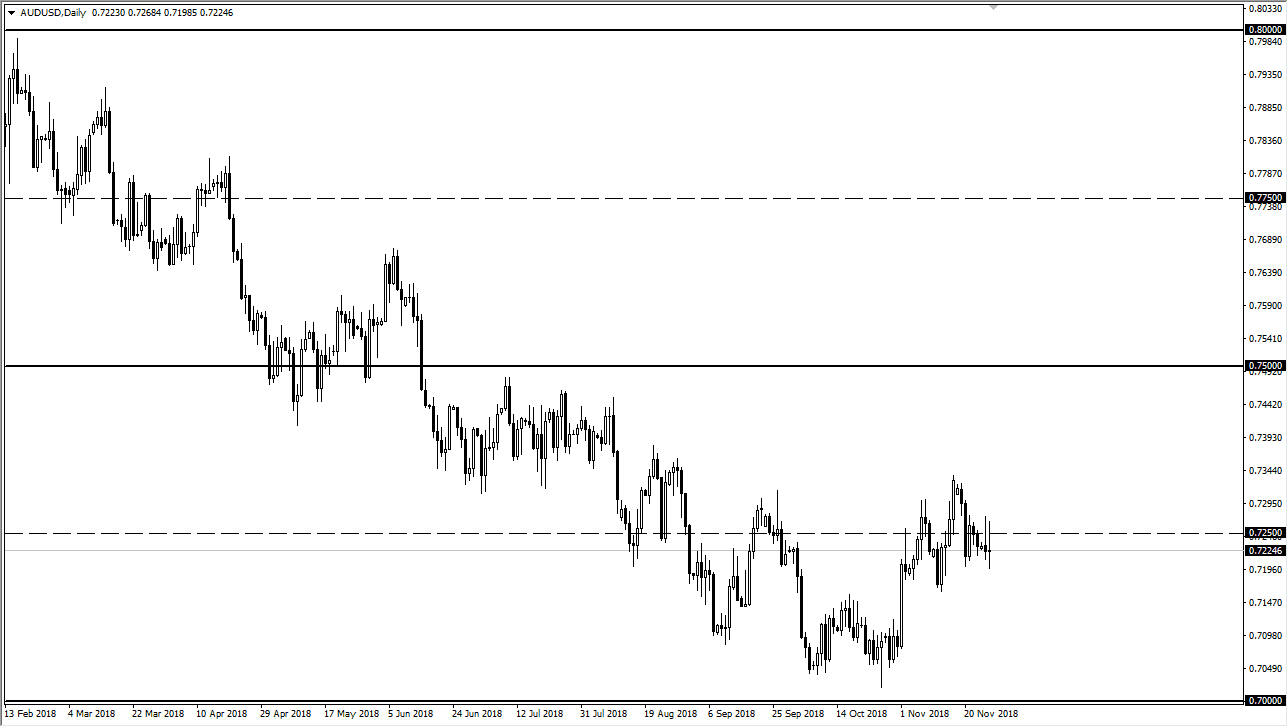

AUD/USD

The Aussie dollar tried to rally during the day but then rolled over again as the 0.7250 level continues offer plenty of resistance. I think at this point, rallies are to be sold as we continue to worry about trade headlines when it comes to the US/China situation. On Thursday, Donald Trump will meet Xi in Argentina, and I think people are starting to come to grips with the idea that nothing is going to come out of it. Because of this, I think the Aussie dollar will reach lower levels, perhaps down to the 0.70 level.

If we do rally from here, I think the 0.7350 level than the 0.75 level both could offer pretty significant resistance. A break above there of course would change everything but in the meantime I think what we are looking at is the market simply waiting to see how things play out and Buenos Aires.