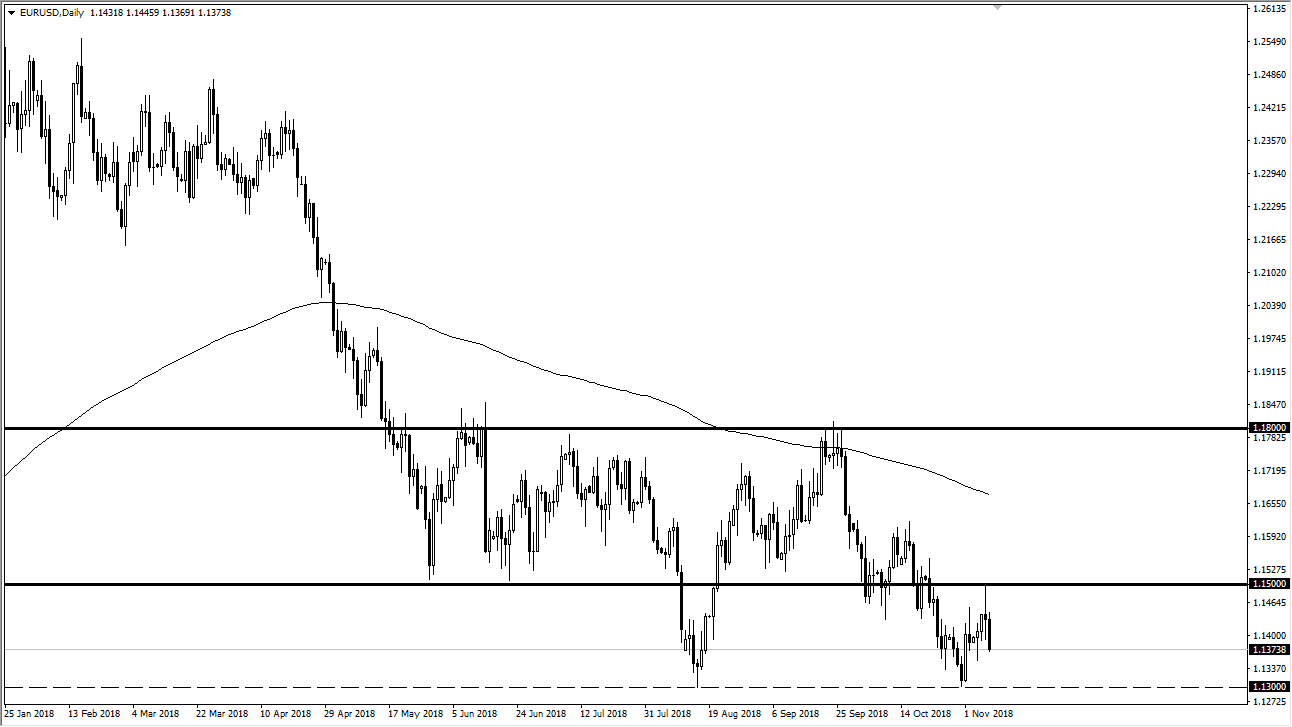

EUR/USD

The Euro initially tried to rally on Thursday but then broke down rather significantly as the Federal Reserve has reiterated its desire to raise interest rates. This of course drives money into the US dollar, and with the uncertainty in Europe it makes a lot of sense that this pair would continue to drift underneath. I believe at this point we are still trading between the 1.13 level and the 1.15 level, so a retest of the 1.13 level may be exactly what we are looking at. Beyond that, I think there is only a matter time before Brexit weighs upon the Euro and of course the Italian situation flairs back up. At this point, 1.13 looks like a target, but that target may be in serious jeopardy as well. If we broke above the 1.15 level, that would be rather bullish, and a bit surprising.

GBP/USD

The British pound initially tried to rally during the session on Thursday as well, but then broke down below the bottom of the neutral candle from the previous session. The downtrend line of course has been important over the longer-term, and it’s likely that we will continue to see sellers step into this market based upon the Brexit and of course uncertain directionality with the Bank of England. If we broke above the uptrend line, I think there is a barrier of resistance all the way to the 1.33 level, so I remain a seller and not a buyer. If we did break above that level, then I think the British pound could go looking towards 1.35 handle and bring in a lot of longer-term investors. Looking at the charts though, things are starting to look like a descending triangle to me.