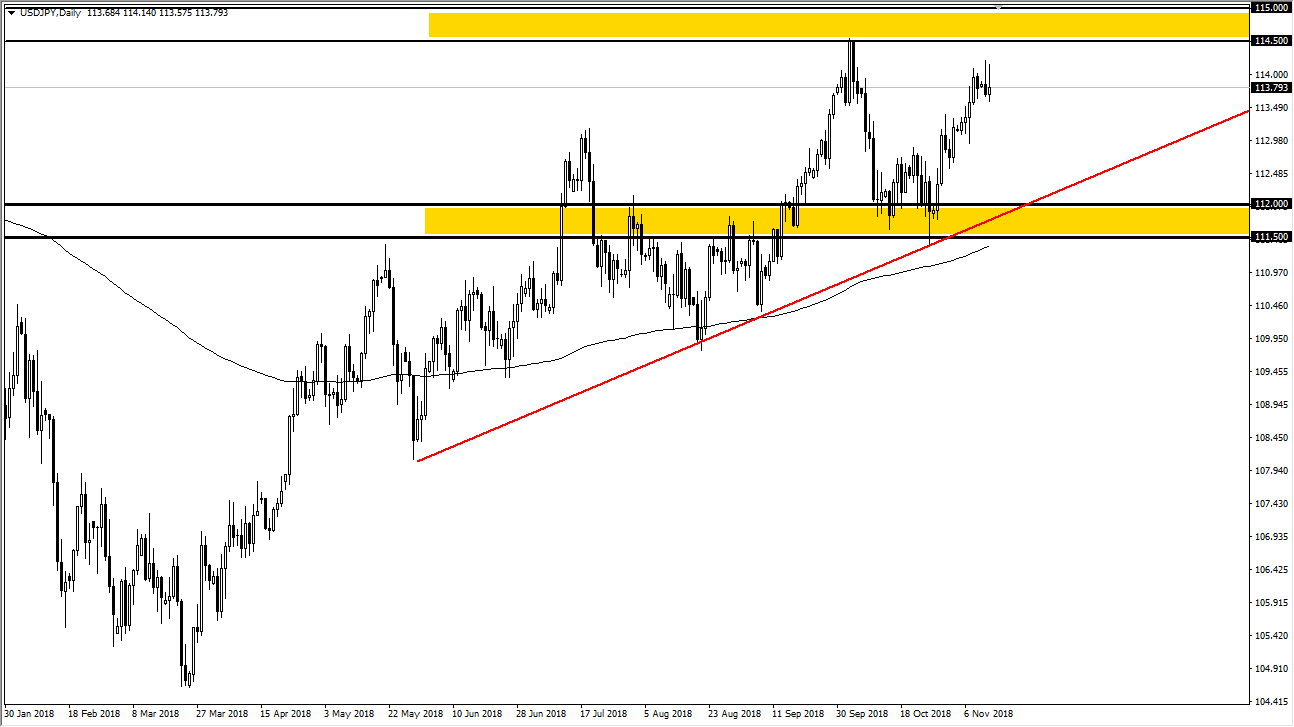

USD/JPY

The US dollar has rallied a bit during the trading session on Tuesday but rolled over to form a shooting star. This is a second consecutive shooting star on the daily chart, and it suggests that we are going to roll over a bit from elevated levels. This doesn’t surprise me because we have seen so much selling pressure in this area. I don’t necessarily think that this is a longer-term selling opportunity, but if you are looking for a mid-range selling opportunity, then you may have one here. I think there is plenty of support underneath near the ¥113 level, the uptrend line underneath, and of course the ¥112 level. The 200 day EMA also offer support. This is a short-term opportunity, but I think longer term we will find buyers to come in and try to push towards the ¥114.50 level.

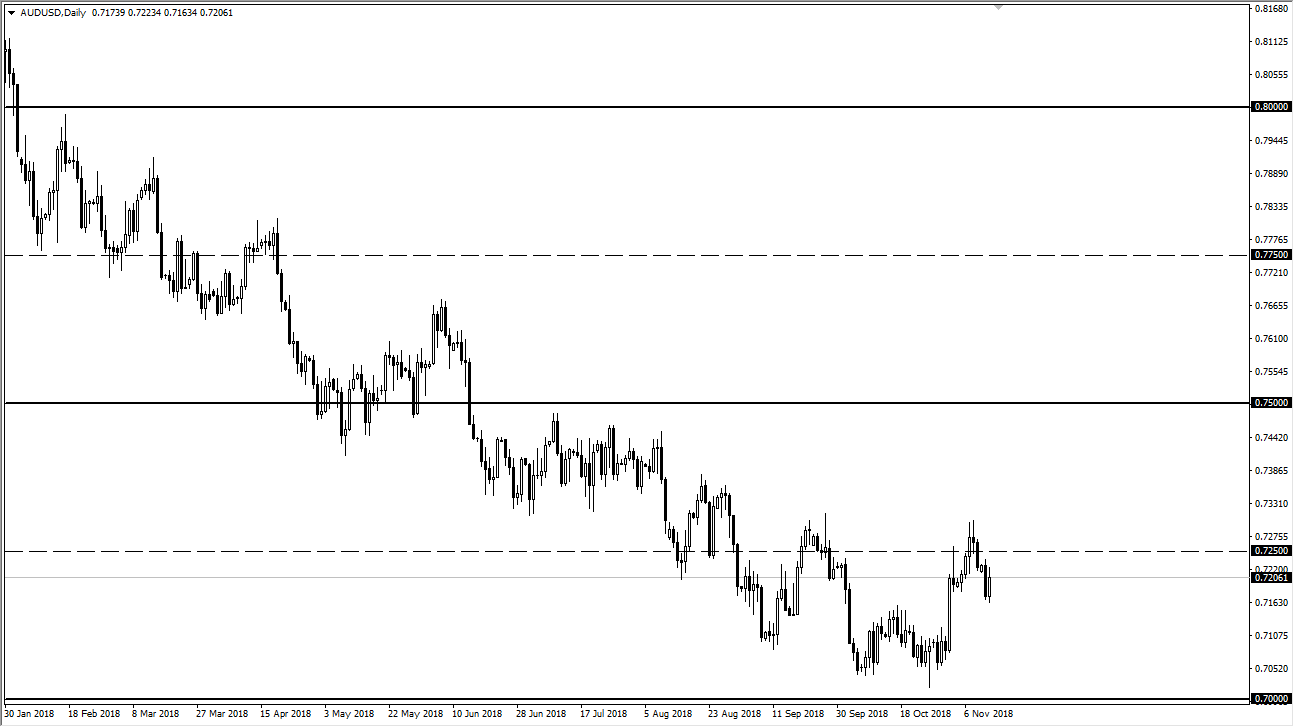

AUD/USD

The Australian dollar rallied during most of the trading session on Tuesday but has failed at the 0.72 level. At this point, I think that the market will roll over and go looking towards the 0.70 level underneath. It’s not until we break above the 0.73 level that I would be comfortable buying, and I think that we will continue to go back and forth as we await some type of resolution to the Chinese/American trade issues. If we broke above the 0.73 level, then I think the market could go to the 0.75 handle but I don’t expect to see that happening anytime soon. We are in a bit of a holding pattern as we await to see whether the Americans and Chinese can come to gather in Argentina during the G 20 meetings.