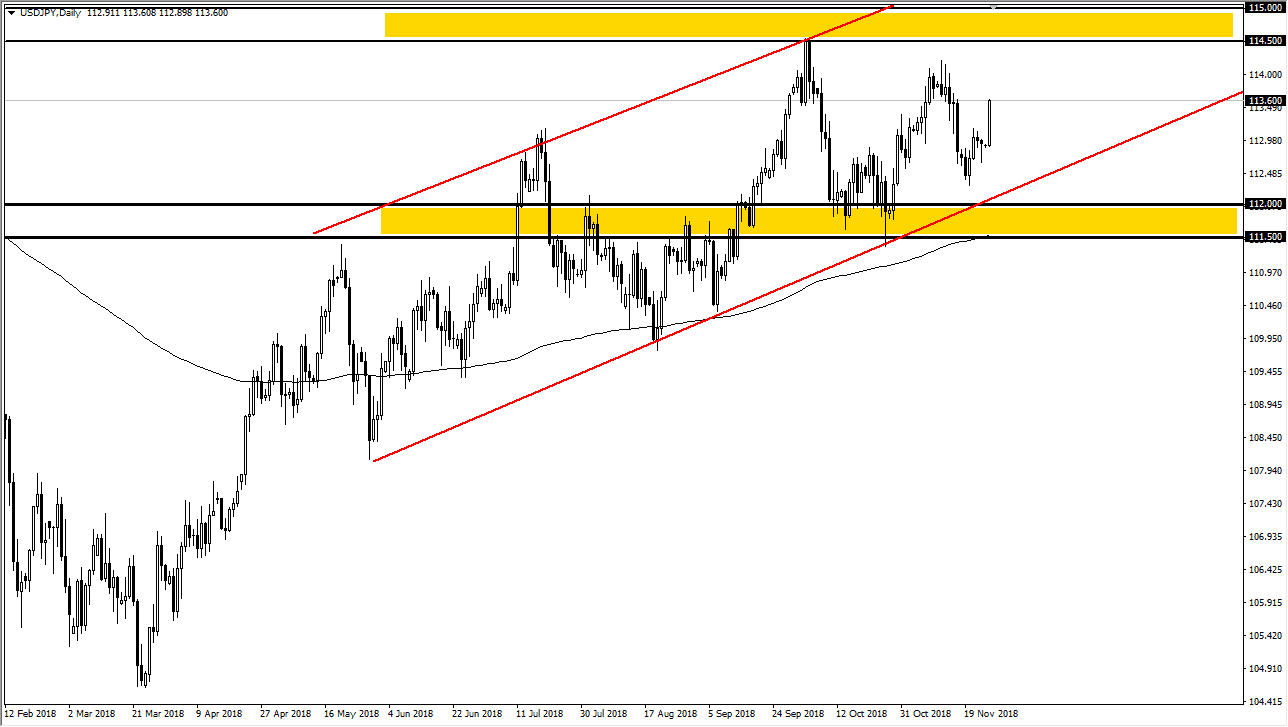

USD/JPY

The US dollar has taken off to the upside during the Monday session as stock markets and a general “risk on” attitude has entered the market. This pair is highly sensitive to the S&P 500 and other stock markets, so the fact that they are rallying during the day coincides quite nicely with this move. However, I see a lot of resistance just above, especially as we get close to the ¥114.50 level. There is a lot of resistance between there and the ¥115 level, so I think what we are looking at is perhaps another day or so up bullish pressure but as soon as we see exhaustion, I fully anticipate seeing this market drop again. There is an uptrend line underneath that should continue to keep this market bullish though, just as the 200 day EMA which is just below there should. As long as we can stay above both of these things, I remain bullish but recognize we need to build momentum to finally break to the upside.

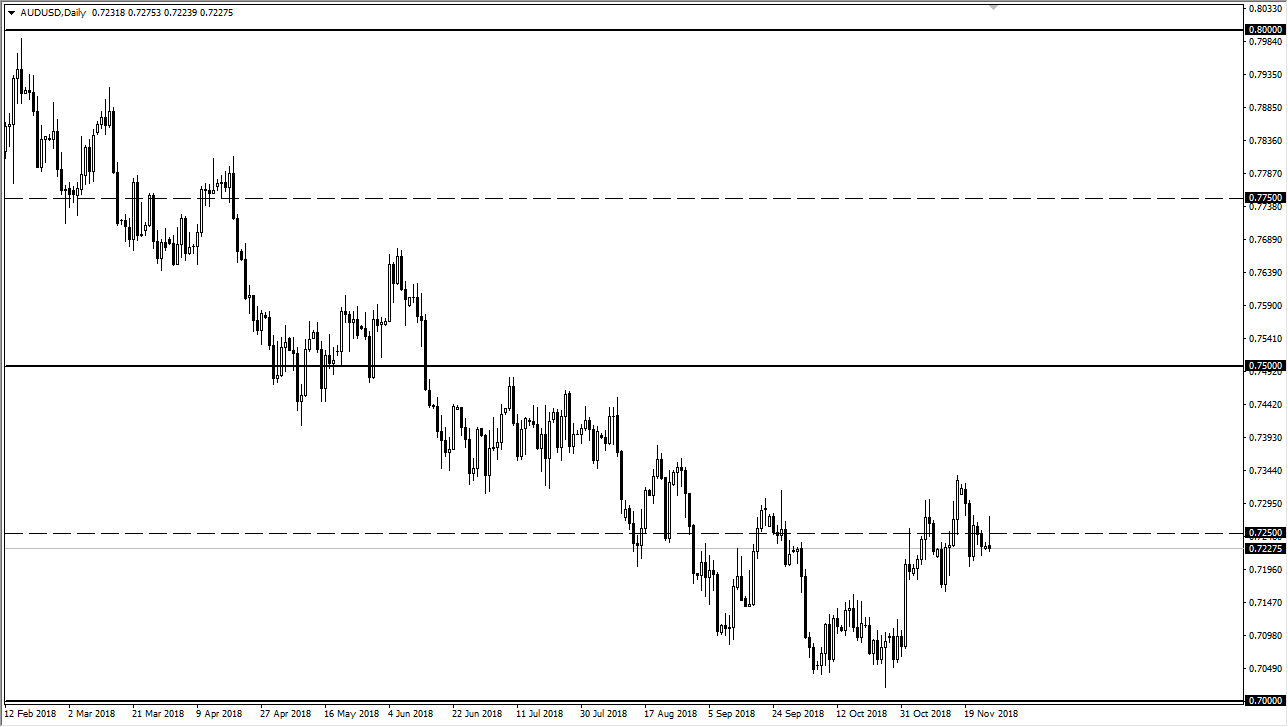

AUD/USD

The Australian dollar initially tried to rally during the day but gave back all of the gains to form a massive shooting star. The shooting star suggests that we could see a bit of a break down from here, as the 0.7250 level has been important more than once. The Australian dollar is going to be very sensitive to the US/China trade relations, as the Australian dollar is so sensitive to the Chinese economy itself. I think at this point, it looks likely that we will continue to see a bit of weakness in this pair, and I think rallies continue to be opportunities to short this market. I think that the meeting in Argentina is what people are paying attention to, but I think that it’s going to be difficult to see a lot of positive momentum out of that as well.