Gold prices fell $2.91 an ounce on Tuesday, ending a five-day streak of gains, as the dollar rebounded from a two-week low. A failure to sustain prices above $1227 also weighed on the market. Mounting concerns about slowing global growth spurred fresh declines in stock markets around the world. U.S. stocks extended losses as crude prices continued to lose ground. In economic news, the Commerce Department reported that housing starts climbed 1.5% in October from the prior month to a seasonally adjusted annual rate of 1.228 million.

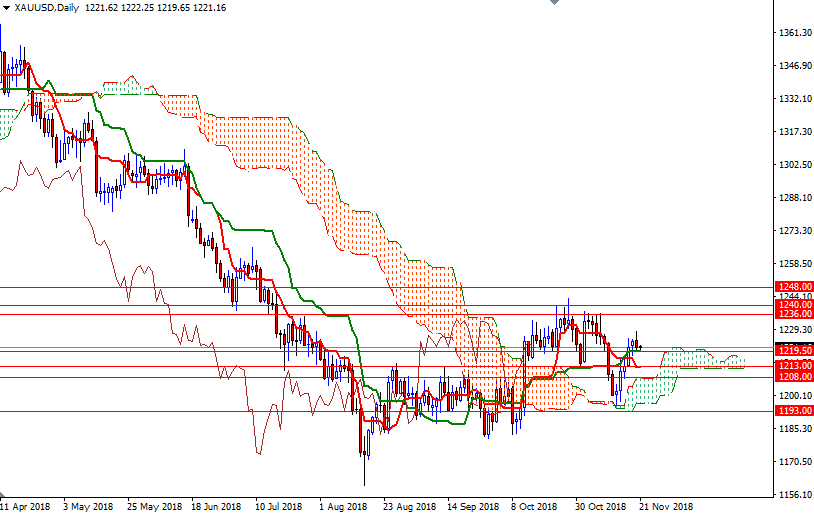

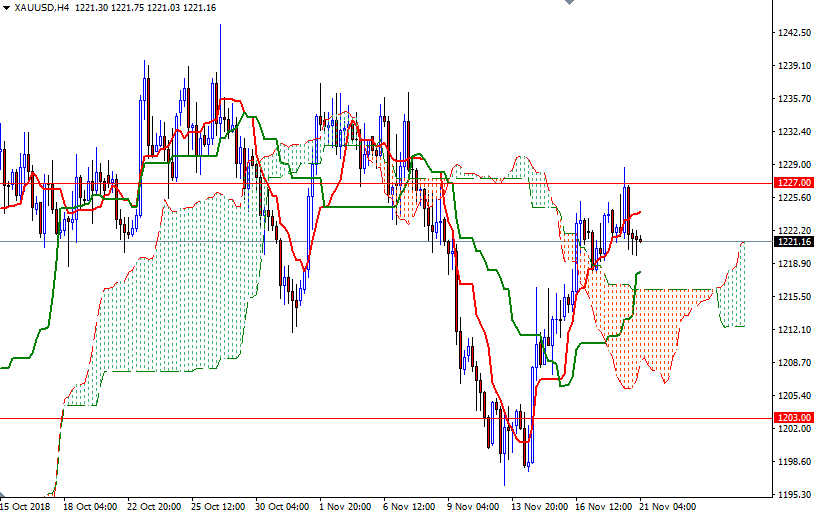

The bulls have the near-term technical advantage, with the market trading above the Ichimoku clouds on the daily and the 4-hourly charts. However, note that the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are negatively aligned on the daily chart and the Chikou-span (closing price plotted 26 periods behind, brown line) is below prices.

If XAU/USD drops below the 1219.50-1219 zone, we may return to 1216.50-1216, the top of the 4-hourly cloud. A break below 1213 could lead to a test of 1208. The bears have to produce a daily close below 1208 to gain momentum for 1203/0. To the upside, the initial resistance stands in the 1227/5 area. If XAU/USD successfully gets back above 1227, then 1232/0 will be the next stop. The bulls have to overcome this barrier to set sail for 1236 and 1240. A daily close beyond 1240 is essential for a bullish continuation towards 1252/48.