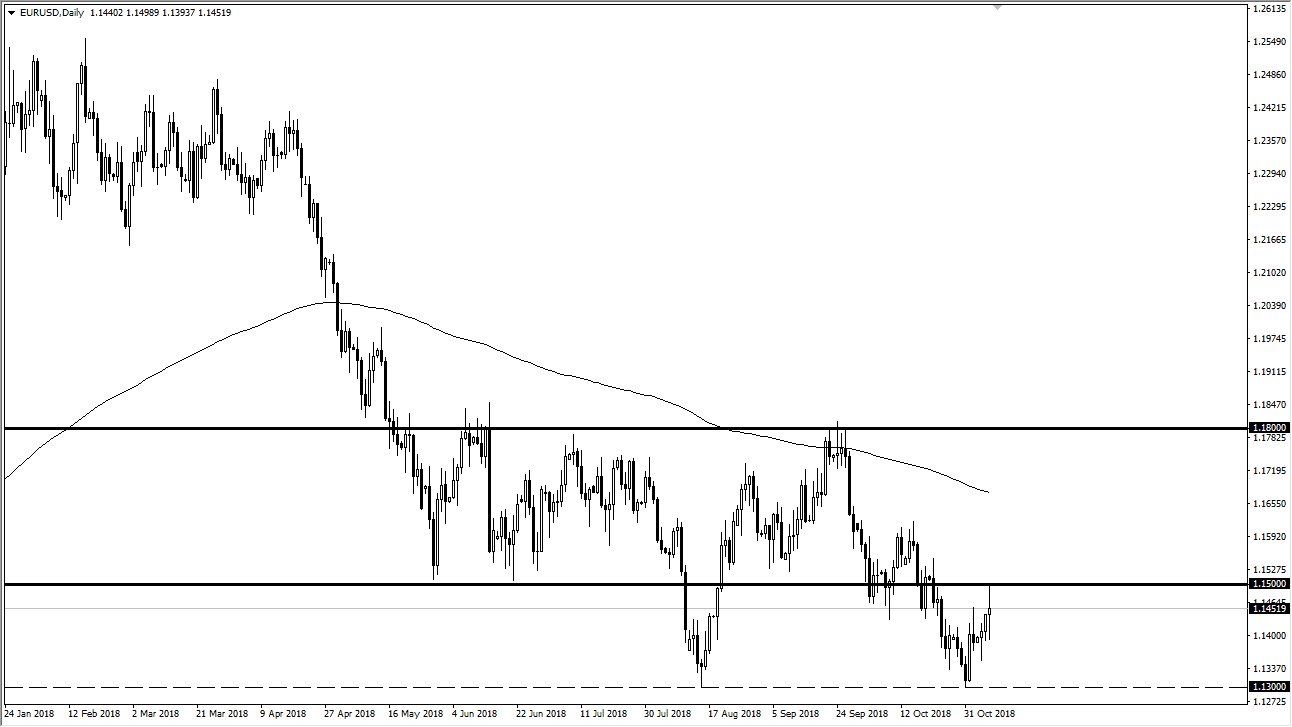

EUR/USD

The Euro went back and forth rather wildly during trading on Wednesday, mainly in reaction to the midterm elections in America. Ultimately though, I think traders are starting to come to the realization that not much has changed. With that being the point, it makes sense that we struggle to break above the massive resistance barrier at the 1.15 level. In fact, that was exactly where you should have been selling during the day. The 1.14 level underneath was massive support, so it does look like we are trying to break out to the upside but have failed so far. Currently, I think the 1.13 level is the bottom of the range, with the 1.15 level being the massive ceiling. If we can break above that, then it’s possible that the market could continue to go higher. Ultimately though, we are in a downtrend and there are still a lot of concerns when it comes to Italy. Higher interest rates in America should continue to put bearish pressure on this market.

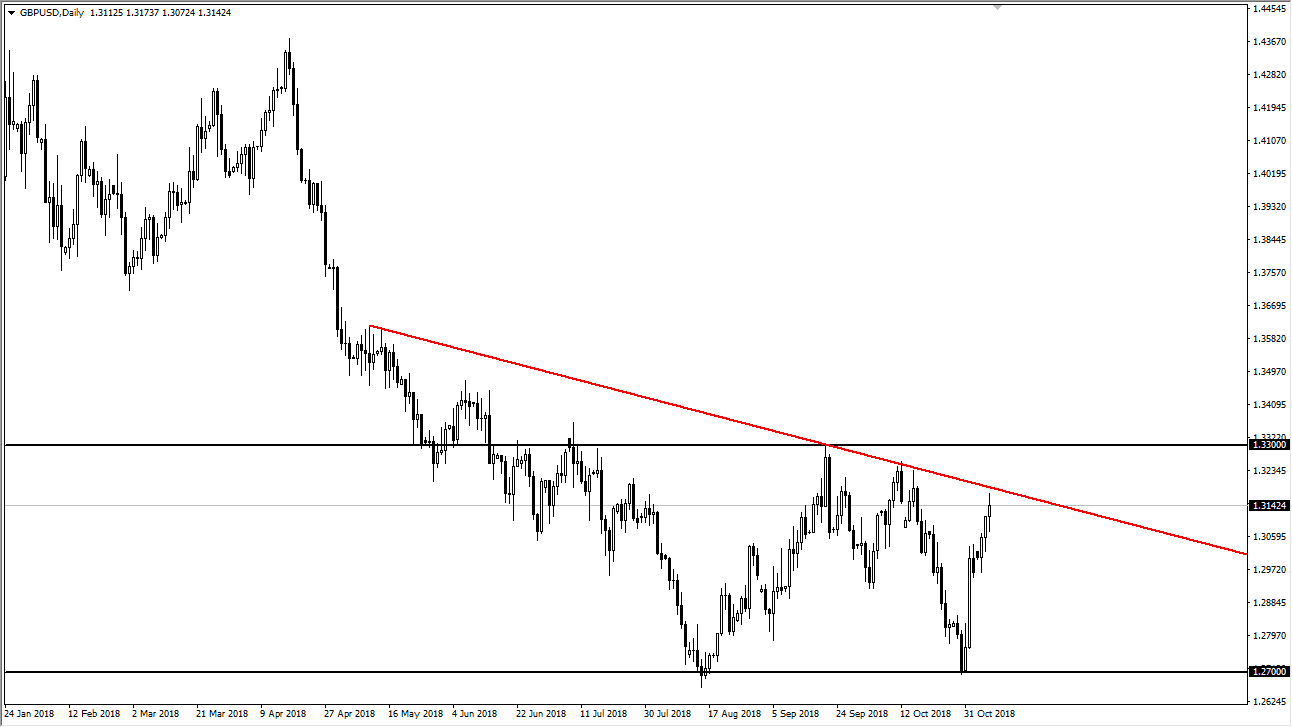

GBP/USD

The British pound had a slightly positive day during trading on Wednesday, but still failed at the downtrend line, as we continue to see sellers become aggressive. Because of this, I still believe that the market is probably to be sold in the meantime, because the headlines for the Brexit will overtake almost anything involving this pair. The higher interest rates in the United States of course make the US dollar attractive in general, so I think that this overbought market will start to roll over.

I would consider this market broken out to the upside if we can clear the 1.33 level, which is a significant resistance barrier. If we did clear that area, then I think we would have a longer-term move just waiting to happen. I believe that until we get the Brexit negotiations over with though, it’s going to be difficult for the pair to rally over the longer-term.