Gold prices ended Thursday’s session up $2.99 an ounce as the dollar fell on expectations that the U.S. central bank will go slow on interest rate hikes next year. The minutes of the Federal Open Market Committee meeting held earlier this month showed almost all participants thought that “another increase in the target range for the federal funds rate was likely to be warranted fairly soon if incoming information on the labor market and inflation was in line with or stronger than their current expectations.”

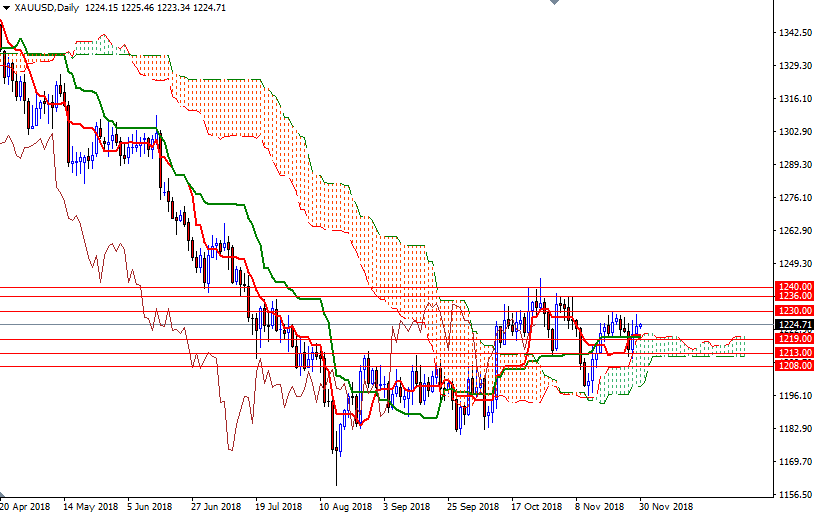

The market is trading above the Ichimoku clouds on the daily chart, and we have positive Tenkan-Sen (nine-period moving average, red line) - Kijun-Sen (twenty six-period moving average, green line) crosses. However, the upside potential will be limited until the technical resistance in the 1240/36 area is successfully broken. Of course, the bulls have to pull prices above the initial barrier at around 1230 to reach there.

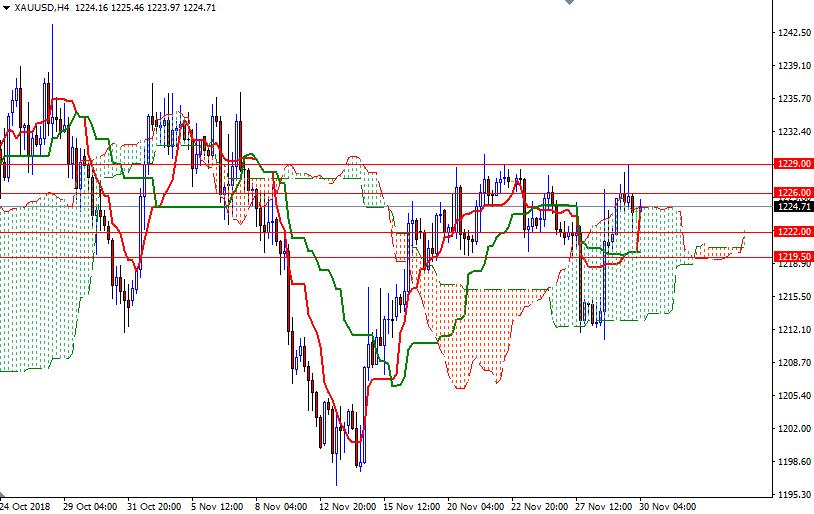

To the downside, the initial support sits at 1222, and that is followed by 1220-1219.50. If XAU/USD drops below 1219.50, the next stop will be 1217.80. A break below 1217.80 suggests that the market will head lower towards the bottom of the 4-hourly cloud. In that case, the market will be targeting 1216/5. Below there, the 1213/1 area stands out as a strategic support.