Gold prices rose $17.96 an ounce on Thursday, snapping a three-day losing streak, as the dollar fell and U.S. Treasury yields pulled back. The U.S. dollar index posted sharp losses on a corrective pullback after hitting a 16-month high Wednesday. The Institute for Supply Management (ISM) reported that its index of national factory activity dropped to 57.7 last month from 59.8 in September. Attention now turns to the week’s final big event, the U.S. employment report from the Labor Department.

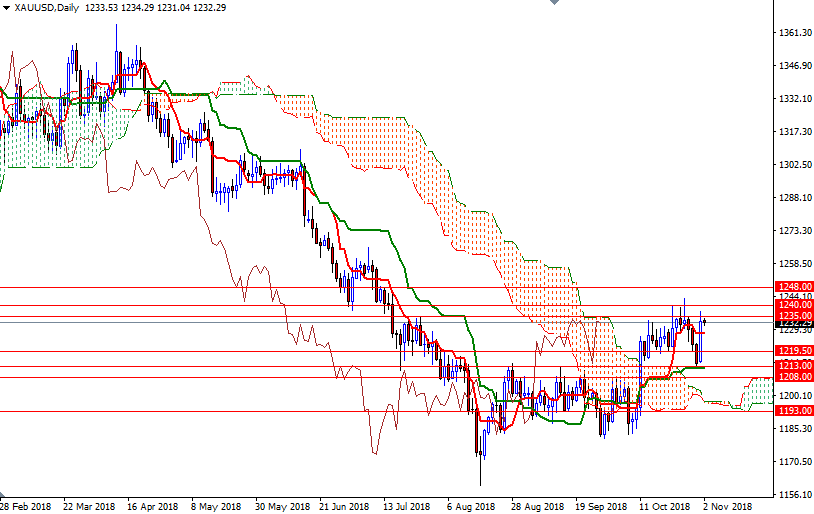

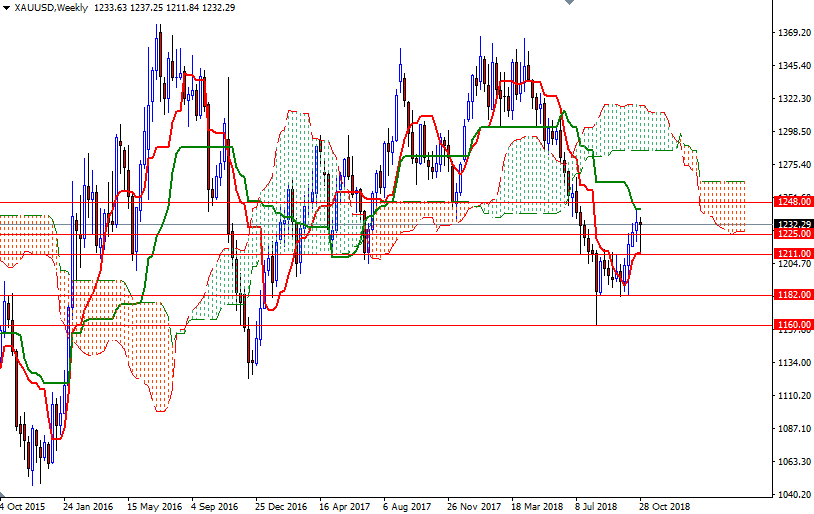

The bulls have the near-term technical advantage, with the market trading above the daily Ichimoku cloud. XAU/USD revisited the 1240/35 area after prices penetrated the hourly cloud. However, as reiterated before, the bulls will need to produce a daily close above 1240 to challenge the bears waiting on the 1252/48 battlefield. On its way up, expect to see some resistance at 1245.50.

To the downside, the initial support sits in 1230.90-1230, followed by 1228. If XAU/USD gets back below 1228, the market will be targeting the 1226/5 area, the confluence of the Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) on the H4 chart. The bears have to drag the market below 1225 to make an assault on a strategic support in 1220.50-1219.50.