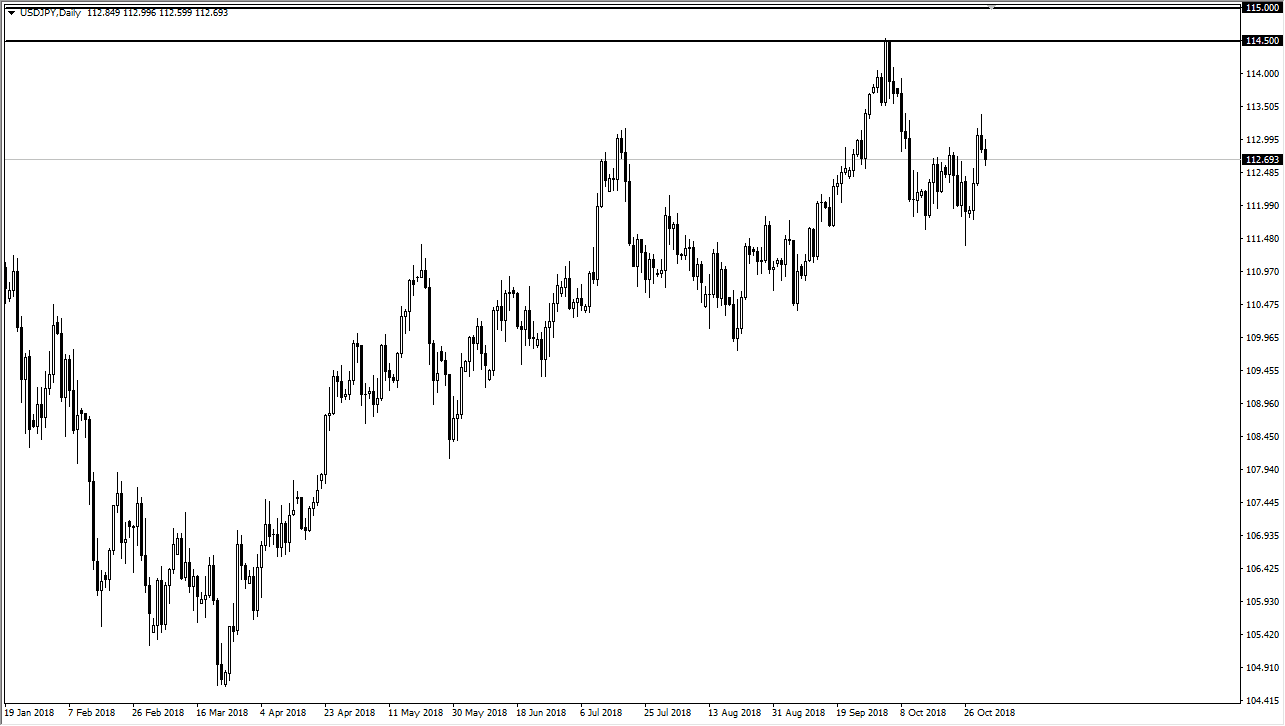

USD/JPY

The US dollar has broken down slightly during the trading session on Thursday, as we continue to see the US dollar and get sold off going into the jobs number today. I think at this point it’s only a matter of time before we will find buyers though, because we are most certainly in and uptrend, and to begin with you should know that the pair is extraordinarily sensitive to the jobs figure, so pay attention to what’s going on around this market. I believe that the ¥112 level underneath is going to offer a bit of a “floor”, so a bounce from there would make a lot of sense. Alternately, if we can break above the ¥113.50 level, then I think the market will go higher, perhaps extending towards the ¥114.50 level which is massive resistance. A break out above that level would be extraordinarily bullish, but I think it will take several attempts.

AUD/USD

The Australian dollar shot straight up in the air during the trading session on Thursday, reaching towards the 0.72 level as word got out that Donald Trump was going to meet with the Chinese leader in Buenos Aires Argentina later this month. Beyond that, I think there might’ve been a bit of position squaring ahead of the jobs number anyway but I do recognize that these rallies tend to be short-lived, so I anticipate feeding this rally eventually. The question now is when will it roll over? I believe that the jobs number will give enough volatility for that to perhaps happen, and I also recognize that there is resistance above at the 0.7250 level as well so I still believe in the downside but obviously don’t necessarily want to jump in front of this mass of bullish move.