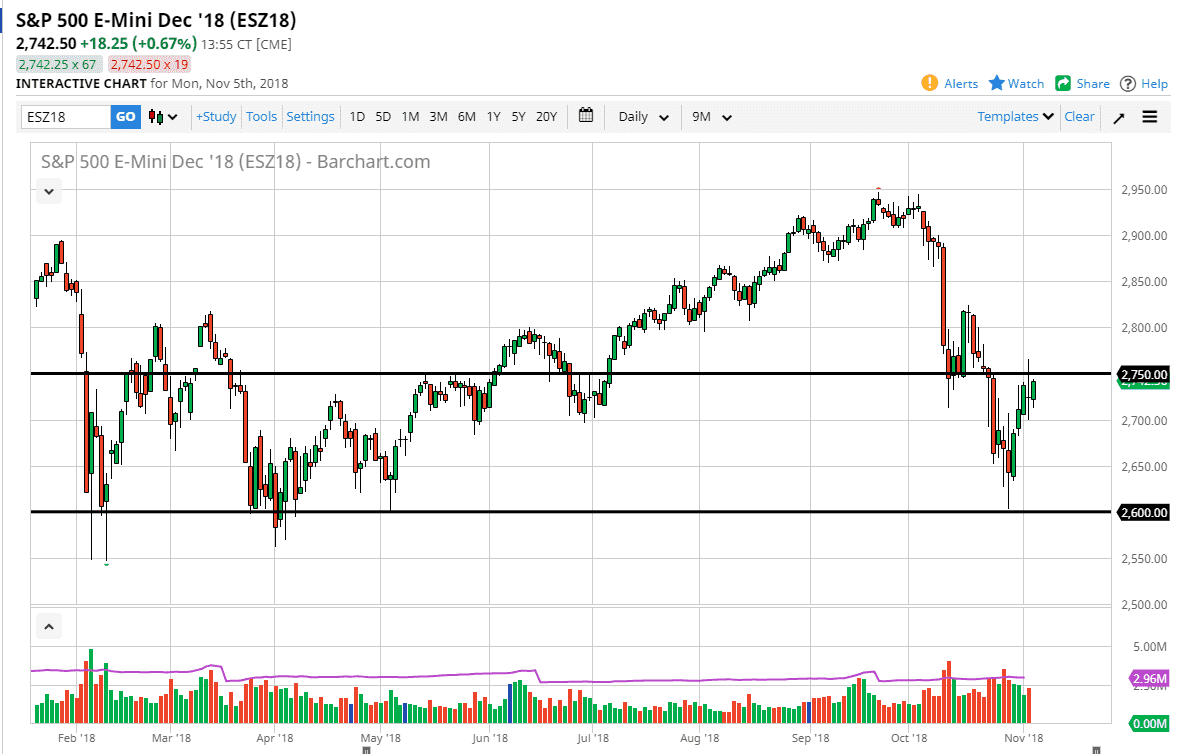

S&P 500

The S&P 500 has rallied during trading on Monday as traders came back ahead of the midterm elections. The 2750 level above should be resistance though, especially considering that we have formed a massive shooting star on Friday. Because of this, I’m not overly bullish of this market and I think that this market probably can’t be tested until we get past the election results. You are probably better off waiting until Wednesday morning to put money to this market as algorithmic programs will buy and sell randomly based upon headlines that will almost certainly be trying to game the market, as we have seen so much of in the British pound lately. I think this is a great opportunity to lose quite a bit of money just waiting to happen.

NASDAQ 100

The NASDAQ 100 has spent most of the day going back and forth, unable to break above the 7000 handle during the day. There is a massive shooting star in this market as well on Friday, and I think at this point there is a lot of resistance just above. I think it’s probably best to leave this market alone until Wednesday as well, because we won’t know market reactions to the elections until after then. Apple is a huge weight upon the NASDAQ 100 currently, and that’s part of what we are seeing on the chart. Stay out of this market, stay out of all stock markets in America for that matter, as the machines will be taking over for the next 24 hours. Murphy’s Law dictates that no matter what direction you put money towards, the market will rip in the other direction. Once the dust settles then we can start to do a little bit more significant analysis.