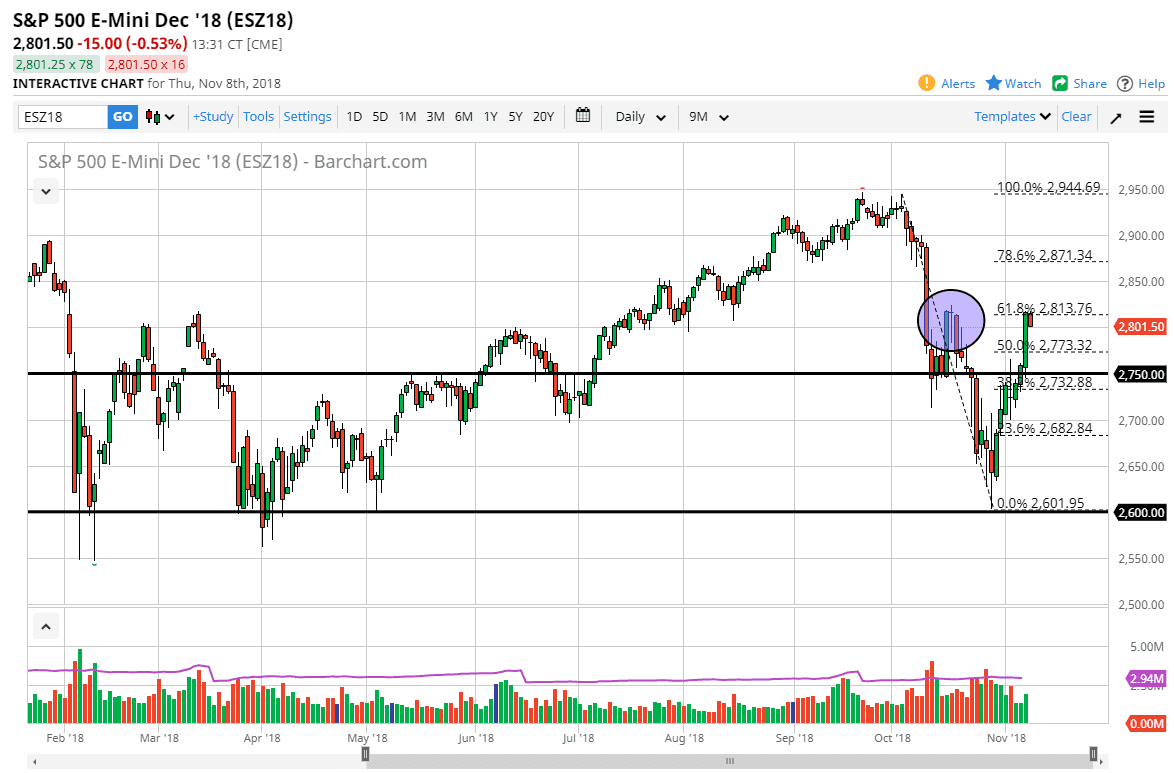

S&P 500

The S&P 500 pulled back slightly during the trading session on Thursday, as we slammed into significant resistance. The 61.8% Fibonacci retracement level has held so far, and I think that the Federal Reserve reiterating its position on interest rate hikes may have some people on the defensive. If we can break above the highs from the last couple of days, then I think we could go higher, perhaps reaching towards the 2900 level. If we close below the 2800 level, we could very well reach down towards the 2750 handle. Ultimately, this is a market that I think has a lot of thinking to do but there is the “Santa Claus rally” potentially happening. It’s a seasonable effect in the stock market as asset managers tried to pad results to show clients at the end of the year.

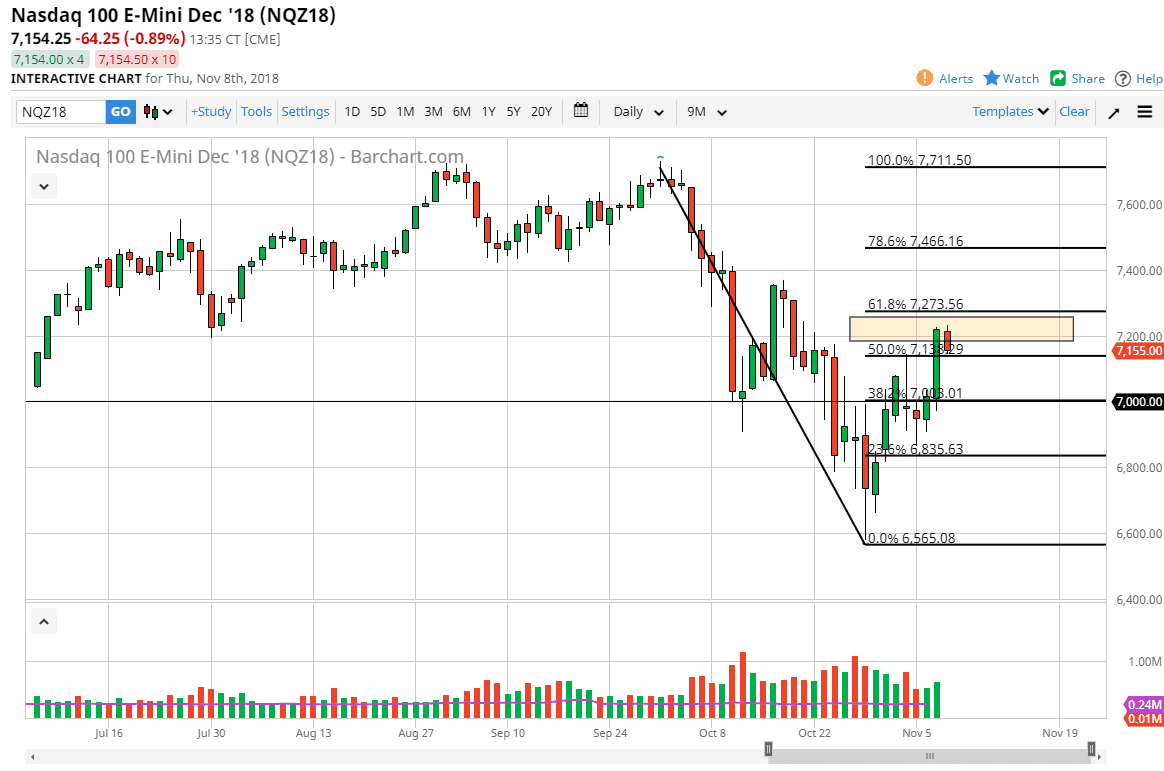

NASDAQ 100

The NASDAQ 100 also pulled back from the 61.8% Fibonacci retracement level. Ultimately, I think that the market falling from here does make some sense, especially considering that the Sino-American relations probably won’t get any better. However, if we break above the 61.8% Fibonacci retracement, then we should grind higher at that point. The 7000 level underneath is crucial, and I think at this point it’s likely that there will be buyers in that area. The bottom of the massive green candle that happened after the election results should be an area where there’s a lot of buyers. If we were to break down below there, it should continue to go even lower. I think the next couple of days will be very important, and therefore we should be a bit cautious.