EUR/USD

The Euro initially tried to rally during the trading session on Monday but failed as we turned around of form a nasty -looking shooting star. It appears to me that the US dollar is still going to reign supreme, and of course there are still a lot of questions when it comes to the Brexit, and of course the Italian debt issue. With that being the case, I think it makes sense that we would continue to sell off rallies and the nasty Friday candle gave you a heads up as to the overall attitude of the market. That’s not to say that we are going to break down significantly, rather I think we will continue to see rallies faded. I believe that the 1.13 level offers potential support, followed by the 1.12 level, and most certainly the 1.11 level which is massive on the longer-term charts. If we were to break down below there the Euro would be in serious trouble.

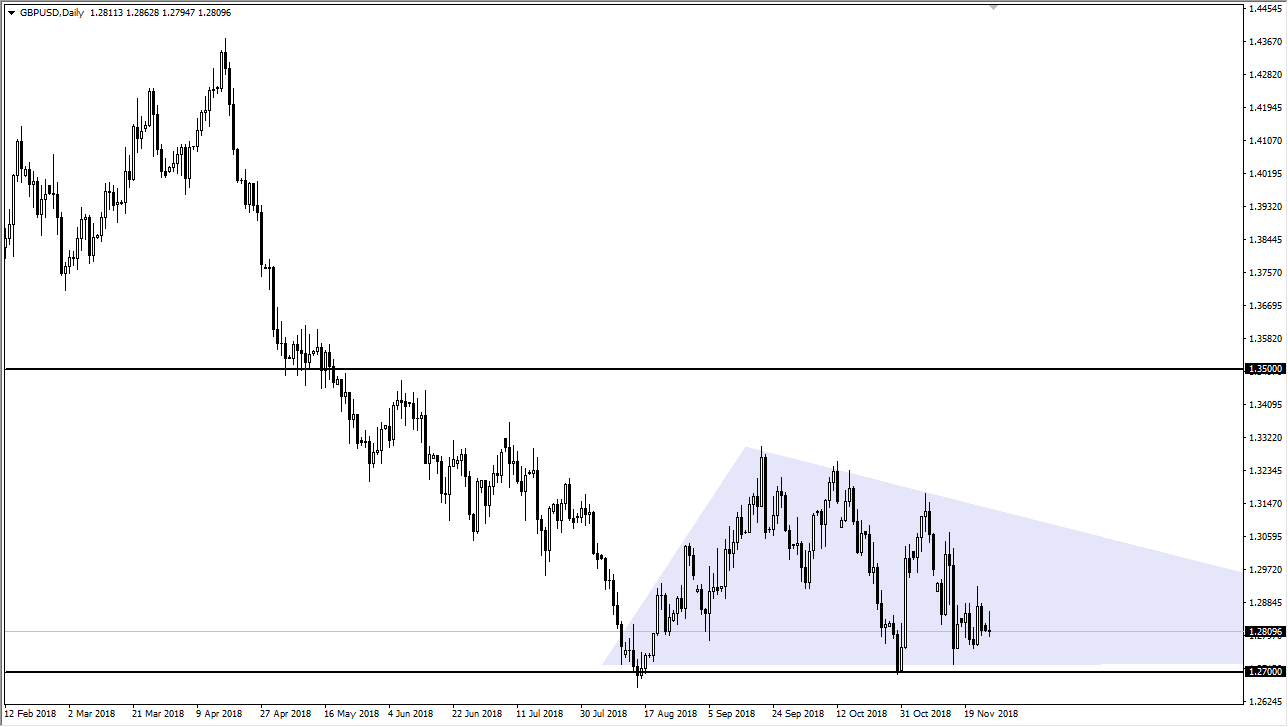

GBP/USD

The British pound tried to rally during the day but rolled over to form a bit of a shooting star as well. This shows that the US dollar continues to be the favorite currency of traders overall, and I think that the 1.27 level underneath needs to be paid attention to. If we break down below that level, it’s very likely that the British pound will continue to go towards the 1.22 handle underneath, as measured by the descending triangle. Given enough time, I think rallies will be faded, because Parliament doesn’t look likely to approve the deal that the European Union and Teresa May have reached. With that, I think we are looking at a “no deal Brexit” more likely than not which of course will be negative for the British pound in the short term.