EUR/USD

The Euro initially tried to rally during the trading session on Friday, but then ripped much lower. It looks as if we are going to go towards the 1.13 handle, and then possibly the 1.12 level. The Italian debt situation continues to be a major issue, and I think that global growth is starting to become a major concern of traders around the world. This is a market that has massive resistance at the 1.15 handle, so rallies between here and there should continue to be sold. I think that the 1.11 level underneath is a major support level that you should pay attention to though, and if that gives way the Euro could collapse rather significantly. I think what we are looking at is more of the “sell the rallies” type of trading on shorter timeframe.

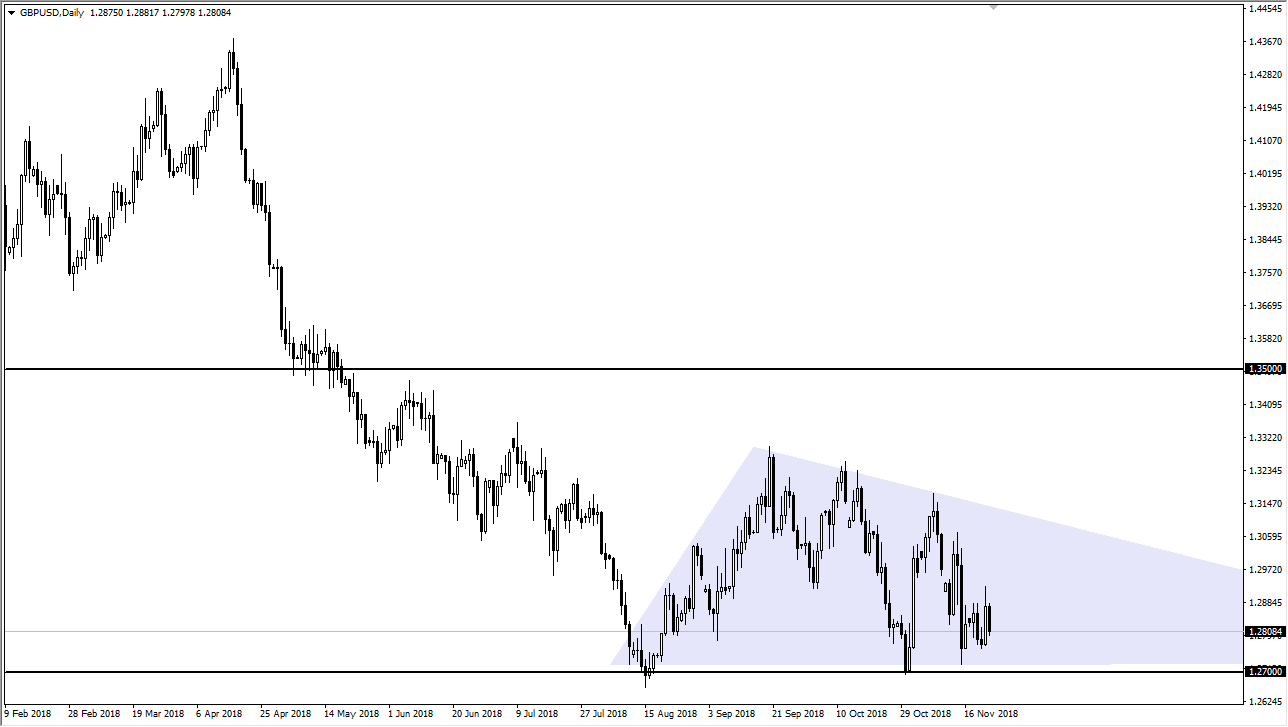

GBP/USD

The British pound fell hard during the day as well, as we have given back most of the gains from the Thursday session that was based upon Teresa May and the EU agreement on a framework of nonbinding agreements after the Brexit deal is figured out. In other words, a lot of hot air and a whole lot of nothing. The 1.27 level underneath is massive support, and I think that if we can break down below there it would open up the floodgates to the downside. The descending triangle sends this market down to the 1.22 level based upon the measurement, and therefore that is my target. I like the idea of selling rallies and I don’t have any interest whatsoever in trying to buy this market, at least not until we would break above the top of the descending triangle, which is well above the 1.30 level.