USD/JPY

The US dollar initially fell during the trading session on Tuesday, but then bounced enough to reach towards the top of the candle stick from the previous session. The 50 day EMA is just above, marked in red on the chart. Underneath though, I see an up trending channel uptrend line, and of course the support barrier between the ¥112 level and the ¥111.50 level. Below there, we have the 200 day EMA painted in black. Because of this, I feel it’s only a matter time before this market bounces and recovers. The market has been in and uptrend for some time, so I think it makes sense that we would have another go at the ¥114.50 level. Otherwise, if we break down below the 200 day EMA, then the market will break down and reach towards the ¥110 level, perhaps even lower than that.

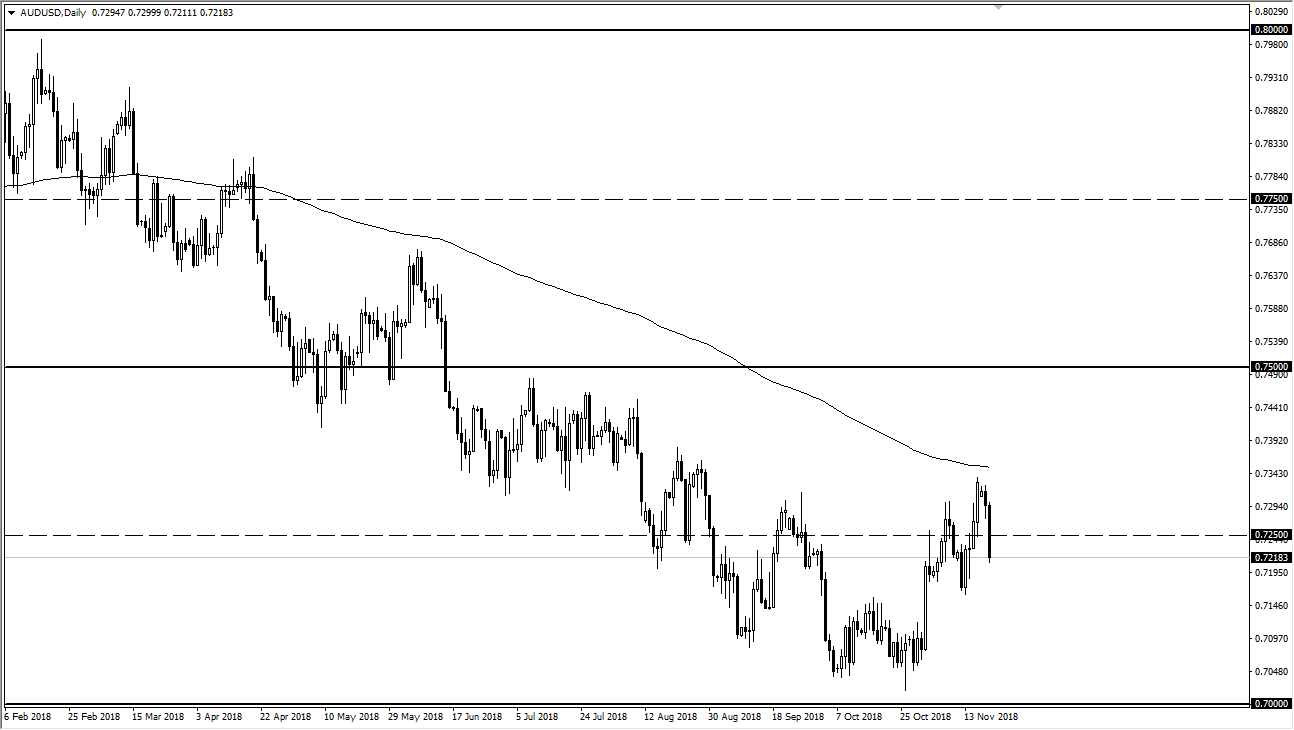

AUD/USD

The Australian dollar got hammered during trading on Tuesday, reaching down towards the 0.72 handle. That’s a very negative looking candle that I’m seeing for the day, I think it shows just how much trouble we have in this market due to the US/Chinese trade spat. I think that continues to be an issue, and I think that the Australian economy will of course continue to be at the mercy of the US and China. The 0.70 level underneath is my target, and I think it should be massive support. However, if we break down below that level it’s very likely that we will go to the 0.68 level. I expect that happens relatively soon though, because we will get through the Argentina G 20 meetings without any type of good news from what I see.