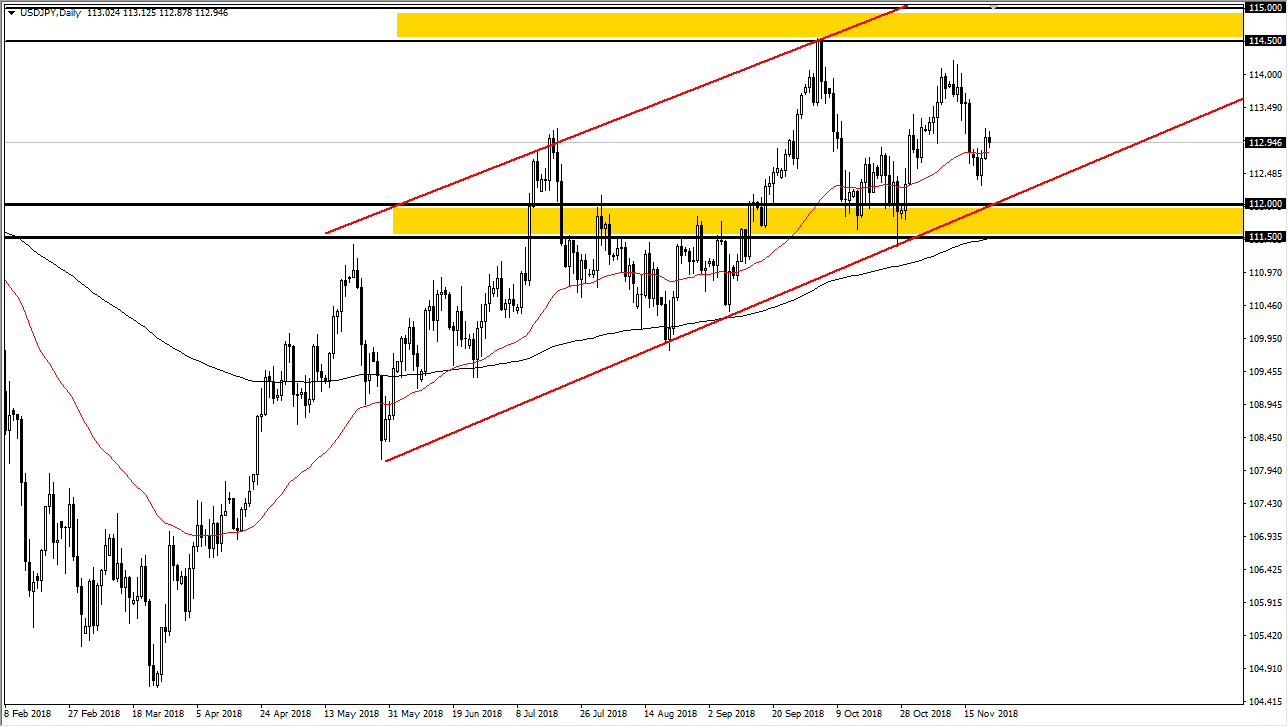

USD/JPY

The US dollar fell slightly against the Japanese yen during the trading session on Thursday, but you should keep in mind that it was Thanksgiving Day, meaning that there wasn’t much in the way of liquidity during at least half of the session. The market should have plenty of support underneath though, mainly due to an uptrend line that is coinciding nicely with the ¥112 support level, and that of course the 200 day EMA underneath. Overall, I think that the market is pulling back to find buyers underneath, perhaps reaching towards the ¥114.50 level which is the beginning of massive resistance that extends to the ¥115 level. Overall though, I think what we are going to see more of his volatility and therefore I look at short-term buying of the dips as probably the best way to deal with this market as so much in the way of concern is out there.

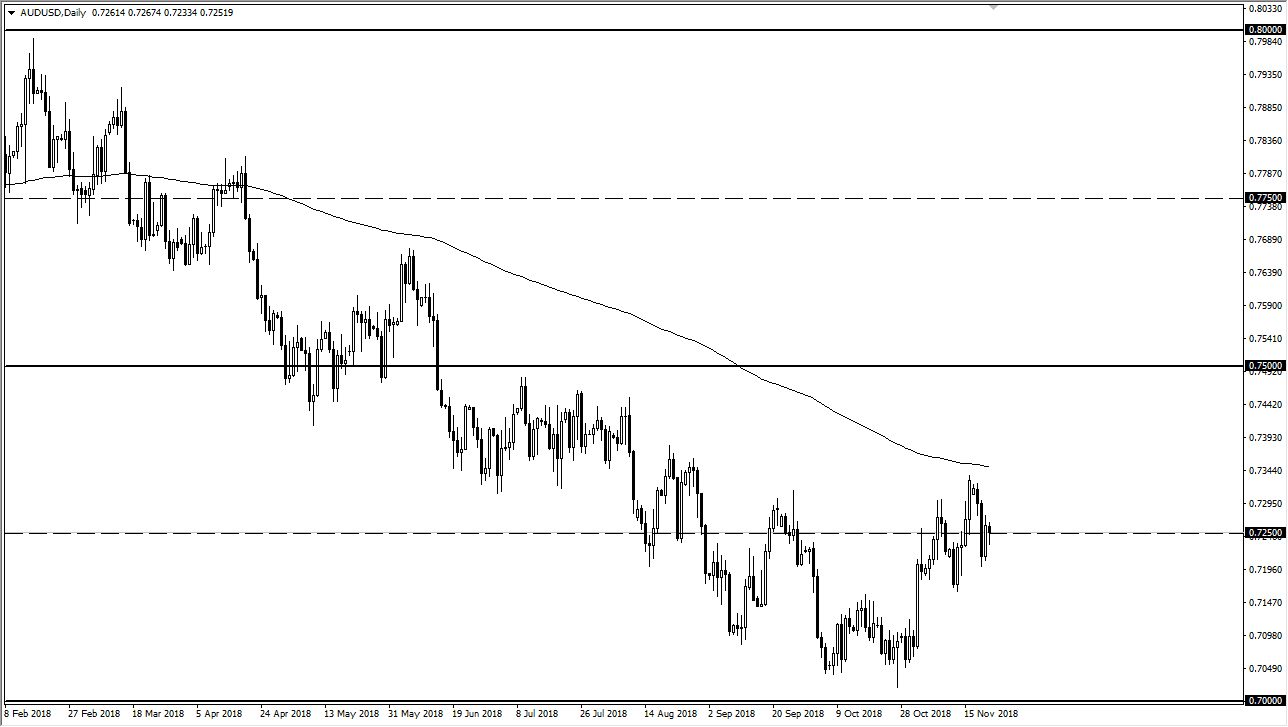

AUD/USD

The Australian dollar initially pulled back during the trading session on Thursday but found support underneath the 0.7250 level. That’s an area that is essentially “fair value” in this market, as it is the middle of the overall consolidation range between the 0.70 level underneath, and the resistance above is the 0.75 handle. But having said that I think that the 200 day EMA above should cause resistance also. In general, I believe that the Australian dollar will struggle due to the US/China trade relations breaking down.

I believe at this point; the market will probably be more likely to reach towards the 0.70 level than the 0.75 level after that. This is a market that is highly sensitive to risk, and as long as the Chinese situation with the Americans continues to weigh upon the overall outlook of the Aussie.