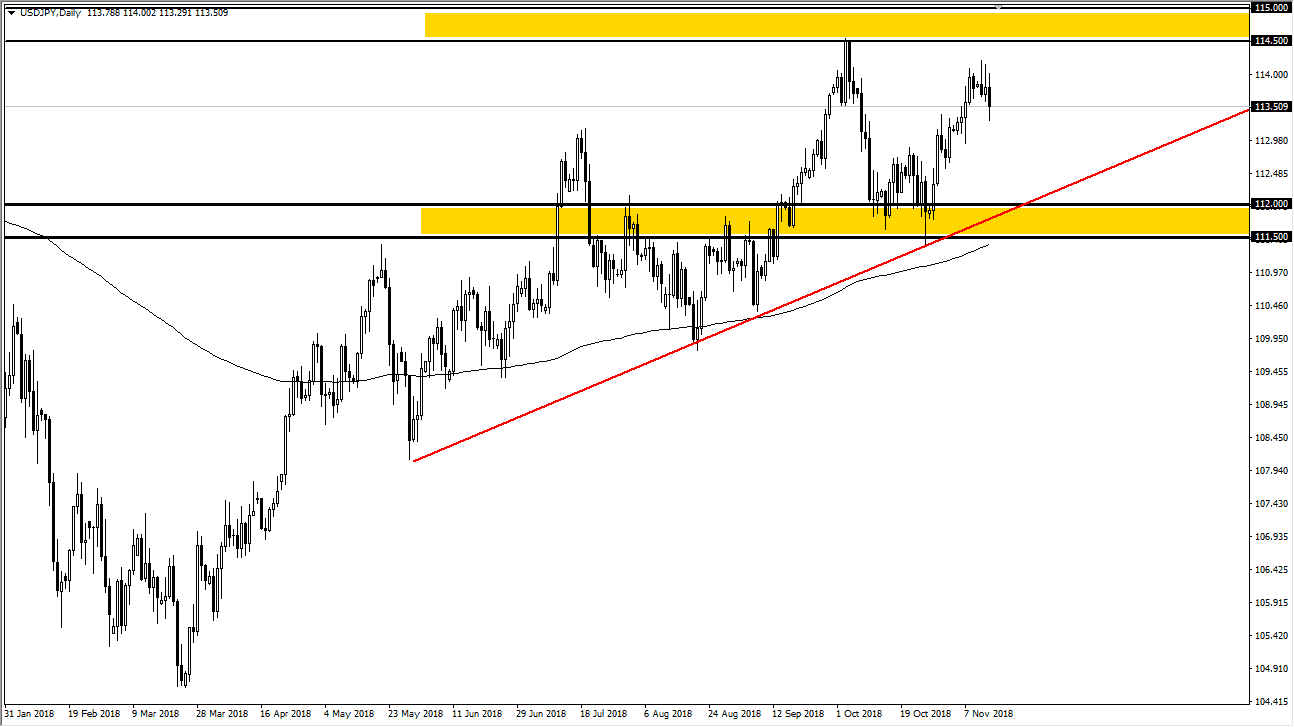

USD/JPY

The US dollar initially tried to rally during the trading session on Wednesday but rolled over again. This time, we did not form a shooting star, we broke further. I still think we are in an uptrend for a good reason, after all the United States has higher interest rates coming, and it should continue to help the dollar overall. The Japanese yen is a safety currency though, so it will get a bit of a bit as well. This is why I believe that this pair will probably outperform the other yen related markets. There is a major uptrend line underneath that should continue to offer support as well as the ¥112 level. The 200 day moving average is below as well. The area just above at the ¥114.50 level signifies a massive resistance. It’s not until we break above the €115 level that we can go higher for the longer-term, but in the meantime I think that short-term pullbacks will be short-term buying opportunities.

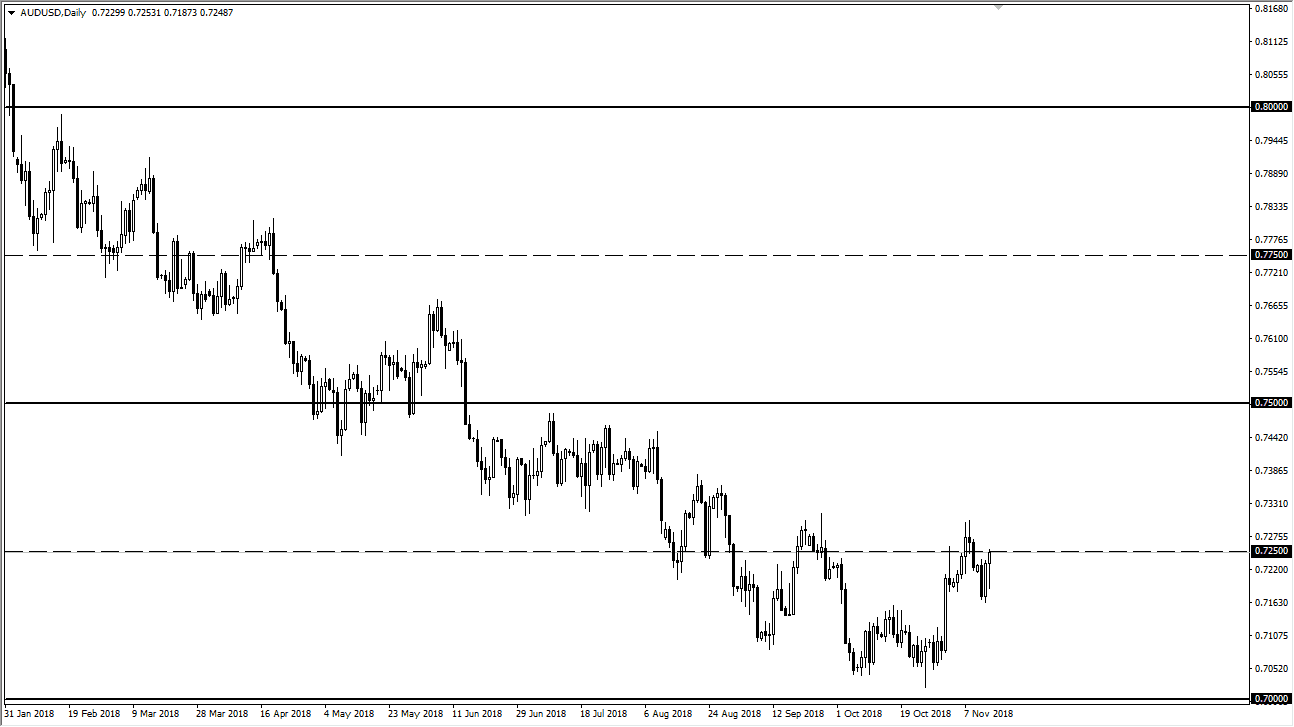

AUD/USD

The Australian dollar initially fell during the trading session on Wednesday but turned around to rally towards the 0.7250 level. The hammer like candle suggests that there is a lot of support underneath, but I see a lot of resistance just above. The market is going sideways overall, and I think that the market is still very confused, because the trade war continues to be very sticky between the United States and China. As long as that’s going to be an issue, it’s likely that we will continue to see a lot of confusion and volatility. I do believe that we will probably move quicker to the bottom and the top, unless of course we get some type of major breakthrough between the Americans and the Chinese. I don’t think that’s going to happen in the short term, so I continue to look for exhaustion to sell.