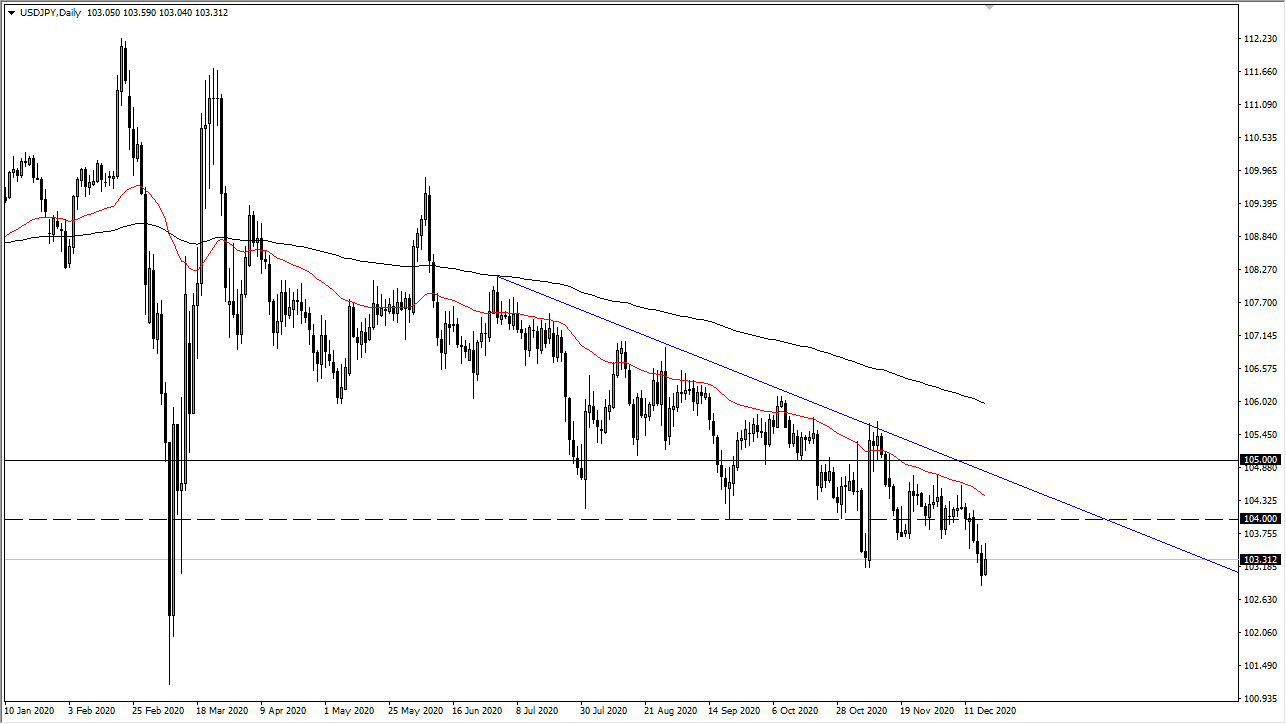

USD/JPY

The US dollar fell rather hard against the Japanese yen during the trading session on Friday, slicing through the bottom of the hammer on Thursday, showing signs of breaking down a bit. Slicing through the ¥113 level is a negative sign, but we do also have massive amounts of support underneath at the ¥112 level, and of course the bottom of the uptrend channel, which has been relatively reliable. I think at this point, it’s only a matter time before buyers jump in, but if we were to sliced through the ¥111.50 level, then I think the market continues to go much lower, perhaps down to the ¥110 level. At that point, I would expect a lot of buying pressure as well. If we break through that level, then I think the market could really start to pick up some downward pressure.

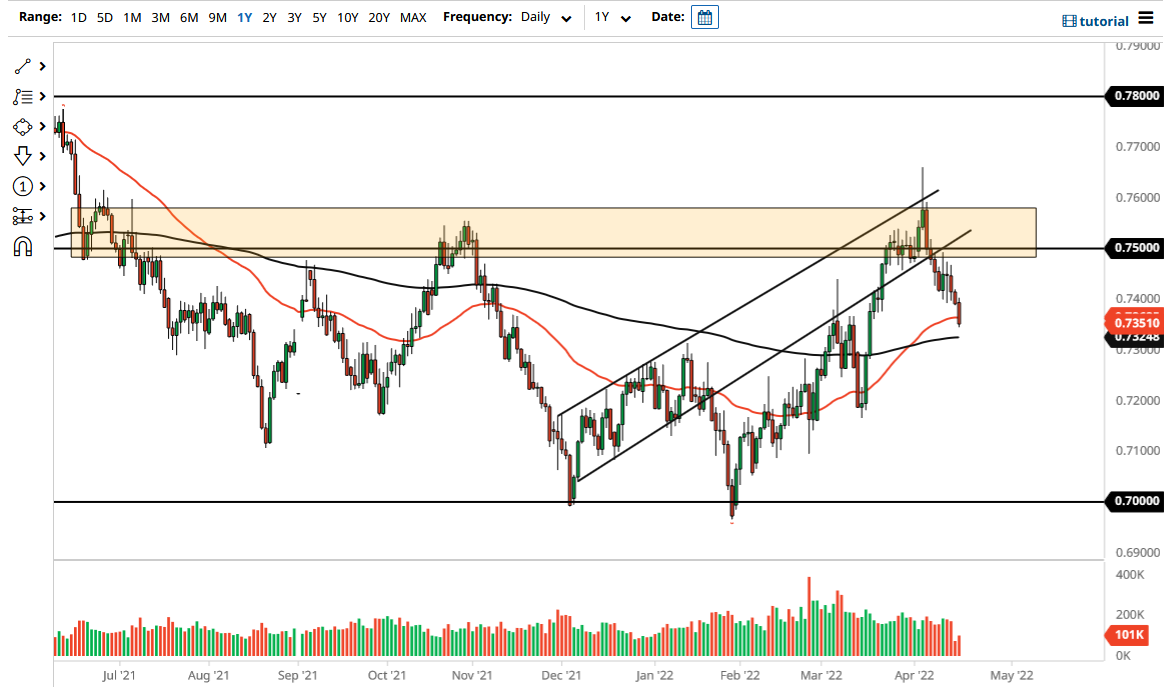

AUD/USD

The Australian dollar rallied significantly on Friday, reaching towards the 0.7350 level. The 200 EMA on the daily chart is just above, and I think at this point it’s likely that the sellers would come back into the marketplace, and of course we have a lot of concerns about the US/China trade war. Ultimately, I think that the market will continue to focus on that problem, and rallies at this point will probably be looked at with skepticism. If we do break above the 200 day EMA, then the market could go to the 0.75 level after that. That area should have a lot of resistance as well. At this point, I’m looking for signs of exhaustion to start selling yet again, as it’s only a matter of time before some negative headlines come out to send this market lower. I think at this point, a lot of people are banking on something good coming out of the G 20 Argentina meeting, which I believe is a little bit optimistic.