Gold prices ended Wednesday’s session down $8.34 an ounce, pressured by an improved risk appetite in the market place. Global stock markets were mostly higher yesterday. Asian shares are up today, following gains in U.S. stock indexes. A strong U.S. dollar also worked against the precious metals markets. In economic news, Automatic Data Processing Inc. reported that the private sector added 227000 jobs in October, surpassing consensus estimates of 188000. Focus now turns to the Labor Department’s more comprehensive non-farm payrolls report which will be released on Friday.

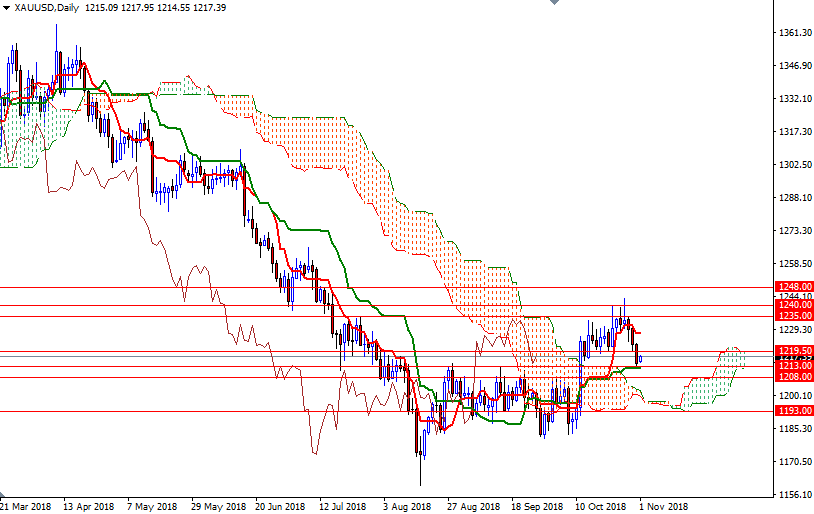

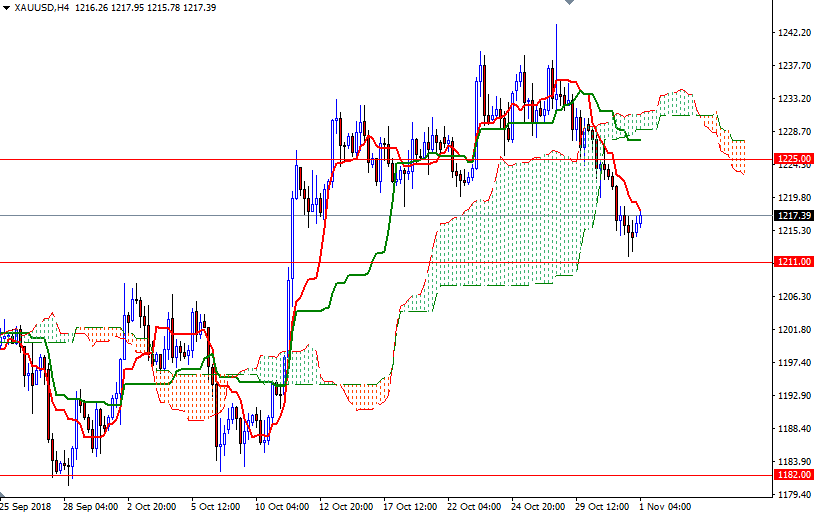

XAU/USD tested the anticipated support in the 1213/1 zone as expected after prices broke below 1219.50. The market is trading above the daily Ichimoku cloud, suggesting that the bulls have the near-term technical advantage. However, the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are flat.

If the aforementioned support in 1213/1 continues to attract buyers, prices may grind higher towards 1219.50-1219, the top of the cloud on the M30 chart. The bottom of the hourly cloud sits at 1221 so the bulls have to penetrate this barrier to tackle 1226/5, the top of the hourly cloud. A break through there cloud lead to push up to 1231/29. However, if XAU/USD dives below 1211, then the market will be aiming for 1208/6. The bears have to produce a daily close below there to challenge 1203/1.